TCL’s Marek Maciejewski shared with us a link to a large number of TCL’s TV and audio training videos and I was especially interested to hear what is going on in the European TV market at the moment, as, in the past, I was very involved in researching the market.

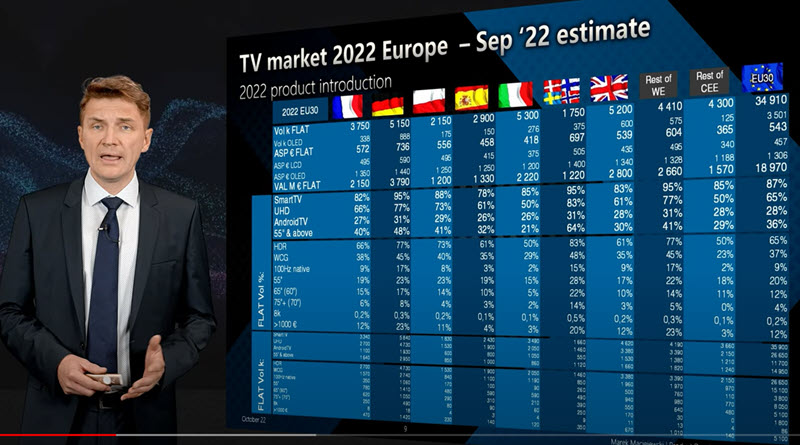

He started by highlighting what he expects for the year as a whole and that means an overall volume of nearly 35 million for the ‘Euro 30’ countries with a value of close to €19 million, at an ASP of €543, up from previous years. As can be seen in the table below, the ASP can vary from €365 (rest of CEE) up to €736 in Germany.

OLED remains at a significant premium to LCD (ASP of €1,306 vs €457) and the market is mainly ‘Smart’ at 87% penetration (but with a number of markets at over 90%). Two thirds of sets sold are UltraHD.

Set size has shown an interesting trend, that is different from the global market. The worldwide average TV size has grown steadily, but the Euro 30 market is just 36% at 55″ and above – and that is down on the average size in 2020 and 2021 when it was nearly 40%. A significant reason for this is that a number of countries have been upgrading their terrestrial TV infrastructure from DVB-T to DVB-T2 with newer codecs. Consumers have been getting new sets but many of those are in 32″ and 40″ so the average size has not grown, but gone backwards.

On the other hand, Maciejewski said, the percentage of the market selling for more than €1,000 is above 10% for the first time – and expected to reach 12% – and with Germany with 23% in this price range.

There have been revolutions in TV from CRT to flat, from SD to HD and then to UHD (via streaming, mainly) and now a recognition of HDR and larger sizes. There is an installed base in 210 million households with a 9 year replacement cycle. That yields around 25 million sets of ‘steady’ demand, with the rest coming from upgrades such as the switch to digital and flat. However, a recession may be coming, but there are few signs of that in the market in Europe.

Streaming access is a big part of TV viewing new, with Europe viewing around ‘half and half’. In the future, TCL believes that we will get to 100% streaming based on DVB-I technology. In the key top 10 markets, 54% of households have Pay TV subscriptions. There are also 110 million SVOD subscriptions, but penetration is just 37% of households (171 million in the Top 10) as many have multiple subscriptions.

Gaming is also important. There is a seven year replacement cycle, not so dissimilar to TVs. Penetration is around 28% for consoles so in many cases – more than one in four – the TV is connected to a console.

Soundbars have around 15% penetration of TVs, although Germany is again higher with around 21% (and the Nordics at 23%). The market is switching to Atmos as the products become more democratised.

Overall, this was an interesting discussion that acts as a good reminder that there is not just one TV market in Europe – different parts of the continent look very different in many different ways, in the market and also in TV technology.

I’m planning a follow-up DD on some of the technology developments in the market. (BR)