Market research firms have been reducing their tablet forecast since the sales growth has been slowing in 2014. The latest numbers from IDC, which we reported on earlier, show a 6% decline in the first quarter of 2015 compared to the first quarter of 2014. It seems that there’s a new trend developing that does not favor the sale of tablets.

The following table shows how the tablet sales in Q1 played out.

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q1’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| Apple | 12.6 | 16.4 | 26.8% | 32.7% | -22.9% |

| Samsung | 9 | 10.8 | 19.1% | 21.6% | -16.5% |

| Lenovo | 2.5 | 2 | 5.3% | 4.1% | 23.0% |

| Asus | 1.8 | 2.6 | 3.8% | 5.2% | -30.6% |

| LG | 1.4 | 0.1 | 3.1% | 0.2% | 1423.7% |

| Others | 19.7 | 18.1 | 41.8% | 36.3% | 8.6% |

| Total | 47.1 | 50 | 100.0% | 100.0% | -5.9% |

| Source: IDC | |||||

The leaders Apple and Samsung both lost market share, from a combined 54.3% in Q1/14 to 45.9% in Q1/15. Some of the other players either lost or gained market share, but in general the smaller players gained market share.

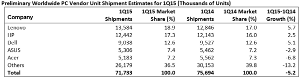

If we follow the logic of the past few years which blamed the downturn of the PC market on the advent of the tablet, we should expect an uptick in the PC market. Unfortunately, the results from Gartner show that PC sales fell by over 5% in the first quarter of 2015.

| Worldwide PC Vendor Unit Shipment Estimates for Q1’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| Lenovo | 13,584 | 12,846 | 18.9% | 17.0% | 5.7% |

| HP | 12,442 | 12,143 | 17.3% | 16.0% | 2.5% |

| Dell | 9,038 | 9,527 | 12.6% | 12.6% | -5.1% |

| Asus | 5,306 | 5,462 | 7.4% | 7.2% | -2.9% |

| Acer | 5,183 | 5,562 | 7.2% | 7.3% | -6.8% |

| Others | 26,179 | 30,153 | 36.5% | 39.8% | -13.2% |

| Total | 71,733 | 75,694 | 100.0% | 100.0% | -5.2% |

| Source: Gartner | |||||

So if tablet and PC sales fell in unison, was it just a bad quarter driven by weak economies? Well, this can’t be entirely correct as smartphone sales increased by 7% according to GfK. Smartphone shipments increased to 310 million units in Q4, worldwide. However, the growth was lower than before with YoY growth of 19% in the fourth quarter of 2014.

There is also a shift in smartphone sales by screen size. Kantar World panel has reported that phablet sales have reached 21% of all smartphone sales in the US. In the first quarter of 2014, US phablet shipments reached only 7% of smartphone shipments.

Another detail, as reported by IDC and Strategy Analytics, is that the sale of cellular tablets in the US increased strongly in the first quarter of 2015. This is completely opposite to the overall tablet sales in the US. While the numbers are different for IDC and Strategy Analytics, this trend is reported by both and confirmed by the results from carriers like ATT, Verizon and the like.

Analyst Comment

From my perspective, consumers are changing how computing devices are being used. For years the clear trend was clearly described by increasing mobility and processing capability. The notebook took over the desktop market, then the smartphone replaced the mobile phone. When the tablet came to the market, Apple envisioned this as a third screen that would take over certain uses like web browsing, video watching and gaming, that typically required a home PC at the time. Today, we are trying to understand what is changing in consumer use again.

From my personal view there are several changes in the CE device landscape that need to be kept in mind.

- The typical tablet allows for a more flexible use of a computing device but is still less easy to use than a smartphone.

- The smartphone has increased in computing power to match a notebook of not long ago.

- Key to real mobility is the availability of cellular data networks that allow a sufficient data stream to the mobile device.

- The phablet combines, to a certain degree, the functionality of a smartphone with the larger screen that almost reaches tablet dimensions.

Users will prefer to carry one device over two or more. This has been proven again and again in the last decades, otherwise we would still be using a PDA plus a cell phone and a pager, etc. The smartphone solved all of these demands. Now the phablet may do the same as a kind of conversion device between a tablet and a smartphone. The good news for the display industry is that it seems that consumers do value larger display screens, preferably with higher resolution.

There is also a difference in the way devices are viewed by the consumer. The tablet may be viewed as more of a computing device and the smartphone as an advanced cell phone. This leads to a difference in the purchasing decision and a longer replacement cycle for the tablet. Subsidies for tablets have more or less run out, while, at least in the US, smartphone replacement offers are still more the norm.

All together, it should not come as a total surprise that we see shifts in buying patterns, based on device developments and improved performance. Nevertheless, so far nobody has accurately figured out how to predict consumer behavior changes over time. – Norbert Hildebrand