Gartner said that PC shipments in Q3 were 5.7% down from last year, the eighth consecutive quarter of PC shipment decline and the longest duration of decline in the history of the PC industry. This was because of week back-to-school demand and low consumer demand, especially in emerging markets.

Gartner said that PC shipments in Q3 were 5.7% down from last year, the eighth consecutive quarter of PC shipment decline and the longest duration of decline in the history of the PC industry. This was because of week back-to-school demand and low consumer demand, especially in emerging markets.

“According to our 2016 personal technology survey, the majority of consumers own, and use, at least three different types of devices in mature markets”, said Mikako Kitagawa, principal analyst at Gartner. “Among these devices, the PC is not a high priority device for the majority of consumers, so they do not feel the need to upgrade their PCs as often as they used to. Some may never decide to upgrade to a PC again.

In emerging markets, PC penetration is low, but consumers are not keen to own PCs. Consumers in emerging markets primarily use smartphones or phablets for their computing needs, and they don’t find the need to use a PC as much as consumers in mature markets”, she said.

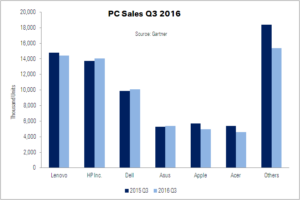

The PC market continues to consolidate, as the top six vendors combined for a record high 78% of PC shipments in the third quarter of 2016 (see Table 1). Lenovo continued to be the worldwide market leader based on preliminary PC shipments, but HP Inc. is nearly tied for this top spot, and these rankings could change when final shipment results are published. Lenovo has recorded six consecutive quarters of year-over-year shipment declines, while the nearest competitors, HP Inc. and Dell, have recorded shipment growth since the second quarter of 2016.

Table 1: Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q16 (Thousands of Units)

|

Company |

3Q16 Shipments |

3Q16 Market Share (%) |

3Q15 Shipments |

3Q15 Market Share (%) |

3Q16-3Q15 Growth (%) |

| Lenovo |

14,434 |

20.9 |

14,789 |

20.2 |

-2.4 |

|

HP Inc. |

14,058 |

20.4 |

13,744 |

18.8 |

2.3 |

|

Dell |

10,111 |

14.7 |

9,856 |

13.5 |

2.6 |

|

Asus |

5,397 |

7.8 |

5,271 |

7.2 |

2.4 |

|

Apple |

4,946 |

7.2 |

5,709 |

7.8 |

-13.4 |

|

Acer |

4,613 |

6.7 |

5,370 |

7.3 |

-14.1 |

|

Others |

15,386 |

22.3 |

18,359 |

25.1 |

-16.2 |

|

Total |

68,945 |

100.0 |

79,098 |

100.0 |

-5.7 |

The stabilization of the PC business market was a key factor for HP Inc.’s shipment growth, Gartner said, as a majority of its revenue was generated from the business segment. Dell’s shipment growth exceeded the regional average in most regions.

In the US, PC shipments totalled 16.2 million units in the third quarter, a 0.3% decline from the same period last year (see Table 2). This is the second consecutive quarter of flat year-over-year PC shipment growth.

“Mobile PCs, which include notebooks, two-in-one PCs and Windows tablets, showed low-single-digit year-over-year growth, but the overall results were offset by a decline of desktop shipments,” Ms. Kitagawa said. “Traditionally, the third quarter has been driven by back-to-school PC sales, but back-to-school marketing campaigns have become less effective for driving PC sales. With so many PCs already in the consumer market, U.S. consumers do not feel the need to buy new PCs; many parents hand down old PCs to their kids. While our PC shipment report does not include Chromebooks, our early indicator shows that Chromebooks exceeded PC shipment growth.”

Table 2: Preliminary U.S. PC Vendor Unit Shipment Estimates for 3Q16 (Thousands of Units)

|

Company |

3Q16 Shipments |

3Q16 Market Share (%) |

3Q15 Shipments |

3Q15 Market Share (%) |

3Q16-3Q15 Growth (%) |

|

HP Inc. |

4,793 |

29.7 |

4,649 |

28.7 |

3.1 |

|

Dell |

3,874 |

24.0 |

3,813 |

23.5 |

1.6 |

| Lenovo |

2,284 |

14.1 |

1,982 |

12.2 |

15.3 |

|

Apple |

2,076 |

12.9 |

2,325 |

14.3 |

-10.7 |

|

Asus |

824 |

5.1 |

783 |

4.8 |

5.3 |

| Others |

2,300 |

14.2 |

2,657 |

16.4 |

-13.4 |

|

Total |

16,152 |

100.0 |

16,208 |

100.0 |

-0.3 |

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads.

PC shipments in EMEA surpassed 19.2 million units in the third quarter of 2016, a 3.3% decline from the same period last year. The EMEA market’s decline was mainly associated with very weak demand in Eastern Europe, Eurasia, and the Middle East and Africa. In the U.K., Brexit had no immediate impact on PC sales, but the depreciation of the British pound against the U.S. dollar caused some vendors to indicate prices will increase through the end of 2016 and into 2017.

Asia/Pacific PC shipments totalled 24.7 million units in the third quarter of 2016, a 7.6% decline from the third quarter of 2015. Early indicators show that the PC vendors performed better than in the second quarter as they lowered channel inventory coming into the quarter and replenished stock for seasonal back-to-school demand. PC shipments in China are estimated to have declined 4.8%. Consumer sales in China were driven by notebook shipments, while the business market was driven by desktop PCs because of cost and computing effectiveness.

Analyst Comment

IDC said that the market was down 3.9% which it called a “better than expected” result. The company said that vendors are re-building inventory which is the result for better sales than some recent quarters and the company highlighted Chromebook sales in K-12 education in the US. IDC said that EMEA notebooks were better than expected. IDC ranked Asus lower with a volume of 4.69 million units.

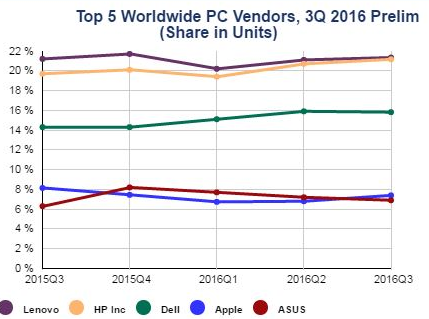

IDC’s PC Brands Trend Chart

IDC’s PC Brands Trend Chart