In March 2018, TECHnalysis Research conducted an online survey of a thousand US consumers that identify themselves as gamers and own some type of AR or VR-capable device. The ages of the respondents ranged from 18 to 74, with nearly 60% falling in the 18-34 range. 55% were female and 45% male. Among VR users, it was discovered that most had tried a smartphone VR head-mounted display, like the Samsung Gear.

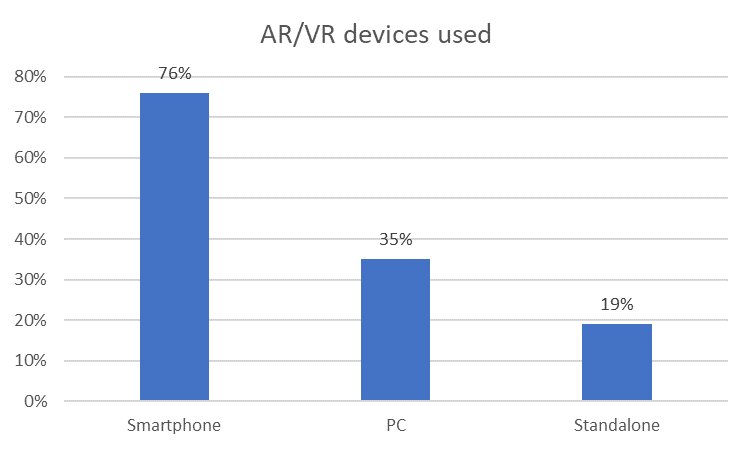

Users of VR HMDs. The total exceeds 100% due to ownership of multiple devices.

Users of VR HMDs. The total exceeds 100% due to ownership of multiple devices.

Source: TECHnalysis

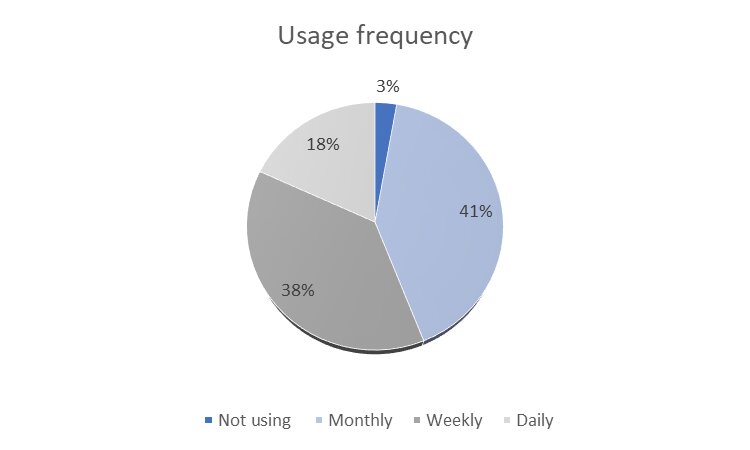

Head-mounted display owners use them sparingly, as illustrated in the following chart.

The frequency that users wore their VR HMDs. Source: TECHnalysis

The frequency that users wore their VR HMDs. Source: TECHnalysis

Most devices are only used occasionally. 41% said they only use a head-mounted display once a month, while only 18% said they use one every day. HMD rankings showed Samsung Gear as the most popular and the HTC Vive as fifth-most popular.

- Samsung Gear VR

- Sony PlayStation VR

- Other VR Smartphone Headset

- Oculus Rift

- HTC Vive

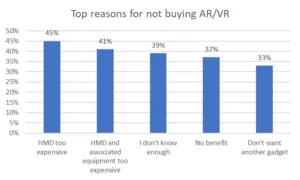

Both the price of headsets and the overall cost of a total solution are major deterrents to purchases for people who don’t currently own an AR/VR device.

Part of the popularity of any given head-mounted display is the price. Source: TECHnalysis

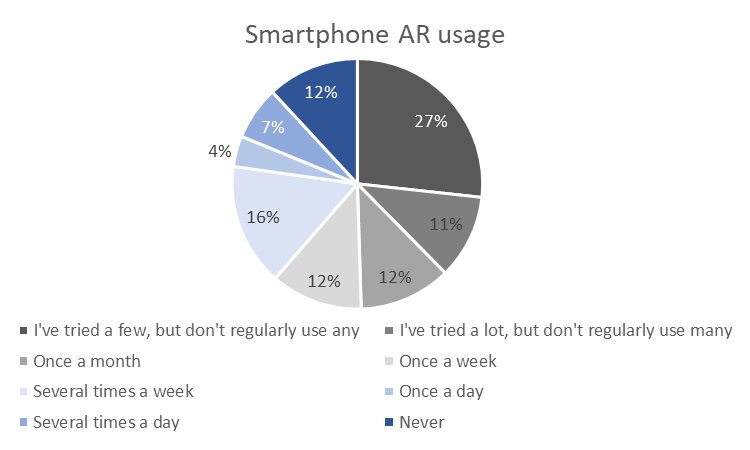

Smartphone-based AR app adoption is limited. About half of the respondents use AR apps, while the other half don’t.

Utilisation of AR with a smartphone. Source: TECHnalysis

Utilisation of AR with a smartphone. Source: TECHnalysis

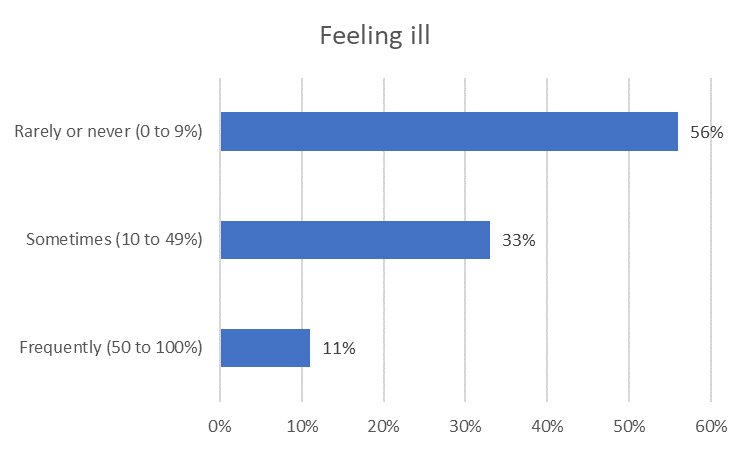

One of the main criticisms of VR is the motion-to-photon latency which causes motion sickness, a problem for more than 40% of the VR users surveyed.

VR discomfort is still a major issue. Source: TECHnalysis

VR discomfort is still a major issue. Source: TECHnalysis

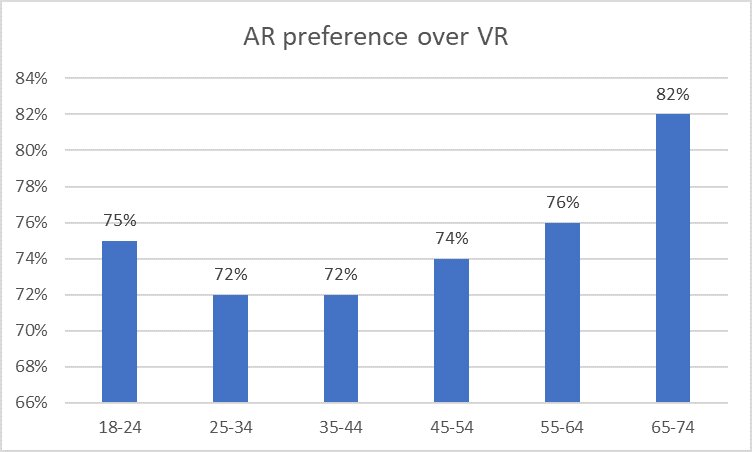

When asked which technology was preferred, all age groups preferred AR by three-to-one.

Users who have tried both prefer AR to VR by a wide margin. Source: TECHnalysis

Users who have tried both prefer AR to VR by a wide margin. Source: TECHnalysis

TECHnalysis has found that there is a strong interest in using VR for simulations and visual travel. Respondents indicated they are interested in many different types of new applications they haven’t tried yet.

Source: TECHnalysis

Source: TECHnalysis

However, they acknowledged they simply don’t know enough about the possibilities yet. About one-third also raised concerns about time and potential costs.

Source: TECHnalysis

Source: TECHnalysis

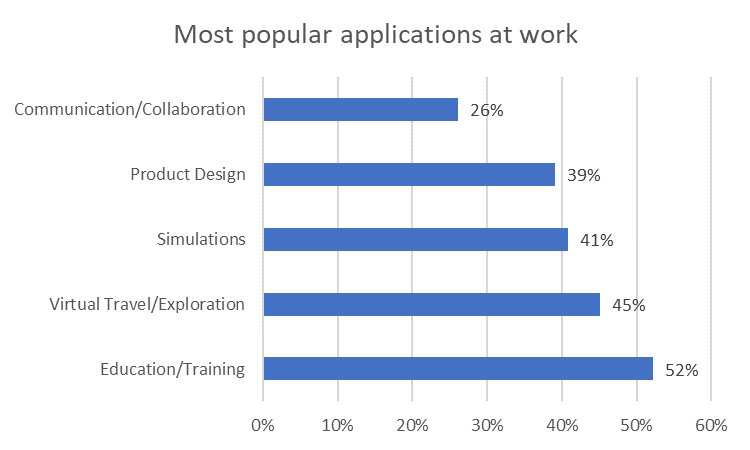

The respondents also indicate they used AR and VR HMDs at their place of employment and for a variety of applications.

AR and VR is being used in the workplace. Source: TECHnalysis

AR and VR is being used in the workplace. Source: TECHnalysis

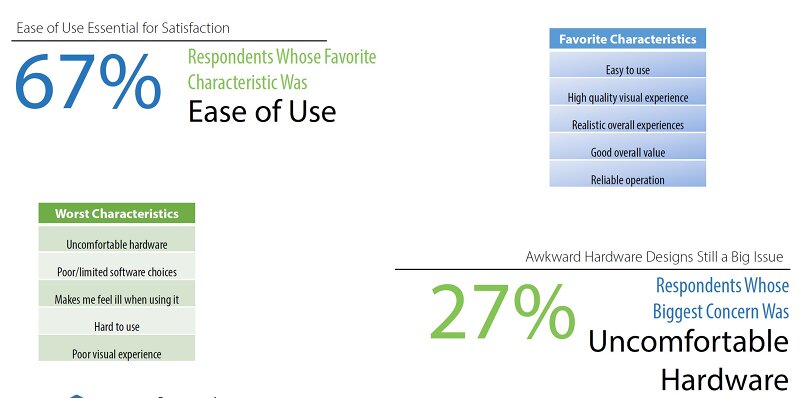

The respondents also indicated they want convenience and comfort. 46% would prefer a standalone device, with higher-resolution screens being the most desired feature

The research indicates that both consumers and commercial user are fascinated with VR, but also know it’s in its early days. TECHnalysis thinks that future buyers are looking for smaller, lighter, more comfortable standalone headsets at prices in the $200 range. Users are open to and excited for new types of applications, but need much more education to learn about them. Gaming is important, but the primary reason for buying is to have new experiences.

Analyst Comment

Bob O’Donnel of TECHnalysis Research is an experienced analyst with many years in displays at IDC. (BR)