Global thin and terminal client shipments fell 8.9% YoY in Q2’15, says IDC, continuing the downward trend seen in Q1 (Thin Client Shipments Suffer After Strong 2014). The market suffered from comparisons to a strong first half result in 2014, which was due to XP PC renewals. In addition, continued currency devaluations in markets outside North America produced project delays.

Aside from APACxJ, all regions saw large declines in volume – most in the double-digit range.

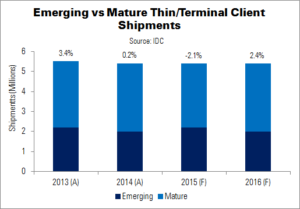

Due to the above factors, IDC expects 2015 shipments to be lower than previously expected. 5 million unit shipments are forecast: lower than both 2013 and 2014. Steady growth will resume in 2016 – 2019, reaching 6.6 million units at the end of the forecast period.

| Worldwide Thin and Terminal Client Unit Shipments, Share and YoY Growth, Q2’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’15 Units | Q1’15 Units | Q2’15 Market Share | Q1’15 Market Share | Q2’14-Q2’15 Growth |

| Hp | 319 | 302 | 25.0% | 25.3% | -14.4% |

| Dell | 301 | 354 | 23.6% | 29.7% | -25.7% |

| NComputing | 213 | 104 | 16.6% | 8.7% | 30.0% |

| Centerm | 111 | 78 | 8.7% | 6.5% | 18.3% |

| Igel | 55 | 67 | 4.3% | 5.6% | -9.2% |

| Others | 278 | 287 | 21.8% | 24.1% | -9.0% |

| Total | 1,277 | 1,192 | 100.0% | 100.0% | -8.9% |

| Source: IDC | |||||