In case you missed it, the word on the street is that 2018 will be known as the year the once booming smartphone device market began to hit saturation and the subsequent consolidation that it brings. Currently a whopping 75% of all smartphone device shipments are from just six companies that include Samsung, Apple, Huawei, Xiaomi, Oppo, and Vivo.

The latest IDC report said: “On a worldwide basis, the top five smartphone companies continue to get stronger and now account for 69% of smartphone volume, up from 63% a year ago. If vivo is included, which is currently number six and has been in and out of the top five in recent quarters, the share of the top companies is 75% and growing. While the market faces some very serious challenges in general, none are greater than the challenges facing the brands that continue to lose market share and channel positioning,” according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

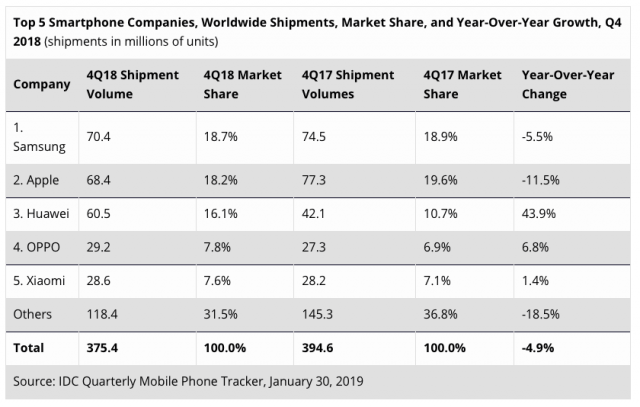

These top five smartphone device makers ship just under 70% of all units in 2018, Source IDC Worldwide Quarterly Mobile Phone Tracker

Notice only Chinese brands are in positive growth territory. Domestic China brand shipments are ranked similarly as global shipments are here, (the number one brand in China in 2018 is Huawei, etc.) Source: IDC The IDC report showed smartphone vendors shipped a total of 375.4 million units during Q4-18, marking five consecutive quarters of decline, and off almost 5% YoY (year over year). Overall 2018 (full year) saw a drop of 4.1% in total device shipments worldwide at 1.4 billion units, setting up a market condition state IDC calls “challenging” for 2019, with a forecast that includes the “likelihood of continued declining market this year,” according to IDC’s Ryan Reith, program VP for the research giant.

Notice only Chinese brands are in positive growth territory. Domestic China brand shipments are ranked similarly as global shipments are here, (the number one brand in China in 2018 is Huawei, etc.) Source: IDC The IDC report showed smartphone vendors shipped a total of 375.4 million units during Q4-18, marking five consecutive quarters of decline, and off almost 5% YoY (year over year). Overall 2018 (full year) saw a drop of 4.1% in total device shipments worldwide at 1.4 billion units, setting up a market condition state IDC calls “challenging” for 2019, with a forecast that includes the “likelihood of continued declining market this year,” according to IDC’s Ryan Reith, program VP for the research giant.

While high penetration levels in key markets is a significant factor in the decline, it’s not the only reason things are going south for smartphones – enter China.

Wild Card China

The world’s number two economy had an even worse 2018 than 2017, as device shipment levels were down just over 10%, leading to continued high inventory levels and reduced consumer spending in China due to the country’s overall slowdown, IDC noted. The effect on the China economy is greater, given that the top four brands in that market are all Chinese, and collectively have boosted domestic market share overall from 66% (in 2017) to 78% in 2018. The brands include: Huawei, Oppo, Vivo, and Xiaomi.

Globally, other smartphone vendor challenges include subscribers’ longer replacement cycles, political and economic uncertainty, and “continuously rising price points,” leading to “growing consumer frustration,” according to Reith.

So yes, while many can remember the days of the good old flip (cell) phone, the smartphone device market (primarily in developed economies) is moving into a mature stage that includes brand consolidation. Break out technologies are on the horizon for sure with the prospect of truly foldable devices and 5G. But until that “next gen” technology takes hold, look for fewer companies to serve a more saturated market. – Stephen Sechrist

IDC Reports A Slowdown of China’s Smartphone Market in Q4 2018

India Smartphone Market Exits 2018 with Highest Ever Shipments of 142.3 million, IDC India Reports