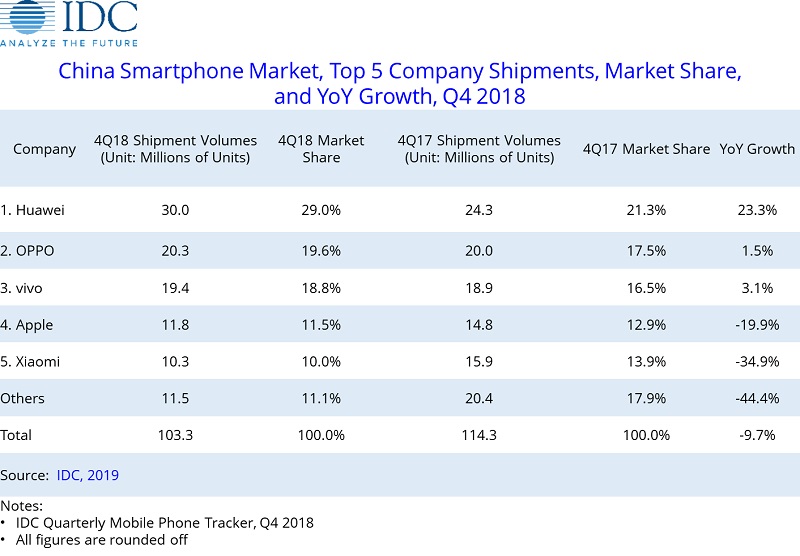

According to the latest International Data Corporation (IDC) Quarterly Mobile Phone Tracker, smartphone shipments in the Chinese market were down 9.7% YoY to approximately 103 million units in Q4 2018.

Among the top five smartphone vendors, Huawei was the biggest winner in Q4 on the back of blockbuster flagship models and a steadily rising brand reputation; OPPO and vivo maintained a stable performance by consolidating their strengths in the mainstream price range and online market; Apple continued to decline in the domestic market as its expensive unit prices became increasingly out of line with the tough market environment; and Xiaomi took a significant fall in the domestic market due to various factors including adjustment of product mix and channel inventories and also internal reorganization.

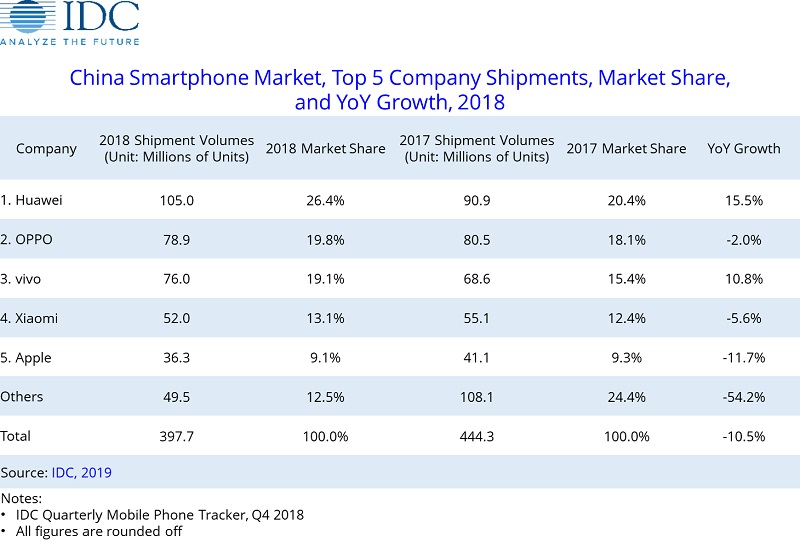

Due to a confluence of factors such as economic pressures, longer replacement cycles, and smaller wallet share, smartphone shipments in the Chinese market were down over 10% in 2018.

Huawei has acquired a clear edge over the competition for extensive applications including photography, gaming and business usage by building solid technology prowess and innovations and collaborating closely with suppliers. By integrating distinctive technologies and different product lines such as the P, Honor and Mate series, Huawei managed to not only maintain strong sales but also steadily improve its brand reputation with excellent synergy. Therefore, its rapid penetration in the 4th to 6th tier markets and stellar YoY growth of market share in 2018 were hardly surprising.

OPPO saw an accelerated ascension of brand image in 2018. While continuing to emphasize nice design, it integrated extensive emerging technologies into its high-end R and Find series and accelerated the shift of focus of brand building to technological innovation. Its A and K series continued to enjoy popularity in the mainstream price range and helped steadily boost its market share in 2018.

vivo impressed the market in 2018 with solid technology content of its products. The NEX launched in June as the first “genuine full-screen display” in the industry earned it wide recognition and gave a steady boost to the appeal of other vivo models to consumers. Its foray into the online channel with the online-exclusive Z series also opened a new high-potential segment for the company. vivo was one of the two vendors that posted a two-digit YoY growth in 2018, with the other being Huawei.

Xiaomi maintained its growth momentum in the first half of 2018, driven by large shipments of Redmi and Mi 8 series, but as its brand image and user groups became increasingly stereotyped, it became imperative for it to adjust its product mix and long-term profit model. As it stepped into the phase of adjustment of the second half of the year, its shipments also experienced a YoY decline, though it managed to steadily increase its average unit price and value of shipments. After its global shipments hit 100 million units in October, it set about optimizing its organizational structure and product lines. In the future, Xiaomi will need to focus more on further optimizing its lines of midrange and high-end products, technology-focused brand building, and more sophisticated physical channel operations.

Apple has experienced declines of shipments for three consecutive years since 2016. In 2017, its new-generation iPhone models, though highly innovative and keenly sought after, significantly increased users’ replacement cycles due to a sharp increase in the average selling prices. Furthermore, its 2018 models were offering routine enhancements without substantial innovations to justify the replacement, especially at further increased prices. On the other hand, China’s tough economic environment, impressive innovations of homegrown products, and increasingly discerning consumers were also factors that contributed to Apple’s steady decrease in market share in the Chinese market.

“The Chinese smartphone market still looks hardly optimistic in 2019,” said Xi Wang, IDC China Senior Market Analyst. “By reviewing the market in 2018 in terms of takeaways and lessons in the areas of technology, product and user, vendors will be better positioned to cope with the challenges ahead and identify new opportunities.”

Technology

China is in a globally leading position in related 5G technologies, but it should be clearly noted that 5G phones will remain a small share of overall smartphone shipments by the end of 2019 and that it will be a long way to go before large-scale 5G adoption.

Product

With respect to product offerings in 2019, IDC believes that the flagship models will be playing an important role in showcasing the company’s strengths, improving brand value, and strengthening customer loyalty. For their products in the mainstream price range which are meant to boost their sales, they could equip them with some flagship models’ technology features with a view to exploring and testing related technologies before large-scale production and also differentiating them from the competition.

User

In the saturated domestic smartphone market, winning over existing users will be a more crucial task for smartphone vendors. In this regard, it is advisable to improve precise planning and utilization of limited product and marketing resources based on in-depth user profiling and analysis in terms of extensive factors such as age, gender, city tier, hobbies and interests, and brand perception.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.