The artful master of linguistics and baseball legend Yogi Berra has been quoted as saying, “When you come to a fork in the road, Take It!” Great advice … keep moving forward. The problem for the video content industry is that there are too d**n many forks, each has potholes and everyone is certain his fork is the right one.

“Why would I want to be Bach? I’m me.” – Stevie, “I Used to be Famous,” Netflix, 2022

“Why would I want to be Bach? I’m me.” – Stevie, “I Used to be Famous,” Netflix, 2022

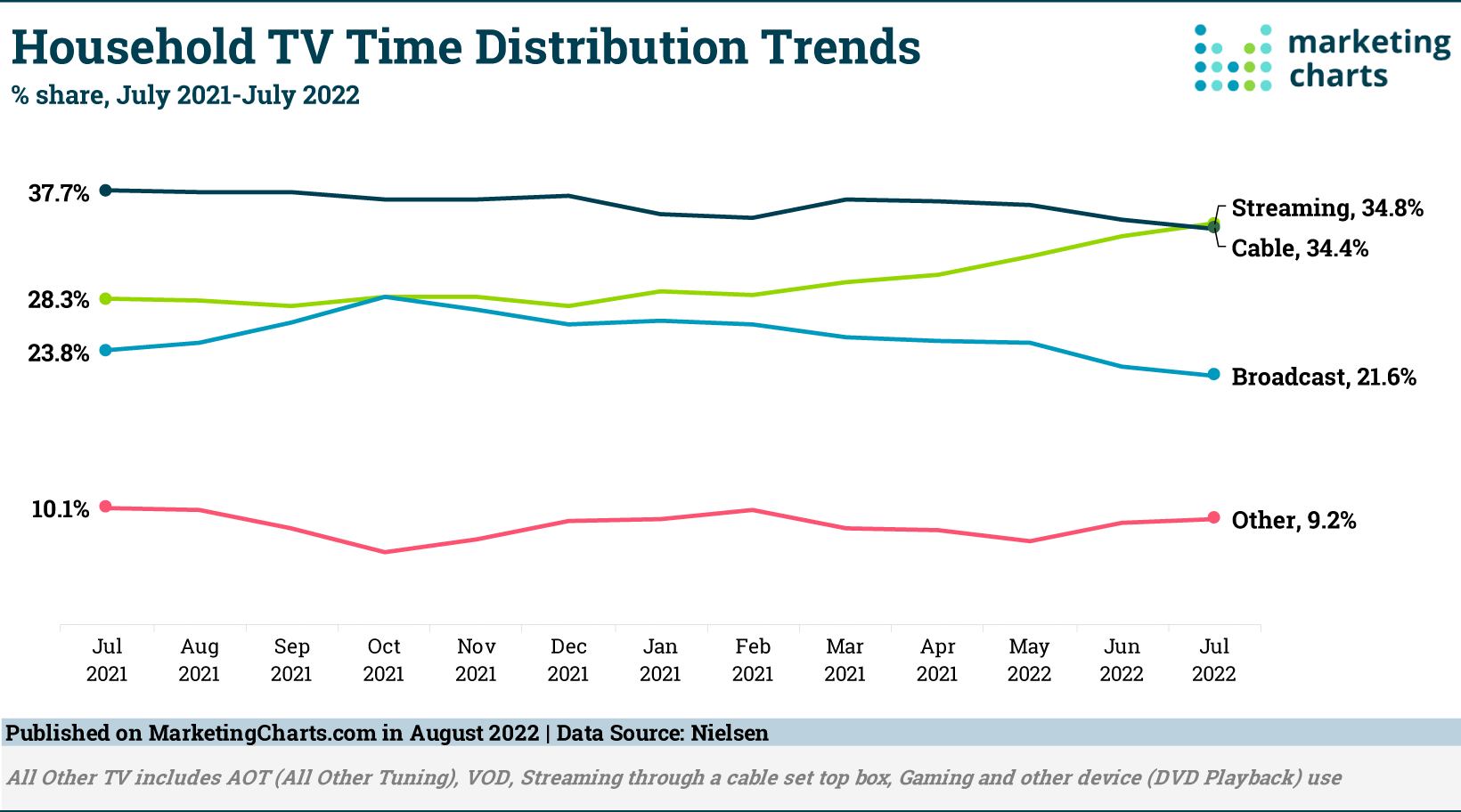

Slow Decline – People are finding that picking what/where/when you watch shows/movies is a lot more enjoyable than living by someone else’s schedule.

Slow Decline – People are finding that picking what/where/when you watch shows/movies is a lot more enjoyable than living by someone else’s schedule.

The one thing everyone can agree on is that linear TV is slowly, painfully fading and becoming a niche entertainment service at best. US Pay TV subscriptions have fallen 6.1 percent per year with everyone feeling the pain – cable, satellite, telco – of steady declines. Similar declines were shown in Europe, while developing countries produced slight increases.

During the latest period, pay TV lost 2.1 million customers; and while the loss might not seem alarming, it has been consistent for the past five years for all of the participants including Sling, DirecTV and Hulu Plus. To balance their P&Ls, Pay TV services shifted from scripted to reality shows which are less expensive to produce and will undoubtedly impact a lot of content creators who relied on TV shows a major portion of their business.

Networks and studios moved their best scripted shows to their fledgling streaming services. In addition, linear TV services supplemented their bottom lines by expanding their ad slots. Allan McLennan, Chief Exec/Global Head of M&E Industry Strategy, PADEM Media Group, said,

“The streaming revolution is refreshingly very transformative for the global media and entertainment industry.”

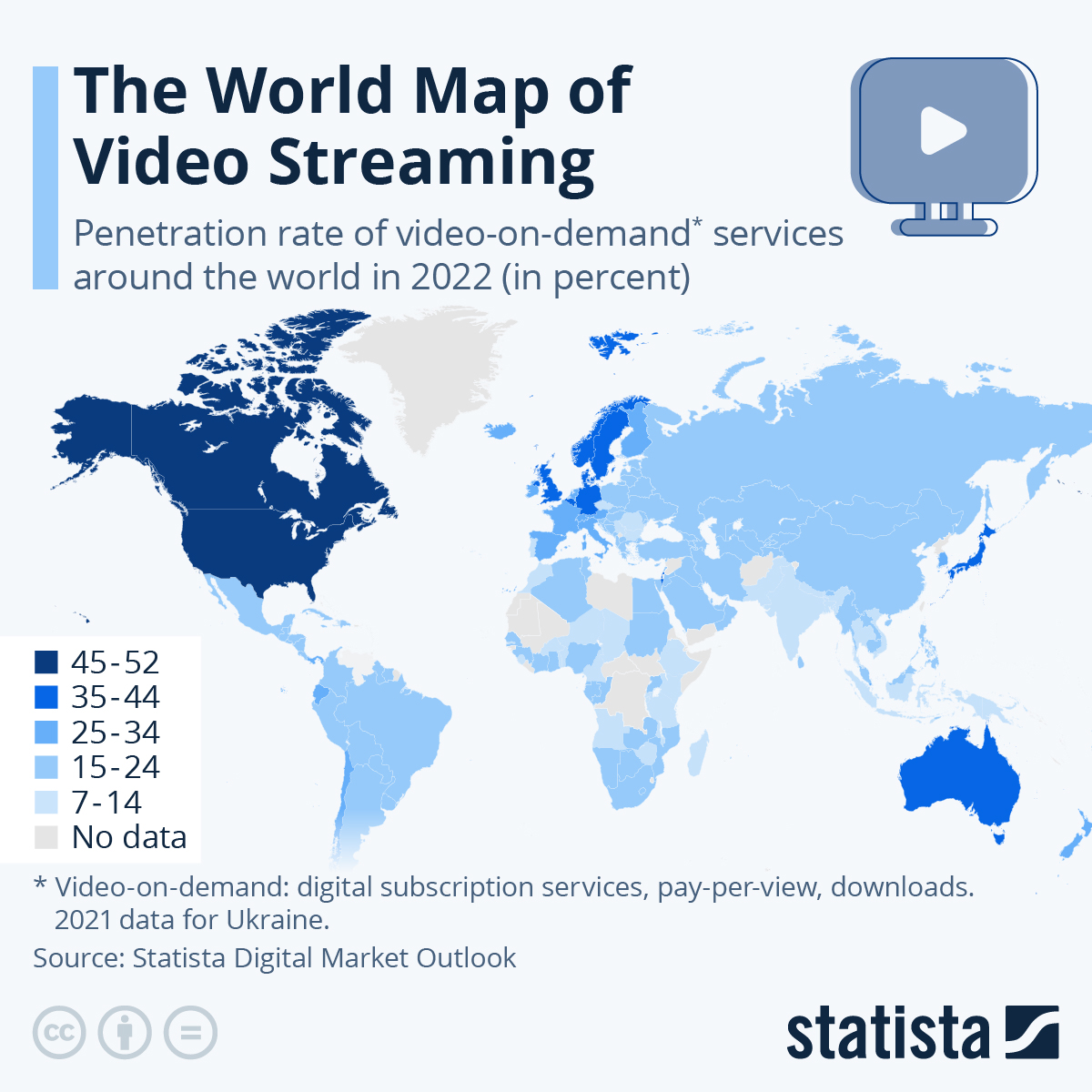

Global Sweep – As the communications industry increases the availability of the internet – fixed and wireless – people increase their enjoyment of streaming content on demand.

Global Sweep – As the communications industry increases the availability of the internet – fixed and wireless – people increase their enjoyment of streaming content on demand.

He noted that nearly 85 percent of developed countries population (up from 79 percent) and 49 percent of the world population now has internet access (up from 40 percent five years ago) and are eager to use online streaming services.

“People around the globe realize that one of the key benefits of streaming over traditional services is that they can decide what to watch, when to watch it and conveniently on the screen/device they prefer,” McLennan commented.

“In addition, they are generally able to more affordably choose shows/movies/event from a much broader library than the earlier day/time services,” he added.

While the North American market has reached about 50 percent of the population streaming, there is still room for growth. For example, in Europe, penetration ranges from 42 percent in England and 14 percent in Bulgaria. The most promising markets that Netflix, Amazon Prime, Disney+ and Apple TV+ have been aggressively focused on (190+, 200, 100+, 100 respectively) include growing their content libraries and subscription bases.

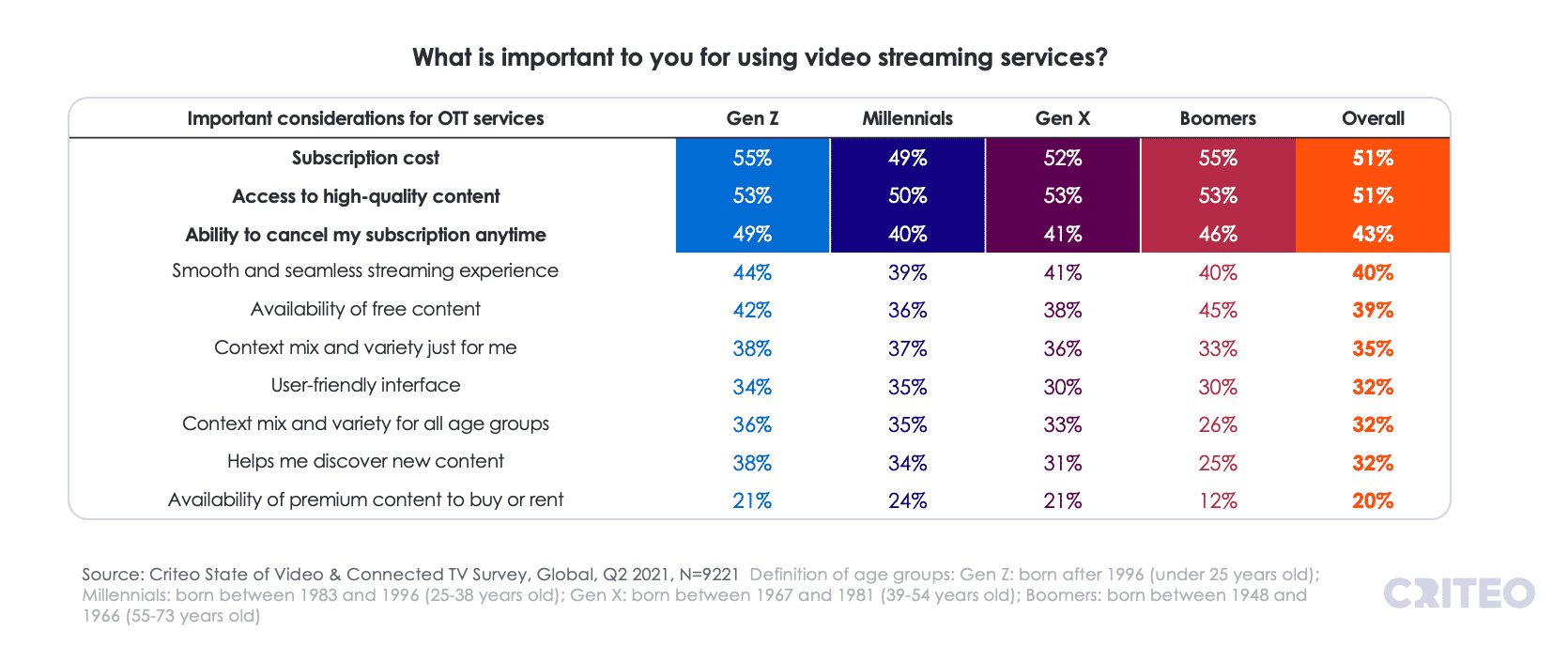

But the consumers’ rapid embracing of the viewing options and every service’s belief that they have the types of quality content people will be willing to pay “a little more” for seems to be coming to a screeching halt. Consumers are dealing with rising prices in every aspect of their basic household budget while service providers ignore this and are rushing to increase their subscription rates.

Pressure Point – While streaming services contend their content is worth “a little bit more,” consumers have a different idea as their entertainment budgets get stretched to the limit.

Pressure Point – While streaming services contend their content is worth “a little bit more,” consumers have a different idea as their entertainment budgets get stretched to the limit.

Consumers are also signing up for services based on promotional or discounted offers and at the end of the trial period canceling the services or retaining them and cancelling others.

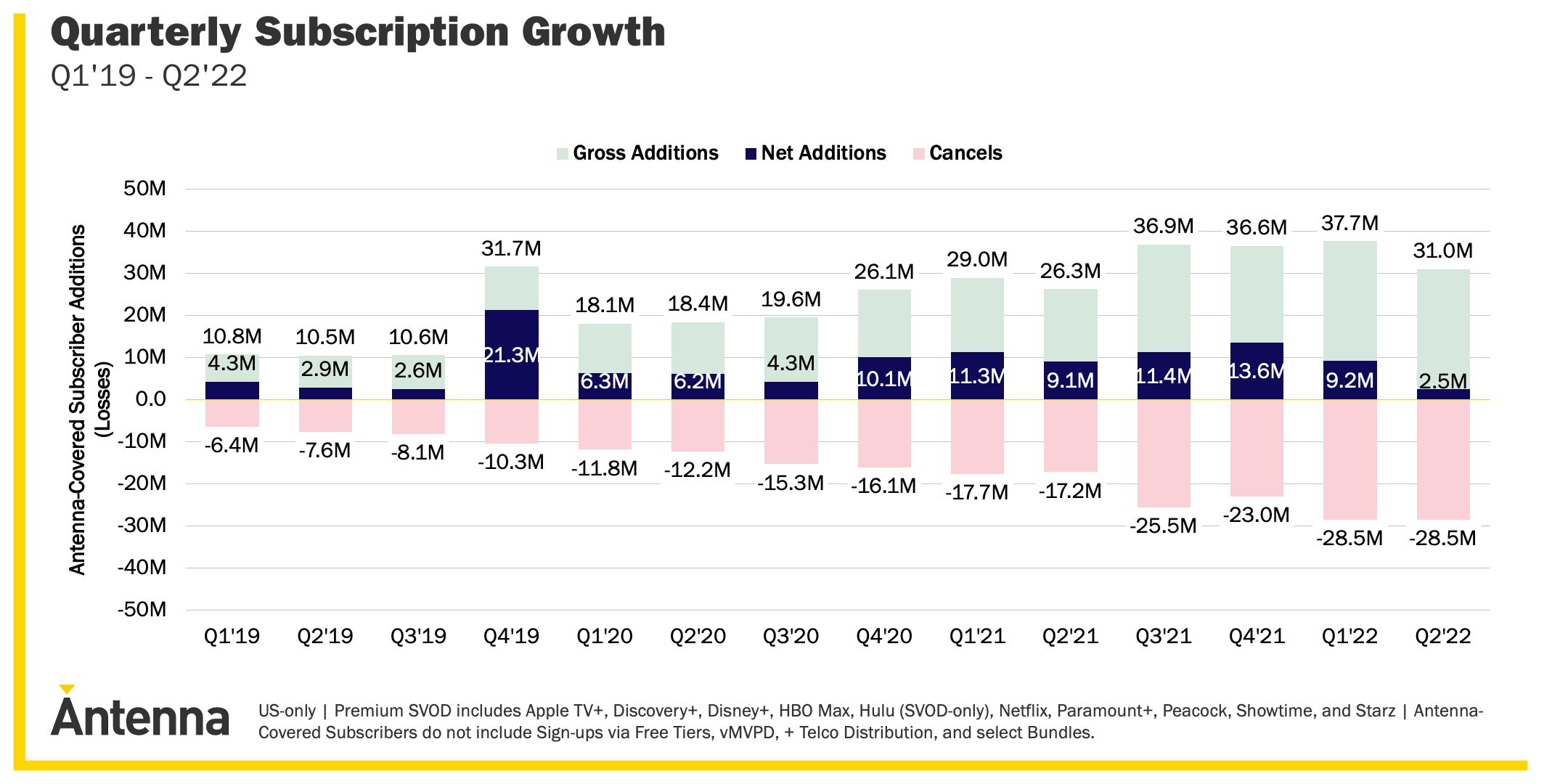

Ups, Downs – Churn – adding/subtracting services – has been something the communications industry has lived with since the beginning; and with the introduction of multiple services, the constant release of new content, and inviting special offers, it is becoming a consideration for streaming services.

Ups, Downs – Churn – adding/subtracting services – has been something the communications industry has lived with since the beginning; and with the introduction of multiple services, the constant release of new content, and inviting special offers, it is becoming a consideration for streaming services.

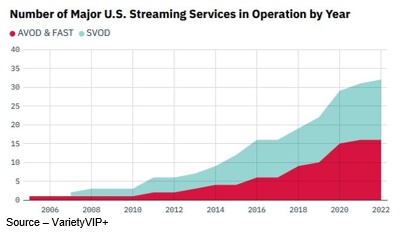

To soften the churn impact, nearly all of the streaming services have or will shortly initiate more economic options – AVOD and FAST (free ad-supported streaming TV) services.

We Don’t Mind – Streaming services thought their initial consumer appeal was the absence of ads for uninterrupted enjoyment, but folks are clearly showing that for a lower priced service, additional payment watching ads isn’t all that bad

We Don’t Mind – Streaming services thought their initial consumer appeal was the absence of ads for uninterrupted enjoyment, but folks are clearly showing that for a lower priced service, additional payment watching ads isn’t all that bad

McLennan said that AVOD services like Pluto, FreeVee, Peacock, Rakuten, Tubi, YouTube, Watch4, Joyn, Tencent, Baidu’s iQiyi and Alibaba’s Yokou, Vidio, Viu, and hundreds of others around the globe are set to see an increase in both Monthly Active User (MAU) hours watched and revenues. He estimates that the services will more than double their revenue over the next two years to reach $56 billionh. Fast services like Roku, Samsung TV, LG Channels, Plex, Kanopy and others have grown rapidly in recent years because of the low cost of entry and lower cost of content McLennan noted.

However, he added that they all they suffer from content overlap, lack of service differentiation and increasing viewer growth. He emphasized that FAST’s saving grace may be the breadth of distribution through smart/connected TV (87 percent in US, 40 percent globally).

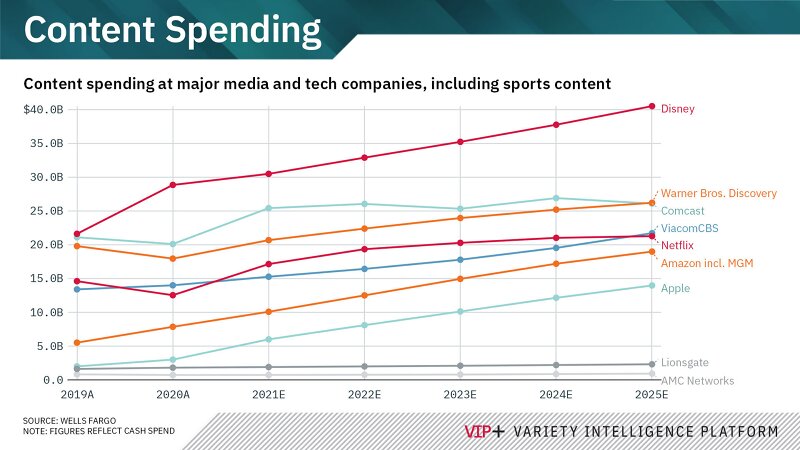

Investments – People like fresh, new, innovative content to watch and streaming services that don’t invest in new content face the prospects of reduced subscriptions

Investments – People like fresh, new, innovative content to watch and streaming services that don’t invest in new content face the prospects of reduced subscriptions

To keep their growth on track – and to “justify” fee increases – the global SVOD service majors are maintaining their investment in new content.

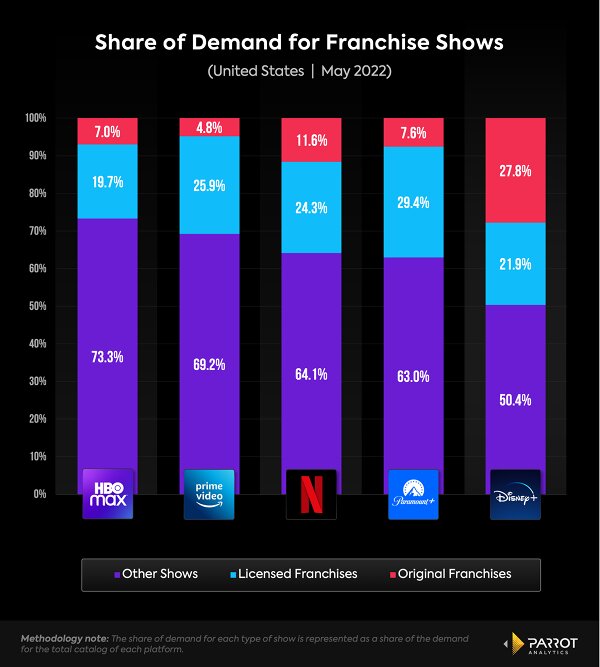

Okay, so maybe new isn’t the right word. They’re focusing a lot of attention on franchise shows as well as prequels/sequels of projects in the most widely viewed genres – superhero, comedy drama, sci-fi drama, sitcom, and crime drama. Even shows/series from 2011, 2013 and 2018 are being re-released due to the added interest and their quality.

Hedging Investments – Studios and streamers know that the best way to ensure a good ROI on their content investments is to deliver stuff folks are interested in – franchised projects including prequels, sequels and spin-offs.

Hedging Investments – Studios and streamers know that the best way to ensure a good ROI on their content investments is to deliver stuff folks are interested in – franchised projects including prequels, sequels and spin-offs.

In addition, they’re clawing back shows they previously contracted to competitive services such as Yellowstone (and spinoffs) and Star Trek returning to Paramount + from Peacock as well as Disney’s Marvel and calling IP (intellectual property) like Iron Fist, Daredevil and The Defenders back home. While these moves are good, they aren’t enough to maintain their steady growth now that consumers have an overabundance of good to great paid viewing options.

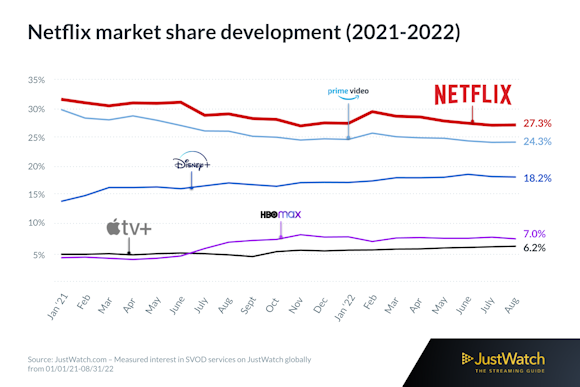

Market Share – Business was simpler when Netflix, Amazon, and Hulu shared the stage, but as new participants entered the scene, overall market growth slowed but leaders continued to show why they were leaders.

Market Share – Business was simpler when Netflix, Amazon, and Hulu shared the stage, but as new participants entered the scene, overall market growth slowed but leaders continued to show why they were leaders.

The rapid acceptance of ad-supported streaming is clearly showing SVOD management that many individuals and families will tolerate advertising to pay for some of their content. Most of the SVOD services have, or will shortly, introduce their own lower-cost, ad supported viewing options because it has become obvious that families have reached their pain point when it comes to the size of their monthly streaming bill. The size of the pay TV bill encouraged folks to cut their cable service bundle for one or two inexpensive streaming services. And now that the cost of their internet service and six to eight streaming services have reached a similar level, they have begun cancelling services.

Netflix, which has already found the SVOD service ceiling – $16 for the standard plan – will slowly introduce ad-supported pricing in hope of winning back some if not all of their recent lost subscribers. The ad-supported tier may also convince friends and neighbors who are using someone else’s credentials to watch the service’s shows to sign up for their own Netflix service. McLennan suggested that the new pricing plan could generate nearly 8 million subscribers next year and as much as $1 billion+ in incremental income during the same period. Disney has announced that its Disney+ ad-tier pricing will cost the same as the company’s current service and that they will be increasing the cost of their ad-free tier.

Hulu has long had both SVOD and AVOD service options. Their picture is murky though because with Disney owning 70 percent of the service (Comcast/NBCUniversal owns the remainder) Disney has also included it in a bundle offering with Disney+ and ESPN+.

In addition, while both firms want 100 percent of the service, there’s a very good chance Comcast’s CEO Brian Roberts will sell the company’s share at a handsome profit and use the money to acquire one of the services presently burdened with an excessive $43 billion merger price tag. Word is Roberts is looking hard at one of the content creation/delivery services that is struggling to right itself. And it would certainly be a welcome addition to NBCUniversal’s Peacock streaming service which has had trouble attracting a significant subscription base in the fast-moving streaming entertainment arena.

The floundering organization is slashing staff and projects and has done little to spell out a clear path to recovery other than to talk about a 10-year plan that mirrors Disney’s MCU (Marvel Cinematic Universe) success in the theater and streaming.

“When there’s blood in the water, sharks gather rather quickly,” McLennan observed.

Amazon Prime already has the ad-free SVOD service bundled with its Prime service which includes free product deliveries (handy for the holidays) as well as its FreeVee ad-supported service. They could also be planning a FAST bundled service that includes content from other broadcast and studio organizations.

Paramount Global CEO Bob Bakish has said they will raise the price of Paramount + SVOD service and introduce an ad-supported tier. Of course, he also gave families a reason to stick with their SVOD service, noting that they plan to release Top Gun: Maverick on Paramount + following its theatrical run sometime in the fourth quarter.

Apple TV+ may be the lone holdout to adding an ad-supported service but then it comes free when folks purchase products like phones and computers. In addition, their Apple One bundle is designed to be an all-inclusive entertainment and personal package that includes Apple Music, Apple Arcade, iCloud+, Apple News+ and Apple Fitness+.

Even Disney’s recently returned CEO Bob Iger, recently observed,

“But they’re not going to stand pat. They’re going to continue to grow; and they’ll grow well. They have deep pockets. They have great access to consumers. They have strong technology platforms. They’ve proven they know how to do it. So, they stay.”

In other words, competition in the video streaming market is stiff with major services already well established in the consumer’s mind and budget. And with hundreds of channels out there it is only going to get worse.

The challenge for the consumer is finding just the content he/she wants when they want to watch it and minimize the amount of time it takes to find the content.

“While it won’t be a simple task,” McLennan said, “the obvious solution for everyone involved – content producer, service provider and consumer – is to develop a modified service bundling program.”

He emphasized that Disney has already moved in that direction with Disney+, Hulu and ESPN+ which also includes content from Disney-owned organizations including Marvel, Fox, Pixar, Lucasfilm, Marker Studios, Lifetime, History, ABC, A&E, and more. Comcast’s NBC Universal has previously had talks to add Warner Bros properties and HBO Max to their bundled offering. The move could become even more clear by 2024 when a lot of the legal hurdles are allowed to lapse following the merger of Warner Bros and Discovery early this year.

Peacock has had discussions with a number of smaller US and international streaming services but … we’ll see.

Offering a large bundle will obviously reduce the industry’s biggest concern right now – churn. People will be able to discover shows and movies they want to watch much more easily thanks to a single user interface, but it come at a potential cost to the services because of their potentially lower ARPU (average revenue per user).

Competitive dynamics – ego – will probably be one of the biggest obstacles for an inter-company bundle because executives will undoubtedly view the bundling move as a sign that they can’t compete on their own even when it’s obviously in the best interest of the entertainment hungry public. If we’re lucky, the services may be more amenable to adding their content resources to a third-party broadband service provider since they already provide wired and wireless internet service to the families that streamers need to reach.

It’s a lot like the inevitable line Vince delivered regarding Stevie in I Used to be Famous when he said, “All he ever wanted was a friend.”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.