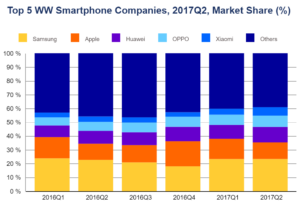

Preliminary results from the IDC Worldwide Quarterly Mobile Phone Tracker, show that OEMs shipped 341.6 million smartphones worldwide in Q2 2017, declining 1.3% compared to the same quarter a year ago, and down 0.8% compared to the previous quarter. However, the leading vendors all saw positive shipment growth with Samsung and Apple both holding slightly greater market shares compared to the second quarter a year ago. The other three vendors in the top 5, Huawei, Oppo, and Xiaomi also grew market share, with Xiaomi just replacing vivo.

IDC expects to see two quarters of positive growth for the second half of 2017, with Samsung doing well with its Galaxy S8 products, and with the presumed August announcement of the Note 8. Other factors are Apple’s anticipated September announcement of the iPhone 8, plus Google’s Pixel 2 and LG’s V30 rumoured introductions.

Samsung remained the leader in the worldwide smartphone market taking a 23.3% share and 1.4% growth. The S8 and S8+ did well and brought a new design and screen aspect ratio of 18:9 to the table. Samsung also continues to perform well with its A- and J-series devices.

Apple shipped 41.0 million iPhones in the second quarter, representing a 1.5% growth compared to the same quarter in 2016. The iPhone 7 and 7 Plus combined delivered double-digit growth at a worldwide level, which helped grow average selling prices by 2% despite foreign exchange issues. It is expected that the iPhone 8 will have a larger AMOLED display, wireless charging, and increased performance and durability. The new model is rumoured to join a new iPhone 7S, and 7S Plus.

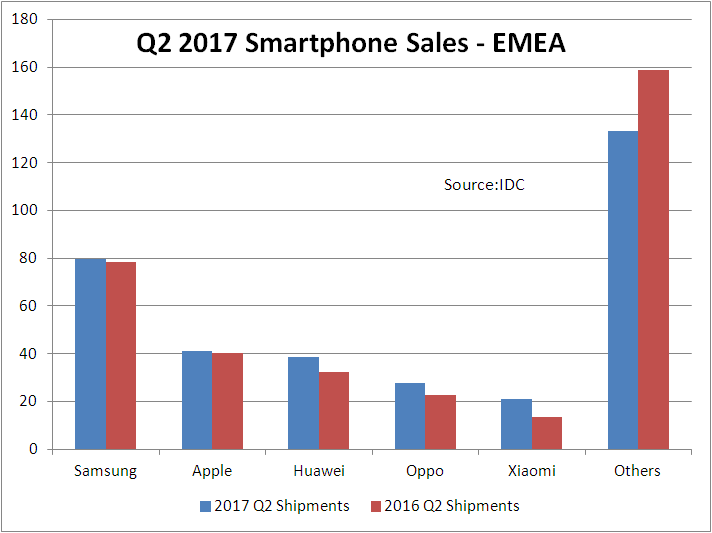

Huawei had strong sales in greater China as well as in many developed European markets. The company had 19.6% growth as well as an improved market share by two full percentage points, compared to the second quarter of last year. Huawei’s P10, Mate 9, and the Honor series did well.

Oppo had worldwide shipments of 27.8 million units and moved its overall share to 8.1%. During the quarter, it expanded its number of service centres in India and added its new exclusive retail outlets as well. In Thailand, the company continued to expand its channels and advertisements with billboards across the country. It also partnered with one of the local operators to offer the A37 for free, which directly helped to grow its customer base.

Xiaomi moved back into the top five with growth of 58.9%, edging slightly ahead of vivo. Xiaomi expanded its offline presence by launching its first Mi Home store and partnering with retailers to increase its footprint. It has also doubled the number of service centres and increased marketing activities.

![]() Smartphone volumes reach 341.6 million in the second quarter

Smartphone volumes reach 341.6 million in the second quarter