Invalidating a patent in South Korea is the process through which the rights and enforceability of a granted patent are revoked or declared null and void by an appropriate authority, typically a patent office or a court. When a patent is invalidated, it means that the patent owner’s exclusive rights to the invention described in the patent are no longer valid, and others are free to use, make, sell, or distribute the invention without infringing on the invalidated patent. According to The Elec, Novaled, a wholly owned subsidiary of Samsung, has been successful in invalidating three patents that cover OLEDs, and electronic transport layer materials from Solus Advanced Materials.

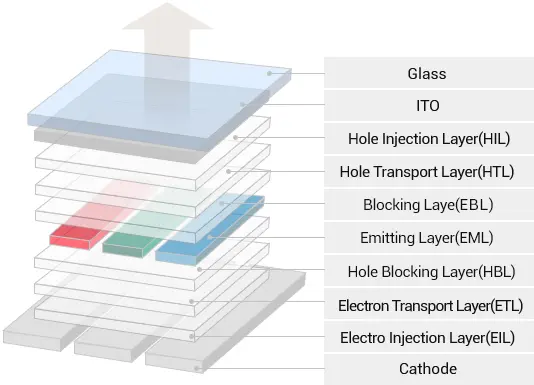

Solus has claimed to have an effective monopoly on the market for the electronic transport layer technology that enhances blue efficiency in OLED displays. However, in Samsung Display’s new material set M13, this technology is supplied by LG Chem. The patent related to this technology is not part of this dispute.

If these patents remain invalidated, other companies can use the technology freely, and Solus will need to develop new technology. Novaled, a supplier to Samsung Display, provides the electronic transport layer for large QD-OLED displays.

Solus excelled in the small OLED electronic transport layer market, holding a 73% market share in 2022, according to UBI Research, and still supplies other components in M13. Among the materials it supplies, the electronic transport layer is developed and supplied solely by Solus, while the rest are produced through an original equipment manufacturer (OEM) process.

Samsung’s OLED Materials Killing Machine

In the summer of 2022, Display Daily covered Samsung’s acquisition of OLED materials manufacturers, Cynora. It’s interesting to revisit that piece of history because Samsung then, as now, has been quite effective at putting up barriers in the OLED materials business to favor its own supply chain, and keep competitors locked out.

At that time, Samsung acquired only the IP of Cynora, and nothing else, for $300 million. That essentially shut out any of its Chinese competitors from having access to that technology. In this instance, Samsung is protecting its own IP, or at least those of its subsidiary Novaled, by invalidating patents that conflict with those it owns or are assigned to its preferred suppliers.