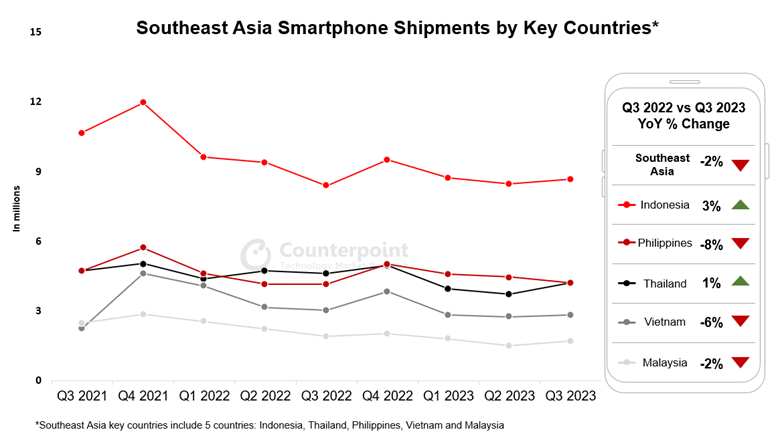

Southeast Asia’s smartphone shipments declined 2% YoY but rose 3% QoQ in the third quarter, according to research firm Counterpoint. The data signals a recovery in demand after a weak first half of the year.

Macroeconomic indicators have strengthened across much of the region, helping boost consumer confidence. Smartphone makers have also launched aggressive promotions and new models, spurring replacement purchases, especially for low- and mid-tier devices.

Indonesia, Malaysia, the Philippines and Vietnam posted double-digit shipment drops in the second quarter but all saw an improvement in the third quarter. Counterpoint expects full-year shipments for Southeast Asia to decline around 8% in 2023 due to the weak first half.

Thailand saw flat growth as its new government introduced measures to ease cost of living pressures. Indonesia benefited from new product launches in September. Vietnam’s economy has rebounded, helping prop up consumer spending. The Philippines economy is recovering but high unemployment and prices are constraining lower-income households. Malaysia’s manufacturing sector remains weak amid slowing Chinese demand.

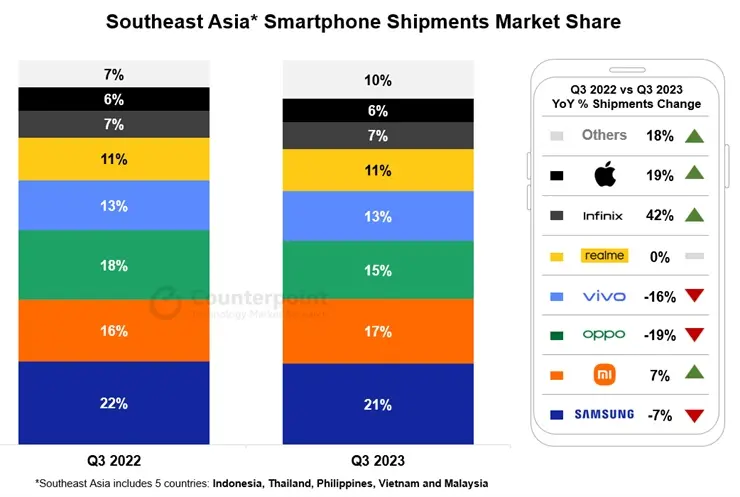

Apple bucked the downtrend with 19% shipment growth, driven by continued demand for its iPhone 13 and 14 series. Samsung maintained first place with 21% share, aided by its new foldable phones. Chinese vendors Xiaomi, Oppo and Vivo faced challenges but promotions and new models helped Xiaomi eke out 7% growth in shipments. Transsion Group brands Infinix, Tecno and Itel saw double-digit growth thanks to affordable devices.

The recovery is still in early stages and sales could accelerate in the fourth quarter as markets continue stabilizing. Southeast Asia remains a key growth market for smartphones due to relatively low penetration rates for services like e-commerce and mobile payments.