Global smartphone production saw a significant rebound in the third quarter, jumping 13% from the previous quarter to 308 million units, according to a new report by Trendforce. This marks a 6.4% increase versus a year ago, ending an eight-quarter streak of YoY declines.

The increase was fueled by reduced channel inventories and seasonal demand spikes. TrendForce expects smartphone production to rise another 5-10% sequentially in the fourth quarter, boosted by e-commerce promotions and holiday shopping. As a result, the projected global smartphone production decline for full-year 2023 is now expected to be limited to less than 3%, with total output reaching around 1.16 billion units.

Samsung Holds Lead, Apple Gains Ground

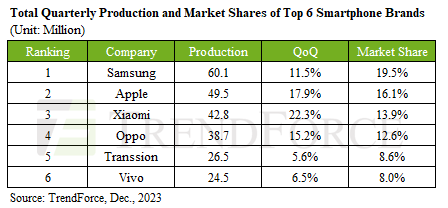

Samsung continues to lead the market, with third-quarter production up 11.5% to 60.1 million units. But conservative planning in the face of economic uncertainty has narrowed its full-year production lead over Apple to just 5 million units.

Apple saw its third-quarter output climb 17.9% to 49.5 million on the back of the iPhone 15 launch. However, low initial yields on components affected growth, resulting in a 1.5% drop in market share versus last year. Still, 2023 production is expected to match 2022 levels.

Huawei Re-entry Puts Pressure on Apple in China

Huawei’s return to the high-end Chinese smartphone market with new flagship phones is impacting Apple the most. As Huawei aims to expand its premium devices in 2024, zeroing in on China, it has emerged as a formidable challenger that could substantially affect Apple’s production next year.

India Fuels Growth for Xiaomi and Oppo

Xiaomi shifted to more aggressive production and stockpiling as the year winds down, with third-quarter output jumping 22.3% to 42.8 million, boosted by a rebound in India. Oppo saw production climb 15.2% to 38.7 million, also fueled by India and South America. The growth trajectories for both companies are expected to continue into the fourth quarter.

Transsion Edges Out Vivo for Fifth Spot

Transsion continued its strong momentum, with production rising 5.6% to 26.5 million units. The increase enabled Transsion to surpass Vivo and grab the fifth spot globally, thriving in emerging markets and steadily gaining share since the second quarter. With potential 2023 growth above 40%, it remains neck-and-neck with Vivo.

Vivo saw a more modest 6.5% increase in third-quarter output to 24.5 million units, as it maintained a conservative stance aimed at profitability.