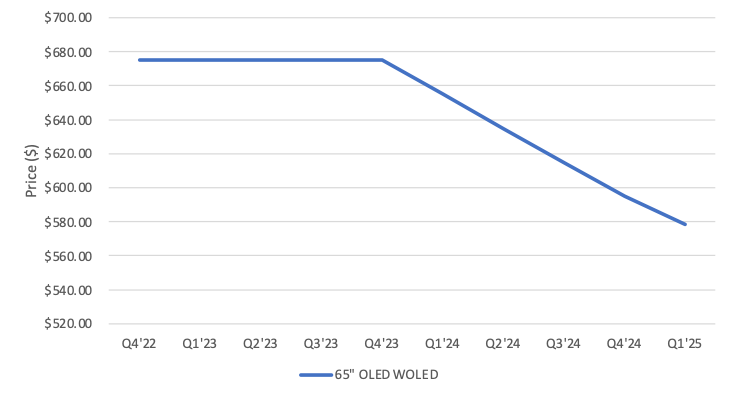

OLED panels have been siphoning off revenue that once went to LCDs and by contributing technology, such as thin film encapsulation, flexible and foldable form factors heretofore unavailable to product designers. OLEDs now have 50% share of the smartphone market, the app that generates the most revenue and is the most dynamic. Moreover, the OLED share is near 80% for the lucrative mid and high ranges. What sets OLEDs apart from LCDs is the high contrast ratio, fast response time, wide viewing angle and the previously mentioned multiple form factors. But these advantages come with some shortcomings, higher costs, lower luminance and lower lifetime. The OLED TV, first released by LG, has been judged to be the best TV ever, outperforming every type of LCD and the luminance gap has been narrowing. But the cost gap remains and can be anywhere from 200% to 300% more than the best MiniLED TVs. In 2023, a down year for most products, OLED TVs were down 30% Y/Y and are not expected to maintain their leadership in Advanced TV sales in 2024. Moreover, neither SDC nor LGD, the only producers of large OLED panels have plans to expand production. Nonetheless, it was the OLED TVs that demonstrated to consumers that OLEDs provide the best image, which is causing buyers of smartphones, tablets, automotive, notebooks and gaming monitors to want OLED based products

Apple was the first non-panel maker to take advantage of OLED performance by converting all iPhones and will soon (2025) offer the iPhone SE4 with an OLED display. Given their success (Apple was the #1 supplier of smartphones in 2023), they recently released the first OLED iPads and plan to switch the entire range of iPads and MacBooks to OLEDs, which is expected to result in OLED based IT products growing from 8-10m in 2023 to over 100m by 2030. Apple’s penchant for display superiority has also caused SDC, BOE, LGD, Visionox and possibly two others to start planning or building Gen 8.6/7 fabs, the only real new fabs for the entire display industry.

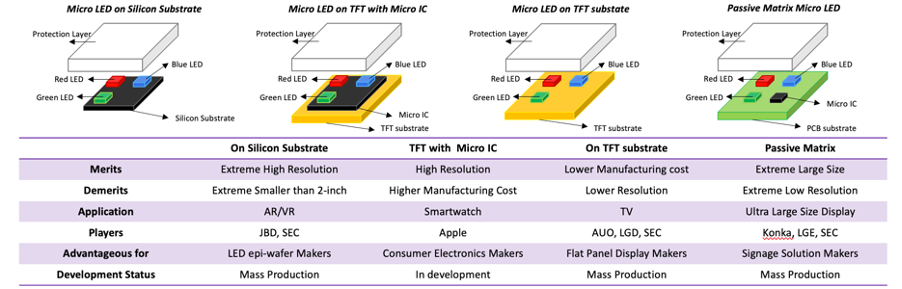

The proponents of MicroLEDs (<10µm per side) saw the OLED success and reasoned that if OLEDs could do it why not MicroLEDs, which they claimed outperformed OLEDS in CR, lifetime, viewing angle, color range, and response time. According to Yole, over 100 companies have spent >$15b in acquiring and developing the technology. But to date they have been unable to produce displays at a cost anywhere near OLEDs. Even Apple, which saw the opportunity to more efficiently control the display production process by designing Micro LEDs, buying the µLED, selecting the mass transfer technique and the rest of the display process and then contracting to assemble the MicroLED panel with a display foundry, determined that these new displays couldn’t compete with OLEDs, even as they chose the low hanging fruit, the low resolution smart watch display to demonstrate the concept. The only commercial products after almost 10-years are very large TVs that use 1mm2 LEDs, cost a minimum of $100,000 for a 100” display and more for larger monitors. Samsung is the leader in this category having developed a display that combines small tiles to create any size display desired. The tiling is so sophisticated that there is no visible edge when tiles are combined. The total market is expected to reach 1m per year, while the rest of the TV set market hovers at 200m per year.

There are no other commercial products, although prototypes exist for every type of application. But the MicroLED folks have yet to absorb the lessons of OLED TVs, which is that no matter how much better a display is, the market will not buy it, if the price is much higher than acceptable technology. MicroLED seems to be relegated to waiting for solution to see-through AR, where the requirements are very high resolution and very high luminance.

The remainder of this article tracks the new fabs, the projected capex, the expected closing of legacy fabs and then moves on to show the role of OLEDs vs. LCDs in all the major display categories. It includes materials from Omdia’s reports on the OLED Display Market Tracker, OLED & Flexible Display Technology Tracker and the OLED and LCD Supply Demand & Equipment Tracker derived from several sources.

Display Capacity — Flat Revenue and Low Capex

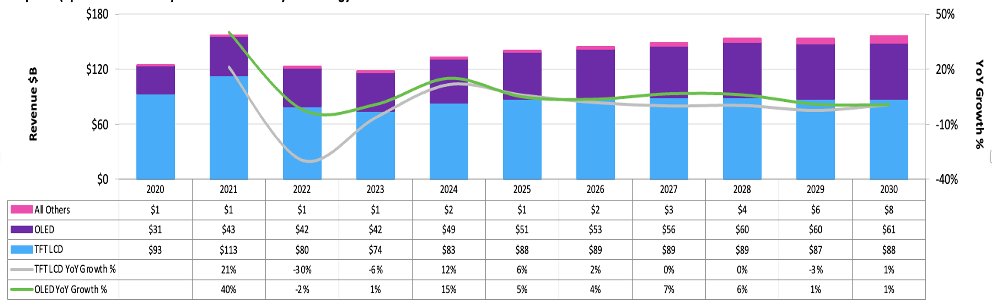

Revenue peaked in 2021 at $141m as the pandemic led to early buying of TVs, PCs and monitors. Revenue dropped in 2022 and again in 2023, reaching $123b down 6% Y/Y. 2024 is forecasted to reach $134b, up 15% Y/Y and for the next several years revenue stay below the 2021 high.

- The lack of revenue growth is a function of the dearth in new applications, where there are no comparable to smartphones, PCs, monitors or TVs creating demand for new capacity. Capacity is in an oversupply condition and capex growth has stalled.

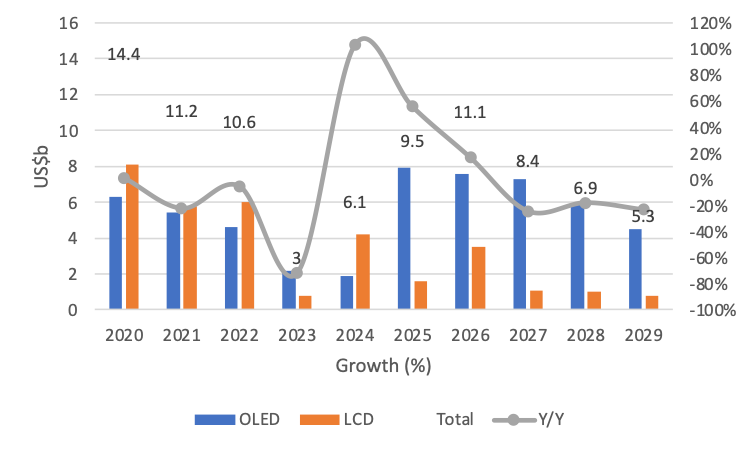

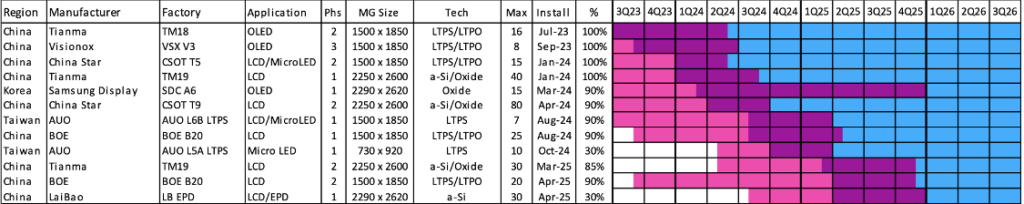

- Based on known 22 fab additions as shown in the next table capex is just $40.3b from 2025 to 2029, an average of $8b per year.

The primary source of new spending is for 3 Gen 8.7 OLED fabs by SDC, BOE and LGD to supply tablet and PC displays for Apple’s initiate to convert its iPads and MacBooks from LCDs to OLEDs. The fabs have several characteristics that different them from the Gen 6 OLED fabs for smartphones and the Gen 8.5 fabs for OLED TVs.

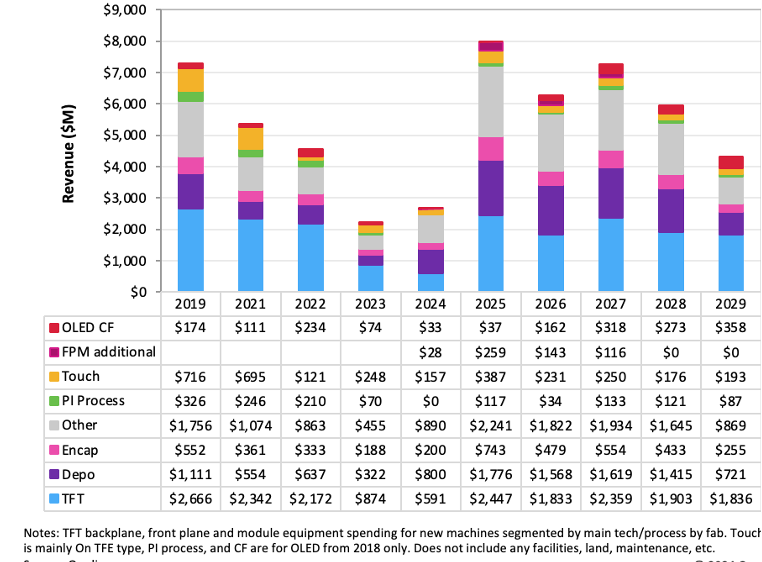

- Deposition is expensive and exceeds TFT costs

- Half Gen8.7 costs for VTE using FMM with tandem stack increases faster than the glass size increase

- The tandem design doubles the number of chambers

- VTE tool capacity is limited as Canon Tokki is able to produce on 2 7.5K tools per year, causing BOE and LGD to look at Sunic as an alternative supplier

- The high cost of the deposition equipment and the use FMMs is encouraging JDI, Visionox and Tianma to experiment with lithographic patterning, which is less expensive more available and produces a higher aperture ratio that leads to longer lifetime and higher luminance. FPM (photo-based RGB patterning) is broken out beginning in Q2’23 for exposure, dry etch PVD, CVD, coater developer and other equipment counted under depo and encap below.

- There is also lithographic spending TFT, touch and color filter processes, which have increased in smartphones as OLED display become more inclusive of component functions, thinner and light efficient.

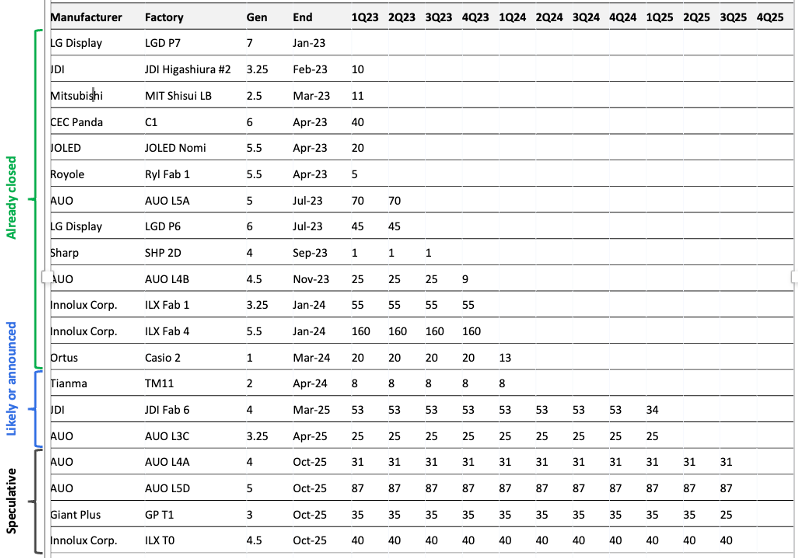

The other side of the investment story is the closing of legacy LCD factories shuttered in 2022 and 2023, and those planned for closure this year:

- South Korean panel makers withdrawing from mainstream LCD production

- Japanese and Taiwanese makers closing older, legacy capacity

- Oversupply, low profitability, and lack of competitiveness against newer Chinese capacity are the main reasons.

- Panel makers, particularly in Taiwan, have, in many cases, shifted legacy factory production to higher profitability and niche products and will continue to run them.

- Japanese and South Korean remaining factories are, in many cases, applying similar value-added production strategies.

The exact dates on fab “shut down” can vary substantially as there are cases, such as Tianma’s TM11 factory in Akita, Japan, where it no longer produces any known commercial products, but glass input continues at a very low volume of several hundred sheets per month. The estimate includes display R&D as well as other non-display applications. The next table provides a projection and the likelihood of closure.

OLED Panel Shipments by Application

This section covers the range of apps that use OLED panels. Where appropriate, OLED shipments will be compared to LCDs to show the gain or loss of market share.

In terms of shipment volume and revenue, smartphones are the largest application. In terms of shipment volume smartwatches are #2, with mobile phone sub-displays used for the cover display in foldables #3. The major change over time will be notebook and tablet displays as the SDC, BOE and LGD Gen 8.6 fabs enter mass production. This week Visionox announced they would also build a Gen 8.6 OLED fab.

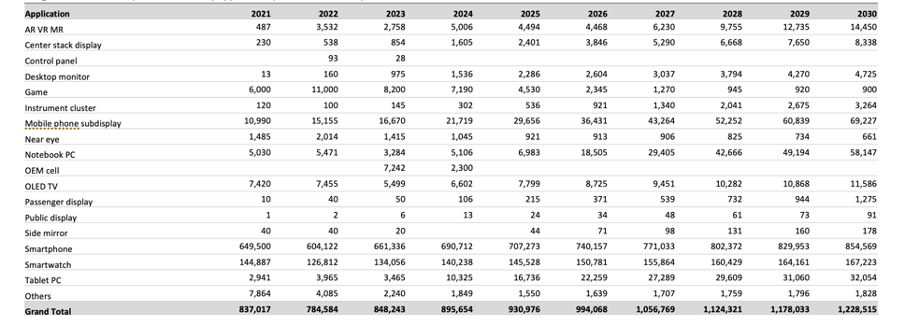

Total OLED shipment volume is forecast to grow at a CAGR of 3% from 837.0m to 1228.5m panels over the 10 year period shown below.

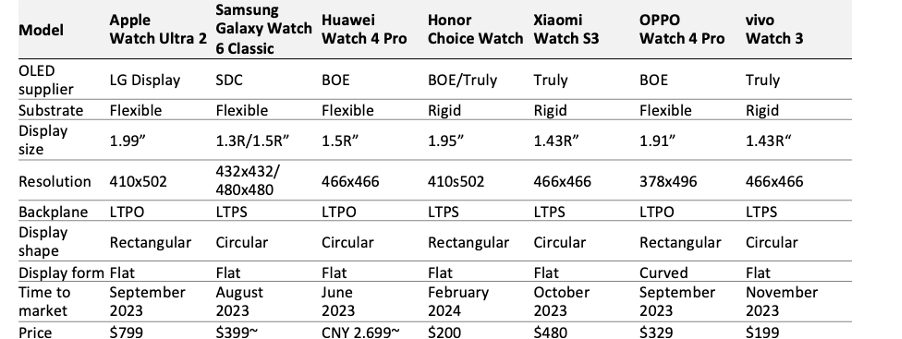

Very Small Displays – Smart Watches

Vary in size from 1.1” to 2.0” and technology includes AMOLEDs, LCDs, PMOLEDs and this year MicroLEDs. Apple was the leading supplier in 2023 with a 33% share, followed by Samsung at 12% and Huawei at 10%, all three use OLEDs. AUO has introduced a MicroLED display for watches, but the volume is very small. Smart watches is the application that Apple tried to use as a steppingstone for all of its displays, but recently cancelled the $3b program.

Apple examined multiple alternative configurations and settled on the MicroLED on TFT with Micro IC. This approach used a digital driving mechanism, which increased the EQE by 20% to 30%, overcoming the lower EQE without the Micro IC that used analog driving. The downside of the Micro IC approach was the higher cost that the MicroLED on TFT substrate, which was already too high.

Small Displays – Smartphones

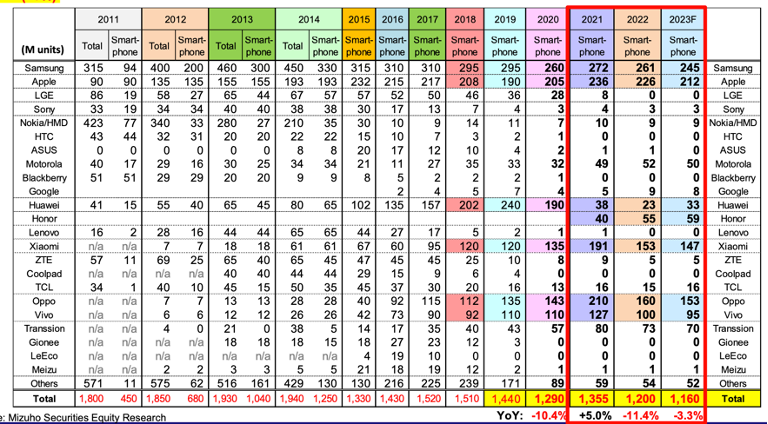

Volume peaked in 2017 at 1.52b and has been down Y/Y since, except for 2021. The shipment forecast for 2024 varies in the range of up 3% to 4%.

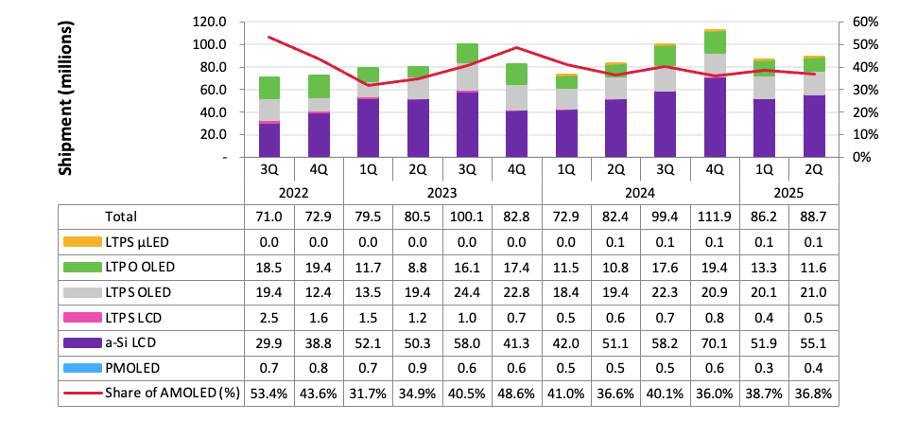

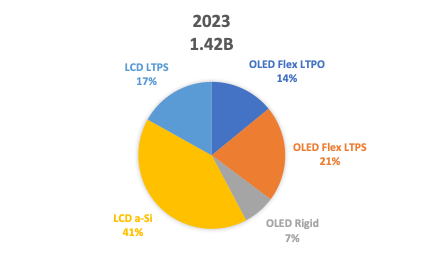

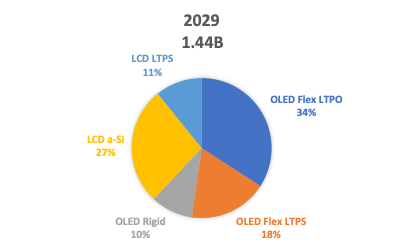

The big change occurring is the shift from LCD panels to OLED panels as shown in the following figure, comparing 2023 panel shipments by technology. While the panel volume remains the same, the OLED share goes from 42% to 63%, with the main shift going from LCD LTPS to OLED flex LTPO.

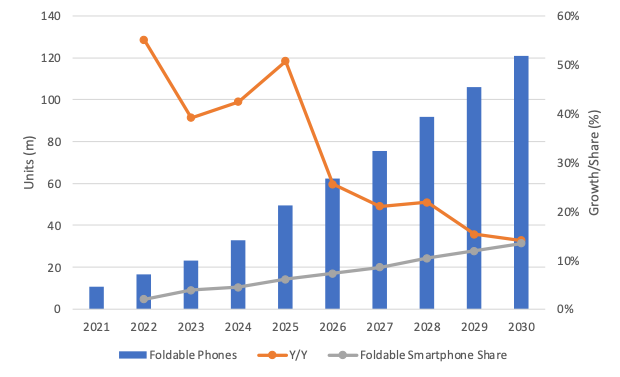

Contributing to the shift is the increase in foldables, going from 23m in 2023 to 120m by 2029 which would be a 15% share of all smartphone panels as shown below.

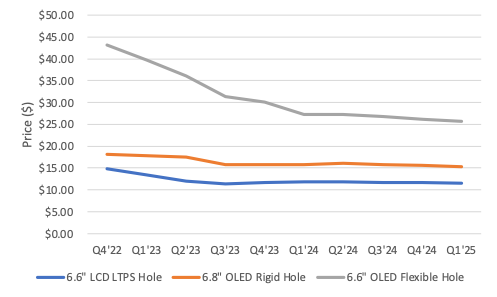

Prices for rigid smartphone panels have remained steady since 2022 with a $3 difference between LCDs and OLEDs. The flexible OLED panel price have come down 33% as all the Chinese panel makers began producing at competitive yields.

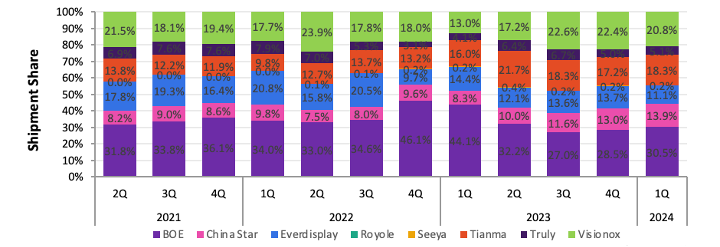

- Chinese panel makers provided 102.1m in Q1’24 OLED panels, increasing their market share from 57.6% in Q4’23 to 65.2% in Q1’24. Flexible OLED shipments were 70.0m in Q1’24 its share increased from 67.4% in Q4’23 to 68.6% in Q1’24

- In Q1’24, BOE accounted for the largest share (30.5%) of Chinese OLED shipments (including OEM cell shipments of Chinese panel makers), followed by Visionox (20.8%), Tianma (18.3%), China Star (13.9%), EDO (11.1%), and Truly (5.1%)

Medium Size Displays—IT

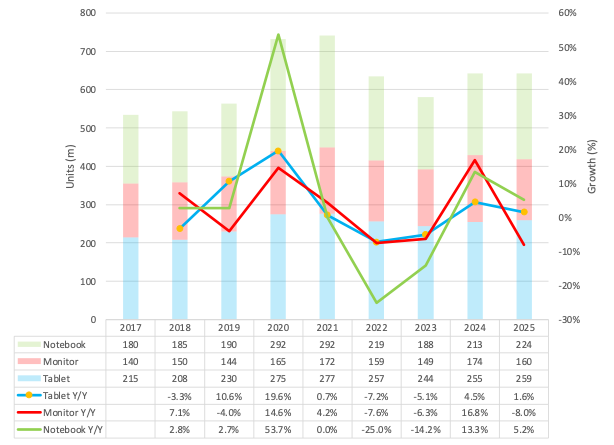

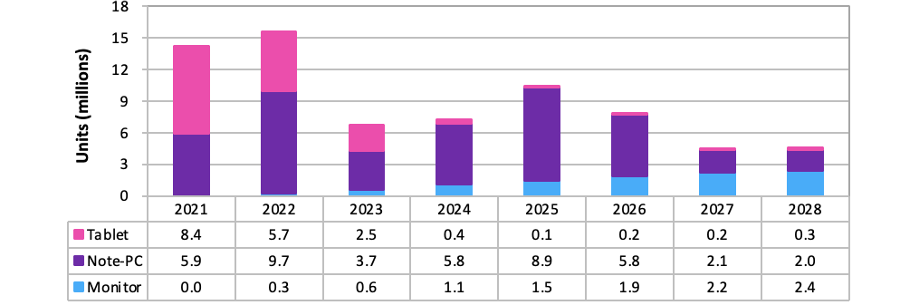

Over the past 6 years, the IT segment has been the most volatile with wide swings in Y/Y shipments. As shown in the next figure, notebooks Y/Y shipments went from +53.7% in 2021 to -25.6% in 2023 to -14% in 2023 to an expected 13.3%. in 2024, as the notebook market recoveries and adopts IT. The other 2 apps were just as volatile although they did not reach the high levels of notebooks.

What began in 2024, is a transition in the high-end, led by Apple, of LCD panels being replaced by AMOLEDs, initially built on Gen 6 fabs using the hybrid design, i.e. trimmed glass, TFE and a tandem stack that will be enhanced by a color filter on capsulation, which eliminates the polarizers and improves the luminance. The OLED panel makers, SDC, BOE, LGD and Visionox are building Gen 8.6 fabs that will service the notebook market. CSOT, JDI and Tianma are currently planning for Gen 8.6, but haven’t yet committed.

Visionox, JDI and Tianma plan to use a different patterning method that employs lithography to produce RGB subpixels eliminating the costly FMMs. CSOT is currently producing IT panels on its Gen 5.5 fab using solution processing and IJP. If they are successful in that endeavor, they will build a Gen 8. Within the high-end (advanced IT and advanced TV) markets there is competition between Mini LED LCDs using QD color film and RGB OLEDs. Since Apple is switching from LCDs and MiniLED LCDs, it is expected that the MiniLEDs will be phased out at the high end leaving OLEDs as the go to display technology at the high end and LCDs either a-Si or LTPS for the rest of the market.

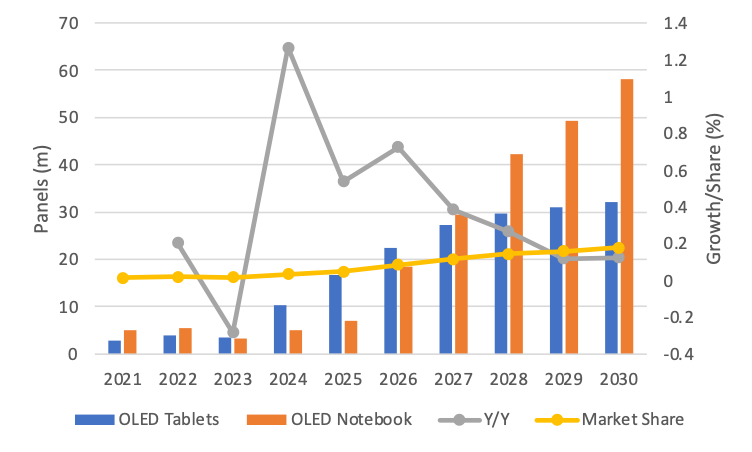

OLEDs had just a small share in 2023, as shown below, but the volume started increasing in 2024 and is expected to reach >30m tablets and just under 50m notebooks by 2030. Approximately, 1m gaming monitors shipped in 2023, but volume is expected to reach only 3m by 2030.

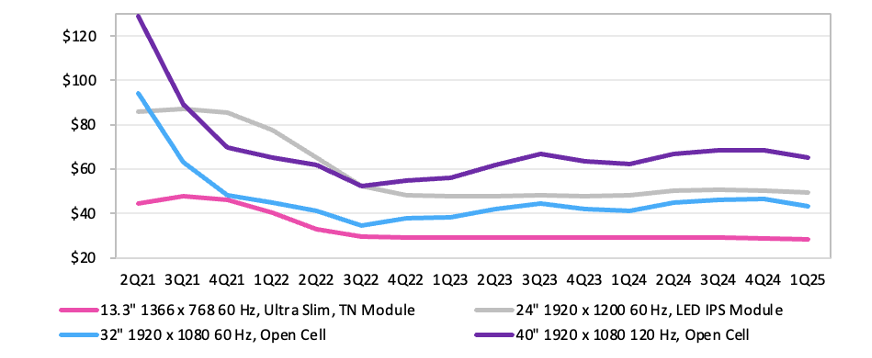

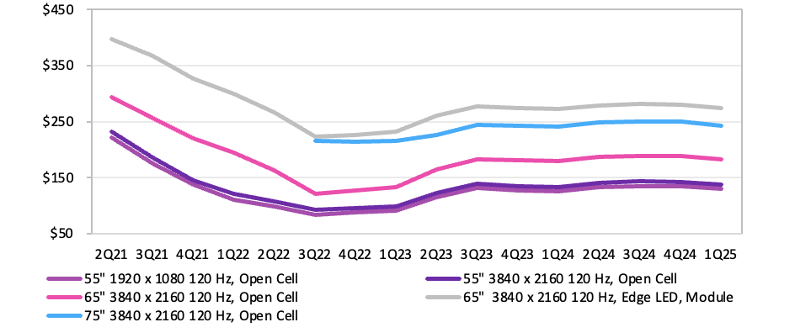

IT panel prices rose when the pandemic began, and demand grew rapidly as previously indicated. But since the end of 2022, they have been relatively stable.

Large Displays — TV

TVs are the buttress of the industry with 75% of the area and about 20% of the revenue, second only to smartphones. Panel makers ship 200m to 250m depending on demand and inventories and set makers produce 190m to 220 m TVs per year. Recently, set makers have been stuck at the bottom of the range. The trend is ever larger TVs and the 75” may soon replace the 65” as the large TV leader.

There are 4 TV categories, 1) Low-end — 36” to 42” – which is serviced by a-Si LCDs , 2) Mid-Range — 43”-55” which is a technology battleground of, a-Si LCD, Mini LED LCD, OLED, 3) the High-End — 55”- 98”, where MiniLED LCD and OLEDs compete and 4) the Very High-End –100”+ — which is dominated by MicroLEDs but has been targeted by TCL and Hisense with 100” high luminance MiniLEDs.

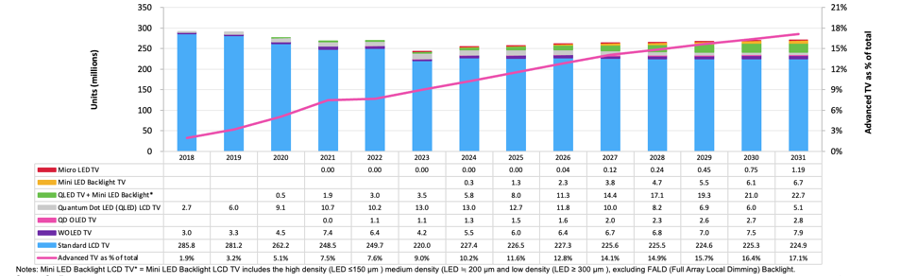

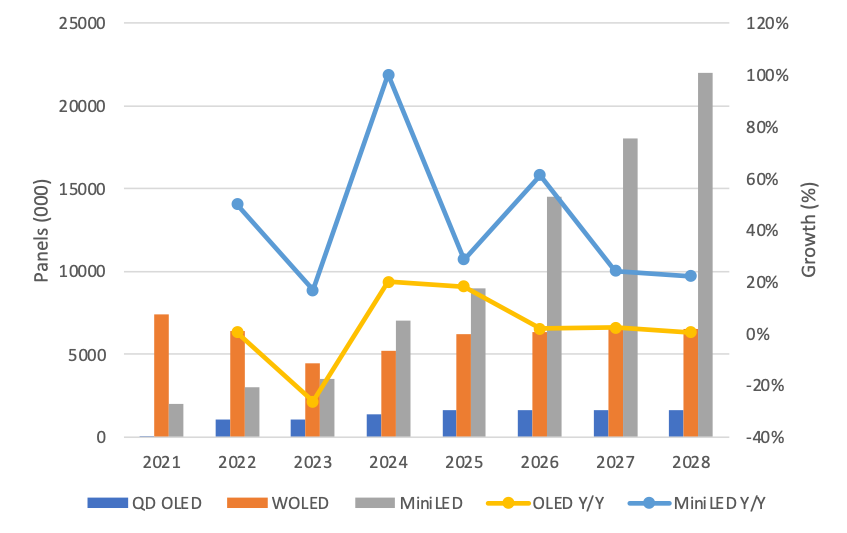

In the Advanced TV category, OLEDs were the leader in shipments thru 2023, but in 2024, MiniLEDs shipments are expected to share the lead with OLEDs, but by 2028 MiniLEDs should reach over 70% of the shipment volume.

The increasing. MiniLEDs are gaining in volume over OLEDs due to 1) the high price of OLED panels vs. MiniLEDs as shown in the next two figures and 2) the almost limitless supply of LCD panels, while only SDC and LGD produce OLED TV panels and neither company is expected to expand production in light of the 3X difference in panel prices.

Vehicle – Multiple Display Solutions

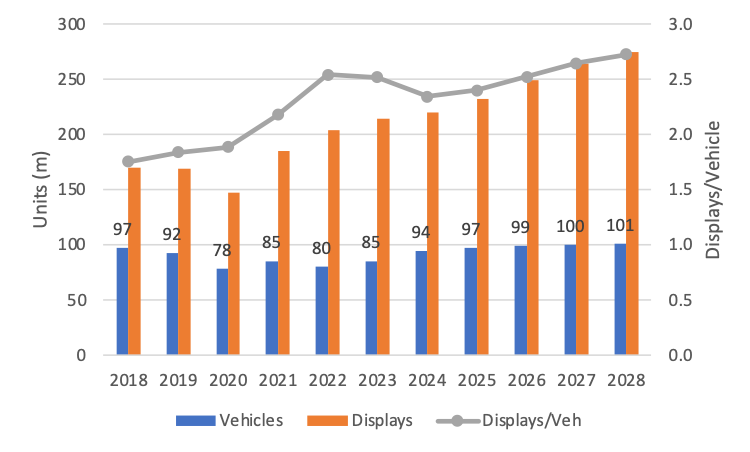

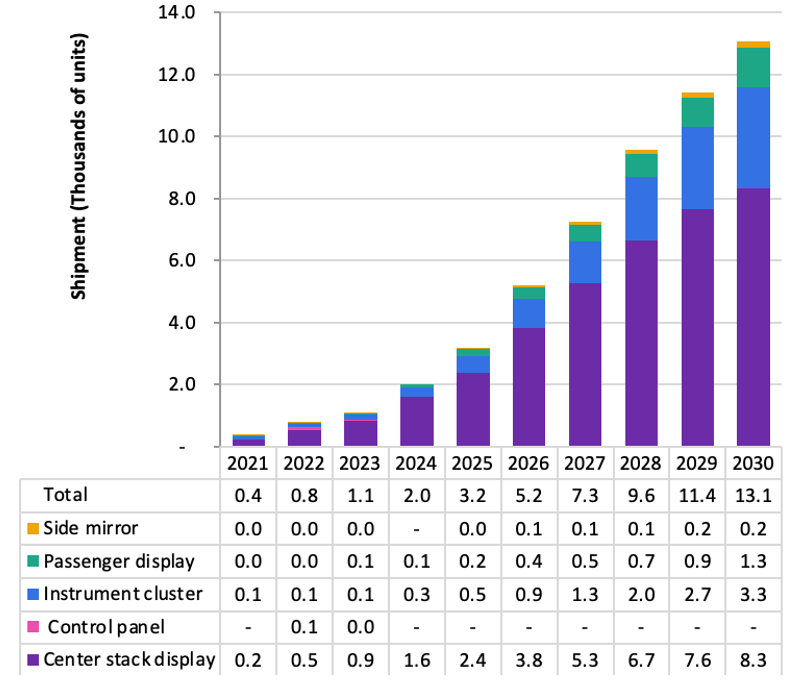

The light vehicle market has gained the attention of the display industry, not because of vehicle growth but because the average number of displays/vehicle has been increasing and the size of the display has grown exponentially. In 2023, there were ~215m displays shipped in vehicles. OLED displays are being used in high-end vehicles as a differentiator. Cadillac installed the first pillar-to-pillar display when it used LGDs OLED in their Eldorado SUV, in 2001, Since then OLEDs have been used by BMW, Mercedes Benz, Audi, Porsche and recently Ferrari indicated they would use an OLED in their next model.

OLED Displays are used for side mirrors, passenger display, instrument cluster and other vehicle apps as shown below. But the high cost of OLED panels have restricted their use and in 2023, OLED displays were only 0.6% of the total panels used in vehicles.

Very Small – AR/VR/MR

With the release of the Vision Pro, Apple has once again changed the game of a product category, taking a lagging product category and pushing it to center stage, despite the high price, heavy weight, big form factor, low sales and lack of apps. As Meta’s Quest series faded, Apple’s entry provides new hope for expansion and is causing other platform leaders to enter the market.

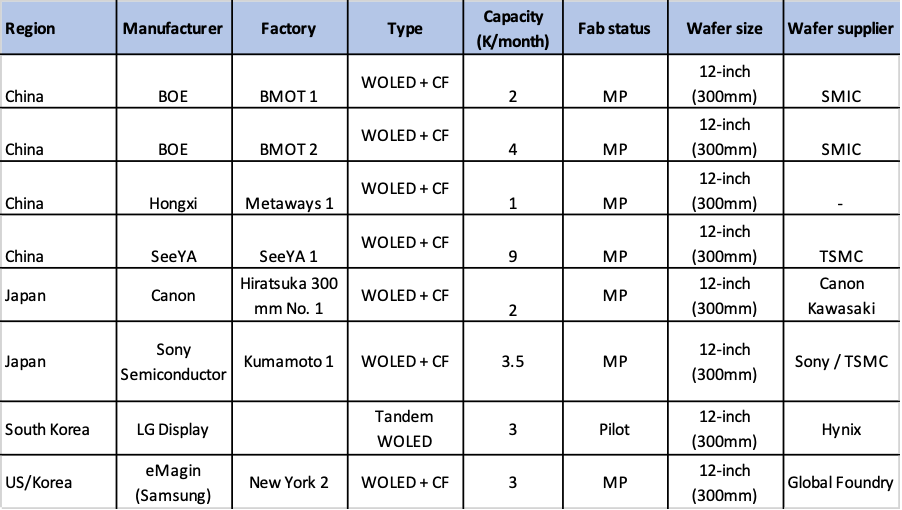

For OLEDoS, Apple’s use of Sony’s 1.3” expensive display is causing VR and MR suppliers to reconsider OLEDs as well as a number of new panel makers to enter the market. Apple is seeking a new panel supplier with a lower base cost, higher luminance and more capacity and is in discussion with a number of companies as shown below.

The center of the LCD display industry is firmly established in China and the technology and capacity gap between SDC and China’s OLED panel makers is closing.

In summary, the era of the crystal cycle is over, LCDs dominate in the low to mid-range segment for most applications because of their low cost and high capacity production base. OLEDs thrive in smartphones and with at least 6 Gen 8.6 IT fabs being developed or planned will displace MiniLEDs in high-end IT. MiniLED LCDs are becoming the leader in the lucrative advanced TV market as the price gap with OLED holds steady or increases and there are no additional planned investments in OLED TV panel capacity. MicroLEDs have yet to take hold because of their high production cost and may eventually be relegated to waiting for Apple, Meta or someone else to solve the human factors issues that will allow human beings to walk around with displays in front of their eyes without getting sick.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.