In the recent “2016 Augmented and Virtual Survey Report“, PerkinsCoie and Upload present some of the results of their online survey about the opportunities, challenges and hurdles for AR/ VR if it is to become a major factor in consumer electronics. While 2016 has been full of such studies, this particular one is gives an “inside view” on what industry players think.

The survey is based on 653 responses from people inside the AR/VR industry with more than half of the respondents being C-level (CEO, president, owner, founder, CTO, VP) players. The rest is made up of consultants, developers, investors, marketing, artists, and other professionals. Only 10% of the respondents identify themselves as being focused on hardware development. This is very important info when we look at some of the results.

The key findings of the report are:

- Lack of compelling content is the number one hurdle for the AR/VR industry.

- COST and issues with user experiences are the next biggest hurdles.

- Two thirds of the respondents believe that AR will surpass VR.

- Half of the respondents believe it will take at least three years for AR to overtake VR.

- 89% of respondents believe that VR and smartphone manufacturers will focus on developing mobile VR technologies.

- Regulatory and legal risks are not considered major hurdles.

- Gaming is expected to be the best funded sector in next 12 months.

- Investors are seeing to increase the size of their investments per investment in the coming year.

Source: PerkinsCoie/Upload – 2016 AR/VR Survey Report – Most intersting segments

When we look at the segments, we see of course gaming being dominant, but the second and third segments are Movies / TV and Live events. This means the top three segments are entertainment-related, while the rest look to AR/VR to better fulfil a task. These are all professional applications.

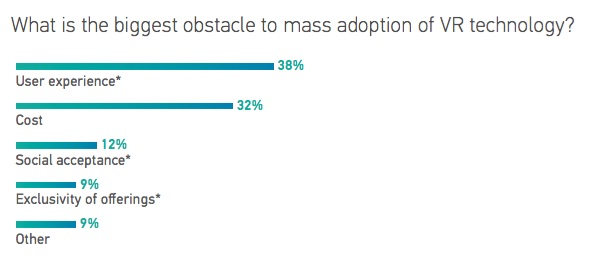

Source: PerkinsCoie / Upload – 2016 AR/VR Survey Report – VR hurdles

Source: PerkinsCoie / Upload – 2016 AR/VR Survey Report – VR hurdles

The biggest hurdles for VR adoption are the user experience and cost. Social acceptance, exclusivity and other concerns are rather minor obstacles in this survey. However, keep in mind that these are all industry experts. What is socially awkward for them, is most likely unacceptable for most consumers.

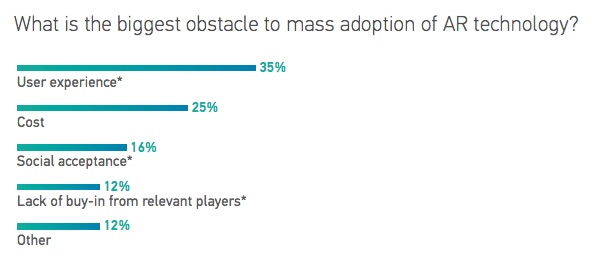

Source: PerkinsCoie / Upload: 2016 AR/VR Survey Report – AR hurdles

Source: PerkinsCoie / Upload: 2016 AR/VR Survey Report – AR hurdles

Looking at the AR obstacles, a very similar picture is seen with VR. Considering the overall state of augmented reality solutions, I would have expected a different set of hurdles for AR compared to VR. In addition, this study was taken in July 2016, basically at the same time Pokemon Go appeared in some countries. I would expect that the success of this AR game would have changed some of the answers regarding AR from industry players.

The companies also included some answers from investors regarding their plans for further investments in the AR/VR industry. While in the past 12 months most investments have been falling in the $0-5 million range, the coming 12 months will see an increase in larger investments as those companies are seeking more money to bring their technologies to the market. Interestingly, only 9% of the investments are hardware-related, while most will go into content and creative tools (59%).

From the companies’ perspective, about half are looking to build a company, while the other half are looking to be acquired or enter into a strategic partnership with a large existing company.

Analyst Comment

Keeping in mind that this is how the AR/VR industries sees its own destiny, it is clear that the industry is aware that the adoption of AR/VR is by no means a ‘slam dunk’. There is a lot of work to be done. As a reminder, since only 10% of the respondents are focused on hardware design, we could expect that the issues in hardware development are somewhat underrepresented in this survey. As a conclusion I would say that if you are asking the hardware specialists, the hurdles are more likely to be centered around hardware development and cost. On the other hand, investors must be under the impression that the existing hardware solutions are sufficient for mass adoption of AR/VR technology, a view I do not share at this moment. -NH