For the second time in three months market research firm IDC cut its smartphone forecast amid maturing world-wide markets as competitive forces continue to build in the space. New research released this week from the firm said it is reducing growth in global smartphone shipments from an initial 3.4% to 1.6% for the year.

IDC senior research analyst Jitesh Ubrani said key to the September 1st 1.8% reduction in forecasted growth for 2016 includes maturing of the US and EU as consumers seem “increasingly comfortable with ‘good enough’ smartphones,” he said. These ” smartphone replacement” markets will contribute to the 1.46 billion global units shipped according to IDC. “Growth in the smartphone market is quickly becoming reliant on replacing existing handsets rather than seeking new users,” Ubrani said. Other factors in the developed markets slowdown include the recent battery issues (now a full blown recall) on Samsung’s flagship Galaxy Note7 S and Apple’s (purported) plan to launch a major hardware upgrade next year, on the iPhone’s 10th anniversary in 2017.

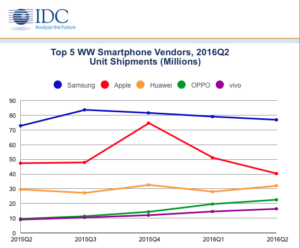

IDC Smartphone unit shipments in MillionsBack in July, IDC reported preliminary Q2 results from itsWorldwide Quarterly Mobile Phone Tracker, where vendors shipped a “relatively flat” worldwide total of 343.3 million smartphones in 2Q16, up a mere 0.3% from 2Q15 numbers (of 342.4 million units.) This was a 3.1% improvement in sequential growth (of 333.1 million units) in Q1 2016.

Meanwhile China smartphone makers are coming on strong, according to the company. IDC reports that three of the top five device providers are from the mainland of China. This includes Huawei (with Q2 market share of 9.4%), OPPO (6.6% market share) and vivo (4.8%). And make no mistake they are actively gunning for both Samsung and Apple sitting on 22.4% and 11.8% market share in Q2, respectively.

Huawei Technologies is on record as recently as last week at the IFA Trade Fair in Berlin, stating that the company is gunning for the number two smartphone slot, as reported by the Wall Street Journal, last Thursday (Sept. 1, 2016). Huawei consumer business group chief, Richard Yu repeated remarks made at the 2015 event, with an aim of reaching number one in smartphones globally “in four to five years,” the WSJ reported.

Gartner differs from IDC’s numbers and currently has the China smartphone device company pegged at just under 9% market share for Q216, globally, behind Apple’s 12.9% and Samsung’s market share of 22.3%. Interestingly, Huawei’s market share growth is booming at 30% over the past year according to Gartner.

Huawei’s IFA Midrange Product Launch

Helping to fuel the future growth is the Chinese company’s commitment to new products and its recent launch of its Nova line at IFA that targets 50 plus Asia and EU markets with a 5.5-inch diagonal (Nova Plus) and 5-inch diagonal display. The device has a starting price at under $450. Huawei uses both an advanced camera, extra long battery life to differentiate its devices. Nova also ships with 32 gigabyte internal memory and three-gigabyte of RAM. There are also reports of the company spending heavily on R&D to boost its patent portfolio, in a wider China device strategy that looks to up-end the status quo of smartphone innovation from the West.

So as Apple prepares for its 2016 product refresh on Sept. 7th, all eyes will be on that company’s response to new global competition in the face of its own declining sales, and flagging innovation. Meanwhile, Samsung is licking its wounds as battery issues for its newest product in the space are creating challenges to its market share dominance. And the world continues to turn. – Steve Sechrist