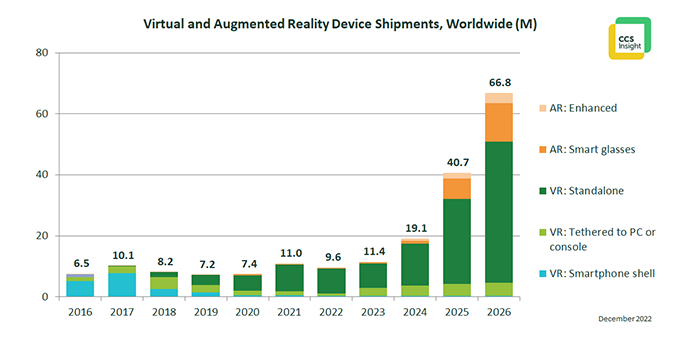

IDC just came out with a report that says Meta had 80% of the AR/VR headset market in 2022 as global shipments declined 20.9% to 8.8 million units. A Chinese market research firm has pegged shipment at 11 million units for AR headsets. Another research firm calculated that Meta sold 9.6 million headsets in 2022.

There’s an oft quoted phrase from William Goldman’s Adventures in the Screen Trade, “Nobody knows anything…” Goldman, the screenwriter of such classic movies as All the President’s Men and The Princess Bride, was referring to how Hollywood never knows what movie is going to work or fail, that it is all a very educated guess. When it comes to market research, it may be that no one knows anything about how real shipment numbers are yesterday, today, or will be tomorrow. But, from personal experience, I know that you can come pretty close, particularly in markets dominated by large corporations that make their finances public, like the flat panel manufacturing and graphics processing units (GPUs). So, why does it seem like the market for headsets is either hugely over-hyped or hugely underrated?

I don’t have an actual answer for that other than to say that there is probably some pressure on research firms and analysts to come up with a reliable model for business opportunities when the only real data they have is from Meta. So, everything is extrapolated from that. However, it could also be that it is hard to size a market that hasn’t found a fit, yet. I alluded that in an article on headsets are not displays essentially saying that headsets are solving all kinds of technology problems associated with stereoscopic viewing, but not really solving a problem for a specific market fit. That makes it hard for analysts to verify numbers, and correlate data based on patterns in target markets. For instance, you can predict a number for gaming monitors based on the data that you have for graphics cards and GPUs, which is what we do at JPR, and then you can correlate with data on PC sales, new game sales, and some sell through data on display sales in general. Couple that with financial data from companies that sell into the gaming market, particularly those that sell accessories, and your prediction model can be quite accurate, enough to build a business plan around.

You look at AR/VR/MR headsets and it seems like the most optimistic—call it wildest—predictions are all hedging their bets around Apple’s MR headset launch, something akin to an iPhone 1.0 messianic product leading everyone to the promised land. Among a lot of companies that work in and around the periphery of AR and VR, Apple’s headset is seriously considered as that much of a game changer. That seems like a lot to ask of something that shows no indication of redefining the category to such an extent that it washes away all of the challenges facing the industry.

So we are living with a range of possible outcomes for AR glasses, VR headsets, and MR devices. Maybe because we don’t have a handle on a consistent taxonomy for the market, and maybe it is because we don’t have anything resembling measurable sales channels, applications, and actual platforms. Instead, we have products that get thrown into the market like mud at a wall, vendors hoping something sticks. We have no real platforms, although we have developer toolkits for iOS, Android, and device-specific ones for PlayStation and Meta. By real platforms, I mean there is no real consensus on where the sum of all AR and VR software development resides and evolves. You have to have a focal point for developers to be able to share their experiences and benefit from learning how to code for the environment. This could be where Apple really does change the equation for the industry. Its platform is consistent, it will have high-quality target devices, and developers will know exactly what they can do on the platform, who will use their applications, and not having to worry about being distracted by capricious product plans and changes.