More than 665 million homes worldwide owned a Smart TV by the end of 2020. This equates to 34% of global households, a figure that is set to rise to 51% by 2026 when Smart TV ownership will reach 1.1 billion homes. Sales of Smart TVs grew by 7.4% in 2020 to reach 186 million units, accounting for 79% of all Flat Panel TVs sold.

The report notes that sales growth over the past year was strongest in North America where government stimulus cheques helped to drive an increase in spending on home entertainment products as consumers found themselves spending more time at home due to Covid-19 related restrictions. Samsung was the leading Smart TV manufacturer in terms of annual sales units for the ninth straight year in 2020 while TCL climbed above LG and into second place for the first time. Meanwhile, the Smart TV market continues to coalesce around a handful of TV streaming platforms or operating systems. Samsung’s Tizen leads the way but major third-party software platforms such as Android TV and Roku TV OS have made strong gains in recent years. The top four Smart TV operating systems accounted for over 50% of total sales in 2020, up from 33% in 2015.

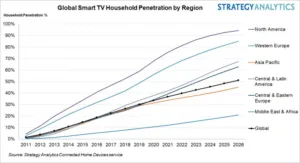

Figure 1. Global Smart TV Household Penetration by Region (Graphic Business Wire)

The full report from Strategy Analytics’ Connected Home Devices service, Global Smart TV Forecast for 88 Countries 2011-2026, can be found here:

Global Smart TV Forecast for 88 Countries 2011-2026

“Smart TV is a standard fit feature of most flat panel TVs sold today and so smart TV household penetration will inevitably continue to grow as consumers replace old sets with new modern smart-enabled versions,” says Edouard Bouffenie, Senior Analyst, Connected Home Devices. “As smart functionality is no longer a point of differentiation but has become a check box necessity, smart TV manufacturers have had to make a choice between maintaining their own software and application ecosystems or licensing a software platform from a third-party partner. While many have decided to partner with the likes of Google’s Android TV and Roku in order to avoid the ongoing costs of maintaining their own platform, several brands including Samsung, Vizio and LG are going it alone and are looking to capitalize on the fast growing Connected TV advertising business.”

“Smart TV usage is growing and is on a path towards becoming the preferred platform for accessing online video content,” comments David Watkins, VP, Media and Intelligent Home Practice. “However, the current Connected TV landscape in the home is incredibly complex and consumers may have multiple devices in multiple configurations to choose from. Factor in different viewing habits amongst different members of the household and it’s clear that TV streaming platform providers face a significant challenge in driving engagement and ensuring that TV viewers remain on their platform and do not switch to another source. Smart TV OS providers must look to influence the TV viewer’s journey through improved content discovery capabilities, advanced analytics and advertising platforms and the development of an intuitive and user-friendly UI.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need.