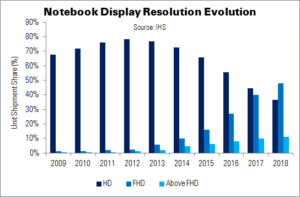

The market for notebook PC displays fell 23% YoY in Q1’16. Panel makers have begun to lower production of the low-profitability HD panels in favour of FullHD types – these panels are therefore expected to enjoy high growth through 2018, and may become mainstream within the next three years, says IHS. Some panel makers have also begun to promote UltraHD devices. However, many customers are still concerned about price more than specification upgrades.

Price erosion affected the notebook PC market last year, as PC makers largely produced low-cost notebooks to maintain market share, rather than focusing on new designs. Half of all notebooks sold last year were priced below $500 – and sub-$300 models represented 15% of the market in Q4.

Consumers today, like PC vendors, are less concerned with specification upgrades, as PCs are most commonly used for low-intensity activities like web browsing. This is continuing to impact upgrades and notebook sales. Jason Hsu of IHS says that PC makers are now searching for what might be the next “driving force” for laptops.

Hsu notes that Microsoft’s Surface Book has been key in promoting high-resolution displays as a differentiator for premium notebooks. However, these also displays also lead to higher power consumption and shorter battery life. They also tend to be used in very thin and light devices, meaning that there is less room for brands to increase battery capacity. This has led to PC makers urging panel vendors to find ways to reduce the power consumption of these screens.

Displays using oxide and LTPS panels are designed to combat the high power consumption of high resolutions. Apple, for example, has been aggressive in adopting oxide-substrate panels in its iMac and iPad Pro products, and is said to be bringing the technology to Macbooks. Samsung Display and LG Display are apparently increasing their investment in oxide manufacturing capacity because of Apple’s adoption.

“With panel demand falling this year, panel makers may have to balance the pressure between fab utilisation and profitability,” Hsu said. “Investing in next-generation technology may not yield immediate returns, while continued reliance on mature technologies may decrease ongoing profitability.”