This is the second part of my report from the DSCC/SID Business Conference which took place last week, but which is still available online to registered attendees. Part 1 is here (The Display Market in 2021 – Part 1)

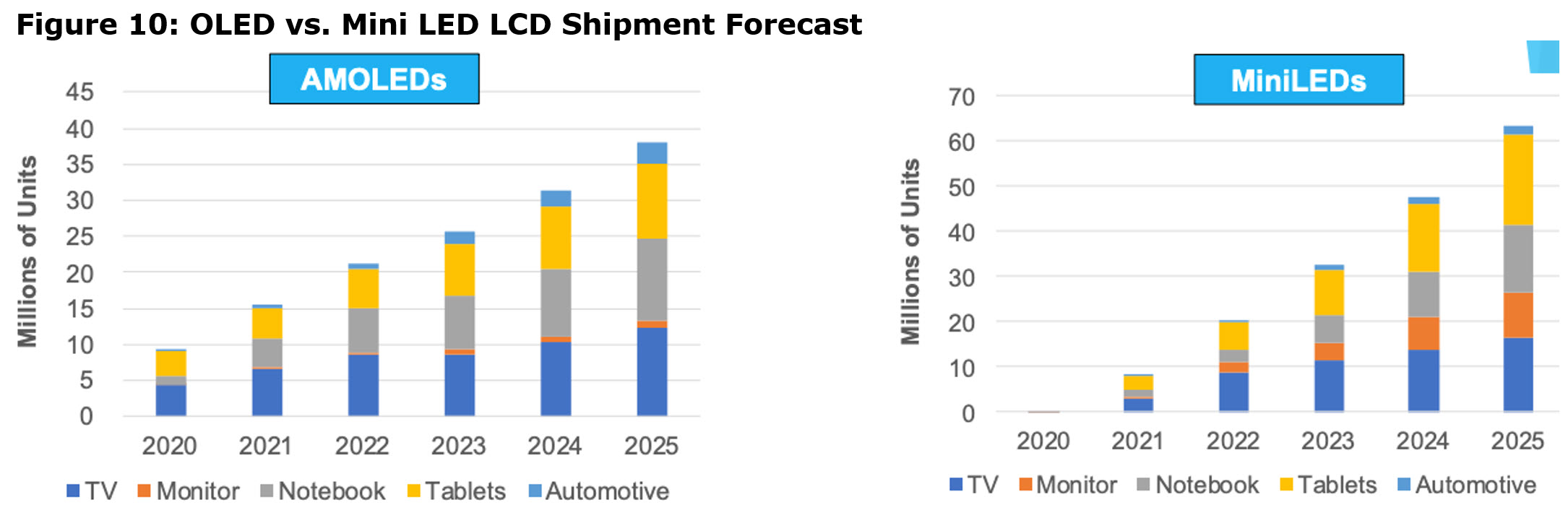

DSCC constructed a comparison of their forecasts for large area displays using OLED and miniLED LCD technology and showed that in 2021 OLEDs would lead miniLEDs by 15 million units to 9 million units. In 2021, both technologies would share 40 million units equally and after 2022 miniLED will grow faster than OLEDs, reaching a total of 62 million units in 2025, while OLEDs hit 38 million. The comparison shows miniLED LCDs growing faster than OLEDs, but in reality, OLEDs are taking share from LCDs, while miniLEDs are simply shifting LCD demand from LED to miniLED backlights.

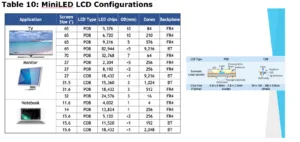

There is a trend to increase the number of LEDs and the number of dimming areas in miniLED LCD sets to compete with OLEDs. As shown in the next figure, depending on the application, the current number of miniLEDs varies from 5,000 to 82,000 and the dimming areas from 4 for notebooks to 9,000 for TVs. But the technology is maturing, and cost reductions are anticipated, increasing their performance, while concurrently reducing the cost.

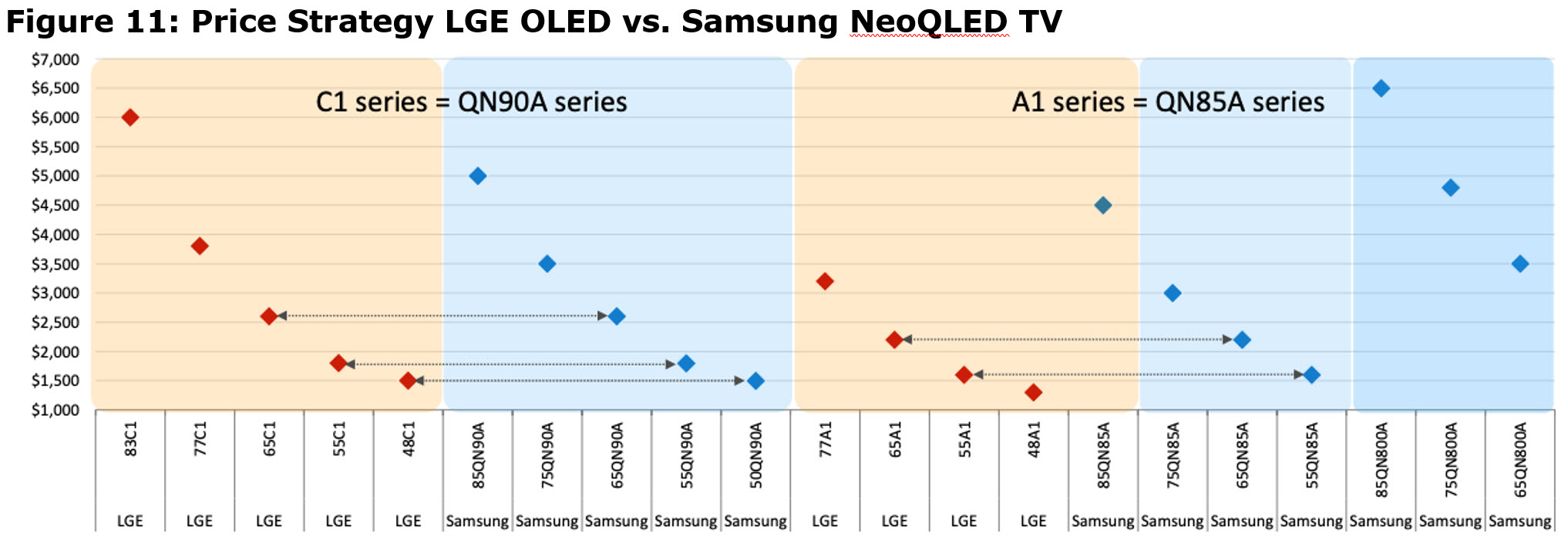

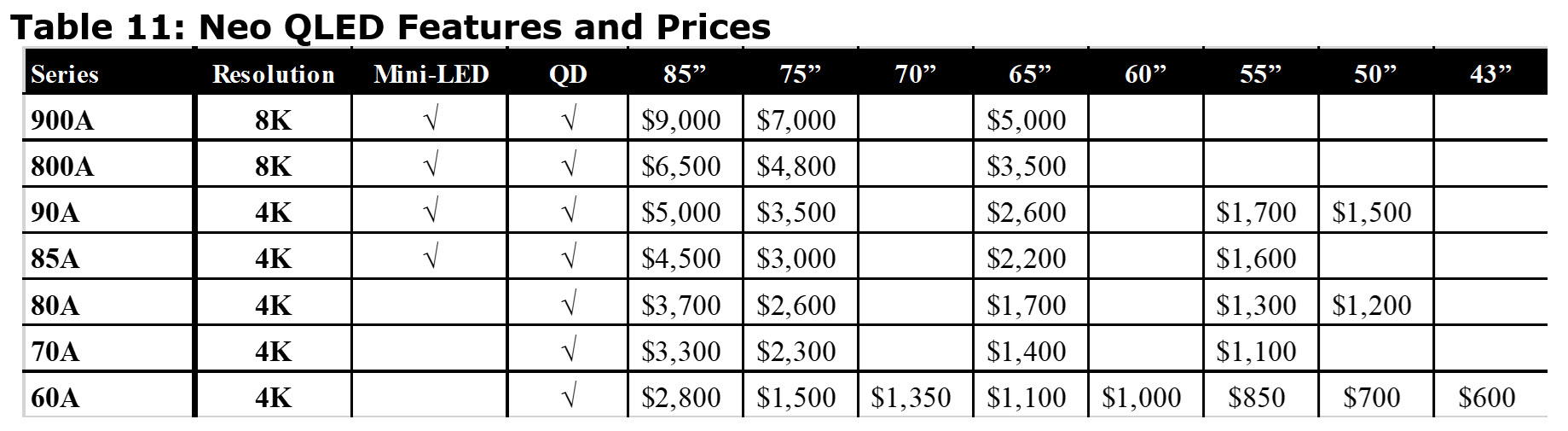

Samsung’s NEO QLED TV line, which includes both 8K and 4K models and a combination quantum dot-enhanced miniLED backlit and LED sets. While each series has slightly different feature sets, it is obvious that Samsung is looking to both promote 8K and mini-LED backlighting in these series, while appealing to almost every price point between $9,000 and $600. LGE does not have the same wide range, but where the match-up is comparable, Mini LED vs. OLED the prices are virtually the same.

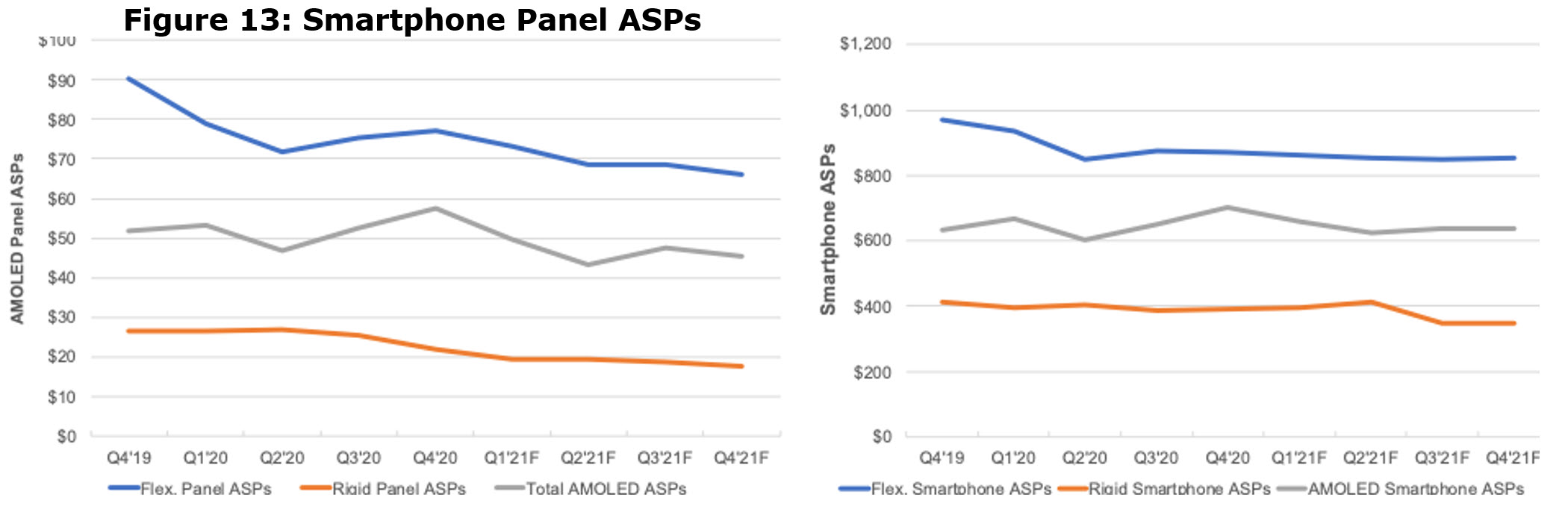

Smartphone panels generate the most display revenue and are 10 times the volume of other applications and it is where OLEDs have made the biggest inroad. Samsung, which makes most of the OLED panels for smartphones, has effectively challenged all the panel makers by raising the technology stakes with a range of innovations:

- First was the flexible display, which used a yellow PI backplane

- The foldable display is an outgrowth of flexible technology, and which required a thinning process, new cover lens, first CPI and now UTG, combining layers. The latest change is replacing the circular polarizer with a combination black PDL and a color filter.

- Integrated Touch

- Under panel camera and sensors, which have been tried by others, but found wanting until released by Samsung

- LTPO, developed initially by Apple, implemented by LG for the Apple Watch, but installed first in smartphones by Samsung

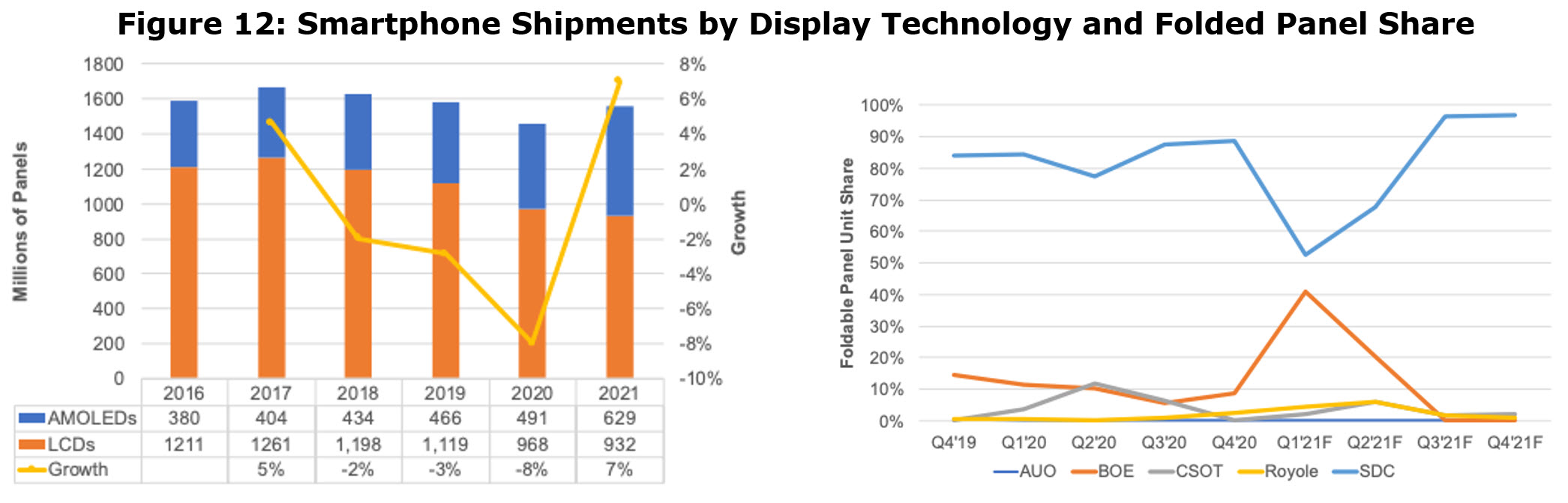

Samsung’s technology innovations and the associated capex has resulted in a dominant position and OLED’s share of smartphone panels, which grew 7% in 2020, even as the smartphone volume contacted and is forecast to grow by 28% in 2021, reaching a market share of 40% in 2021, up from 30% in 2019.

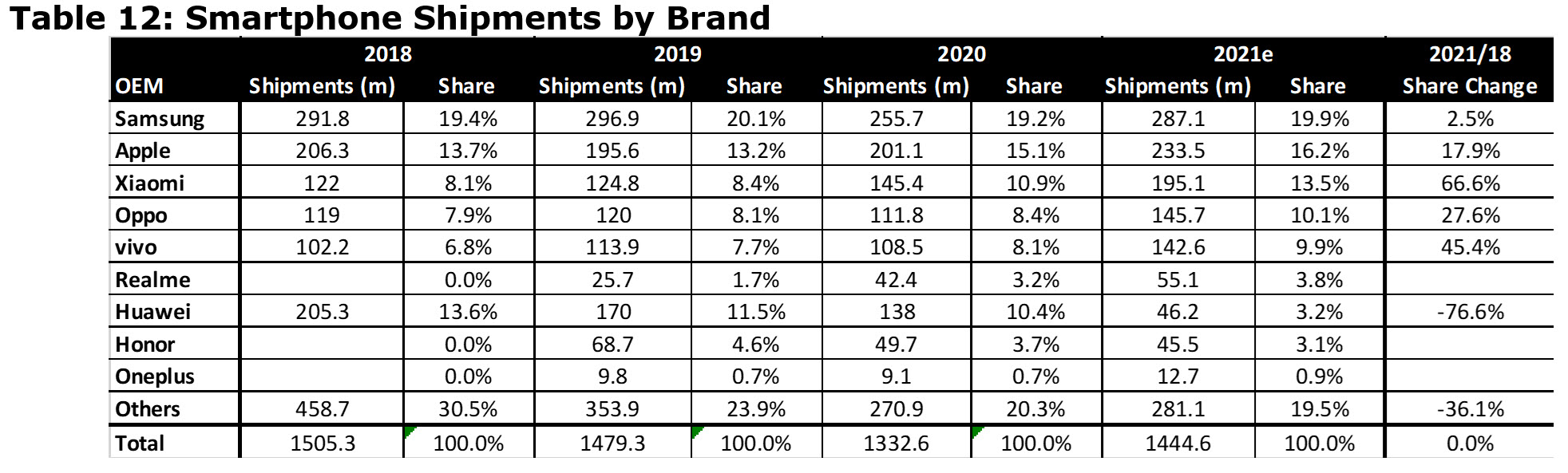

The top OEMs have remained the same between 2019 and the 2021 forecast, with the exception of Huawei dropping out due to the restrictions imposed by the US. Volume is forecast to be slightly down comparing 2019 with 2021 forecasts.

MicroLED

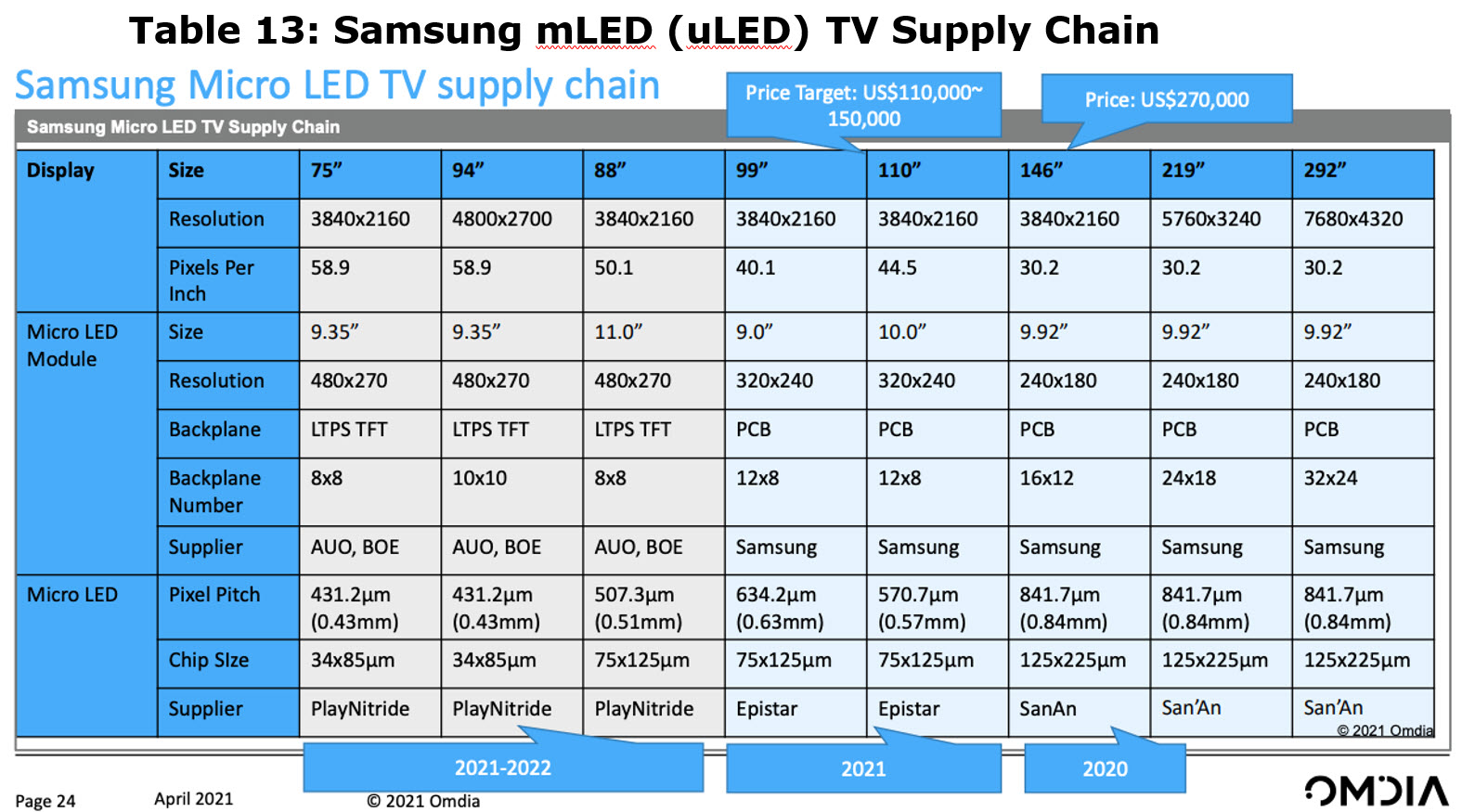

DisplayWeek includes many talks and several announcement of MicroLED technology and prototypes, but the only real products to date are the TVs produced by Samsung and Sony, which use LEDs that are 34×85?m, up to 125×225?m. The challenge remains, however, of how to transfer millions of LEDs from the substrate on which the LEDs are made cost effectively and at high yields.

There were a number of talks on different processes and yield improvement measures, but it still appears to be a daunting task. While Samsung didn’t discuss its QNED process, which involves InkJet Printed nanometer size LEDs, it is the only technique that has the throughput to meet the TACT and cost for large area displays. In the interim, Display Week demonstrated that the emerging microLED revolution is on hold.

The display industry has reached a mature level, where long term growth is limited and the two driving applications: TVs in area and smartphones in revenue are not growing. The reasons are clear:

- The installed base for smartphone is estimated at 4 billion. The population of 7.8 billion people is growing at 1%/year and the majority of the growth is in regions where smartphones are unaffordable. The average replacement time is ~ 3.3 years. Demand based on population growth and replacement time adds up to ~1.1 billion smartphones/year, so the current level of 1.4 billion/year represents the upper end of demand unless there is a technology event causing a shortening of the replacement time, which has been increasing with rising prices.

- TV shipment growth has been demonstrated to be a function of the number of new households reaching $6,000 income per year and the 10 year replacement cycle. TV shipment growth is now more a function of the increased average panel size than the number of new TVs shipped. Two events over the last 50 years changed this status, 1) the switch from black and white CRTs to color and the switch from CRTs to flat panels. OLEDs, miniLEDs, Smart TVs, 4K, 8K have had virtually no impact on industry shipment growth.

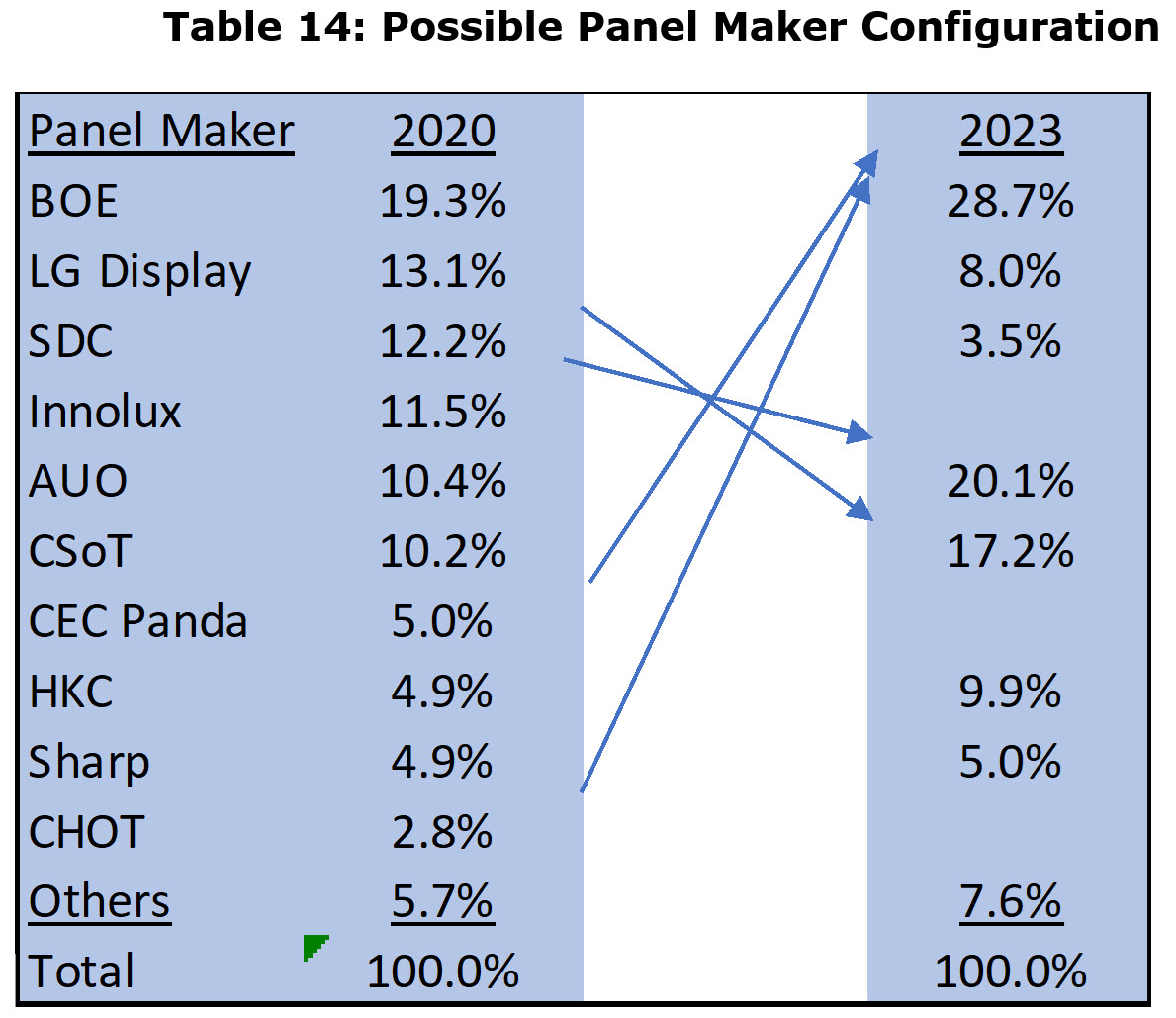

- Ten years later, BOE has a 25% share followed by CSoT at 17%

- The three leading LCD panel makers had a 44.6% capacity share in 2020, growing to 52.8% by 2023

- Capacity dominance has shifted from Korea to China, while the Korean’s have maintained their technology lead.

- BOE is absorbing CEC Panda

- CSoT is absorbing Samsung Suzhou

- HKC is expanding capacity

- By 2023, the major changes expected include Samsung and LG Display exiting the LCD market except for LG’s 8.0% of LCD capacity used for IT; BOE may be absorbing CHOT, Innolux

- If the Chinese allow LCD prices to return to the 2019 levels, it could cause consolidation in Taiwan. Given that Innolux’s parent, Foxconn has turned negative on the display industry caused by losses at Sharp and their Gen 10.5 fab in China, a case could be made for an AUO takeover.

- The net result would be a collapse of the LCD industry from 6 suppliers in 2020 with double digit market shares to three.

The industry has absorbed major changes over the last 10 years. In 2011, SDC and LGD had almost a cumulative 45% share of capacity

The Chinese government is likely to play a major role in the next phase, but it won’t be in providing capital. Now that the Chinese government has succeeded in shifting the center of the display industry from Korea to China, the government will be motivated to increase its return on capital by helping the larger panel makers absorb the smaller ones that have negative free cash flows. Plus, LGD and SDC will eventually have to rationalize their LCD capacity, which under normal circumstances would be non-competitive. The likely consolidation steps, include:

The obvious questions for LGD and SDC are:

-

Can they maintain or even increase their lead in OLED technology?

-

Is the MicroLED evolution real, in what timeframe and for which applications?

Barry Young is the CEO of the OLED Association

Publishers’ Note: We won’t count today’s Part 2 as part of your two free articles per month. Parts 1 & 2 will count as a single article.