As usual, the global smartphone market grew in the last quarter of 2014. First data from market researchers indicate how a new emerging pattern could change the smartphone market for ever and show a relative significant shift in the global as well as local markets.

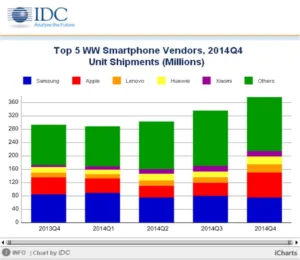

The overview from IDC shows the smartphone shipments on a global basis for the 4th quarter as well as for the full year of 2014.

Data from IDC indicates a significant increase in total shipments from 293 million to 375 million compared to the 4th quarter of 2013. In the last quarter of 2014, Apple almost caught up to Samsung in terms of shipments, with a difference of only 0.6 million separating the two. For the full year of 2014 the difference is quite significant between Samsung and Apple, with Samsung shipping 318 million smartphones versus Apple’s 193 million. As can be assumed from the data, the iPhone 6 is a very successful product launch for the company.

The more interesting part is in the listing of the top five vendors for 2014 versus the last quarter of 2014. According to IDC, the top vendors for the complete year of 2014 are Samsung, Apple, Huawei, Lenovo (without Motorola), and LG. The same order for the last quarter of 2014 is Samsung, Apple, Lenovo (with Motorola), and Xiaomi. As we can see the immediate effect for Lenovo is to climb up the ranks and for Xiaomi to replace LG in the top five.

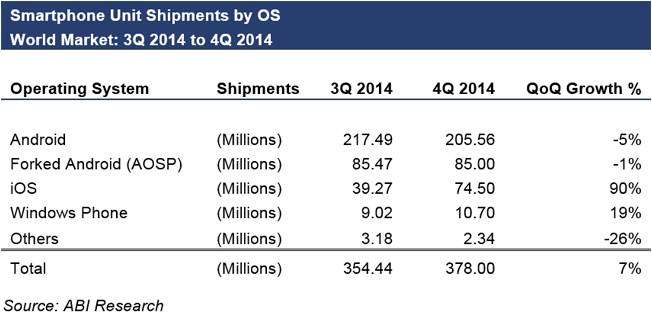

A similar picture is being painted by data from ABI Research for the market share of operating systems. The company shows Android losing market share against iOS.

According ABI Research, Android lost 5% of unit shipments versus the 3rd quarter, while forked Android systems stayed reasonably stable. iOS gained almost 90% in shipments. Based on the few models Apple has, compared to all Android suppliers, large swings of the quarterly shipment data will remain the norm for Apple. Android makers create an almost constant stream of new devices and show fewer swings after the release of a new smartphone model. Interestingly, Windows also shows good growth while the other operating systems are not doing so well.

In the local markets, the story changes quite significantly. The most important smartphone markets today are China and the USA. However, with India joining the worldwide smartphone frenzy, this may change in coming quarters. In these markets, the fourth quarter was quite a disappointment for Samsung. Kantar Worldpanel gives the edge to Apple in the US market. Not only did Apple beat Samsung, but iOS beat all of Android. For the first time since Q4 2012, iOS has topped Android in the US smartphone market.

As for the Chinese market, Canalys saw Apple in the lead in the fourth quarter, while Xiaomi took second place. The same company sees Micromax outselling Samsung in India, a fact that Samsung debates based on data from GfK, that still sees Samsung in the lead.

Analyst Comments

The smartphone market seems to develop into more regional markets rather than the centralized market of former years. The barrier of entry for newly developed smartphones seem to have decreased, as components like processors, displays, etc. make less and less of a difference today. There are still new displays and components developed, but the performance gains are not as significant as in the early years. – Norbert Hildebrand