According to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Gaming Tracker, worldwide shipments of gaming PCs and monitors continue to grow at rates faster than their parent markets.

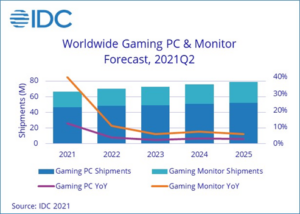

For gaming PCs, which includes both desktop and notebook PCs, unit shipments are expected to grow from 41.3 million in 2020 and to 52.3 million in 2025. Similarly, the gaming monitor market is expected to jump from 14.2 million units shipped to 26.4 million during the same time frame. This equates to the two product categories having five-year compound annual growth rates (CAGRs) of 4.8% and 13.2% respectively.

The solid growth projection is based on strong recent trends. Despite high logistics costs as well as shortages of components affecting both PCs and displays, shipments in 2021 have remained brisk. The second quarter of 2021 (2Q21) ended with combined shipments of 15.6 million gaming monitors and PCs, an increase of 19.3% compared to the same quarter in 2020.

“The gaming market was on fire for years leading into the start of the pandemic in 2020 and things only accelerated as most people were spending more time at home and in front of screens,” said Ryan Reith, group vice president with IDC’s Mobility and Consumer Device Trackers. “At this point the global supply shortage is well known and continues to be a moving target, yet demand for gaming hardware (PCs, consoles, monitors, etc.) and titles continues to surge. Many have speculated that as reopening slowly begins around the world this growth could be in jeopardy, but we are just not seeing that.”

Overall, the value of the combined gaming PC and monitor markets is expected to grow from $43 billion in 2020 to just over $60 billion in 2025 with a five-year CAGR of 7.4%. Despite this growth, slightly different average sales price (ASP) trends are expected to emerge across the two categories. For gaming PCs, IDC expects ASPs to grow from $925 last year to $1007 in 2025, despite the recent introduction of lower cost gaming desktops and notebooks. In comparison, gaming monitors were at $339 last year and are expected to drop to $309 in 2025.

“Increasingly accessible price points and the ability to handle a variety of tasks outside of gaming are just some of the reasons we expect the gaming PC market to remain healthy in the coming years,” said Jay Chou, research manager for IDC’s Worldwide Quarterly PC Monitor Tracker. “However, even within this performance-focused segment of the market, portability is still important, and that means gaming desktops need to innovate to compete against gaming notebooks.”

IDC’s Worldwide Quarterly Gaming Tracker gathers data in more than 50 countries and provides detailed, timely, and accurate information on the global gaming PC and display market. The program provides insightful analysis, quarterly market share data, and a five-year forecast that can be broken down by key geographies.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.