We got a bit ahead this week as I have a family event this week, so wanted to get the issues done so that I could relax and we managed to do that, helped by a dramatic slowdown in news on Thursday as our US news sources sat down to turkey and checking the Black Friday deals. We also had reports from Chris (in Mobile Display Monitor) and Matt (in LDM) from New York last week, and mine from the Fujitsu Forum in Munich last week.

Ken has interesting news on the development of quantum dots and just as we went to press, Samsung confirmed the widespread rumour, shown in our company news, that it was to buy QD Vision for $70 million. Korean sources have confirmed that a big factor in the decision is that Samsung gets control of the ip that QD Vision has. In the end, this is a small amount of money for Samsung and just one of a number of technology companies that it has acquired in recent years (the most recent deal being Harman, agreed just recently)

A separate story that I saw just as we were finalising the issue is a rumour about Samsung being in discussions about selling its PC business to Lenovo. In a number of ways, this wouldn’t be a surprise. Samsung has not succeeded in getting to global scale in its PC business and that has meant it doesn’t have the volume to compete with the top three brands. That, in turn, means its next to impossible for the company to build a profitable business and the company has been rolling back its targets in the PC space. Samsung tends to like to only be in businesses that it can be #1 or #2 in, so a sale would not be surprising. And, of course, the company recently agreed to sell its printer business to HP.

I’ve not really looked at why Samsung has not been successful in PCs, as it has a good vertical supply chain with strength in storage, memory and displays that might have been expected to give it an advantage. On the other hand, the company likes to be a technology leader and innovator and the constraints imposed by reliance on Microsoft for software and Intel for processors mean that it’s hard to be distinctive technically in the PC market.

Lenovo buying the business would also make some sense, as the company has a good track record of making the most of acquisition deals and brand management, although it seems to have slowed in its success recently. The company competes in some of the toughest businesses in the world – PCs, smartphones and servers. Despite this, it has developed and tried innovative products and high quality products.

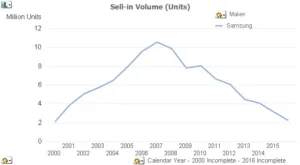

As we reported on the front page of Large Display Monitor, Samsung has dropped back to third equal place in the desktop monitor market, alongside LG. Samsung was the top vendor of monitors in Europe from 2001 to Q2 of 2015, but has looked as though it has been more interested in profit than market share for a while, now. If we exclude multi-function monitors (monitors with TV tuners), Samsung has dropped back from being broadly the same kind of scale as Dell and HP a couple of years ago and significantly more five years ago, to levels that are not much more than half of those companies now. Much of the drop in the market volume in monitors in EMEA over the last 5 years has been in Samsung’s sales.

The question starts to be, at what point will Samsung decide, given that it is expected to get out of monitor panel making, to sell its monitor business? And to who?

Bob

Samsung’s long term desktop monitor sales. Source Meko