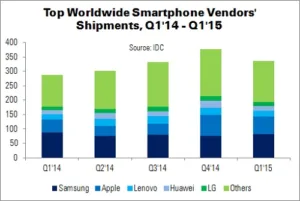

With a renewed focus on lower-cost models, Samsung regained the top spot in the global smartphone market in Q1’15, said IDC. Shipment volumes were seasonally down QoQ – a difference exacerbated by Q4’14’s record results.

336.5 million smartphones were shipped worldwide in Q1’15: up 16.7% YoY (from 288.5 million), but down 10.9% QoQ (from 377.5 million). Shipments of mobile phones (smartphones and feature phones) were down just 0.1% YoY, from 459.3 million to 458.9 million.

Apple challenged Samsung in Q4, but the Korean vendor took a clear lead in Q1 – “despite the soaring global demand for the iPhone 6 and 6 Plus”, said Anthony Scarsella, research manager at IDC. Given that the Galaxy S6 was not available through the entire quarter, Samsung’s shipments were driven by large volumes in emerging markets, as well as steady demand for its mid-range and low-cost models.

Apple also enjoyed a strong quarter, surprising IDC. Consumers continued to demand the new larger iPhones in many markets, including Greater China. China’s overall YoY growth in Q1 flattened significantly, however, so vendors aside from Apple will look outside the country for their next big push.

“Through the rest of this year, we expect all vendors to be squeezed on falling ASPs, while at the high end it will be a battle between the Galaxy S6 and S6 Edge from Samsung versus continued demand for the iPhone 6 and 6 Plus”, said IDC’s Melissa Chau.

| Top Five Smartphone Vendors’ Shipments, Market Share and Growth, Q1’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Shipments | Q1’14 Shipments | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| Samsung | 82.4 | 88.5 | 24.5% | 30.7% | -7.0% |

| Apple | 61.2 | 43.7 | 18.2% | 15.2% | 40.0% |

| Lenovo | 18.8 | 12.6 | 5.6% | 4.4% | 49.2% |

| Huawei | 17 | 13.5 | 5.0% | 4.7% | 25.9% |

| LG | 15.4 | 12.3 | 4.6% | 4.3% | 25.3% |

| Others | 141.7 | 117.8 | 42.1% | 40.8% | 20.3% |

| Total | 336.5 | 288.5 | 100.0% | 100.0% | 16.7% |

| Source: IDC | |||||

Stable Galaxy smartphone demand kept Samsung on top, as well as low-end shipments – particularly to regions such as South-East Asia, the Middle East and Africa. The company’s streamlined portfolio was successful in many mid-tier markets that traditionally favour local brands. The late-Q4 release of the Galaxy S6 and S6 Edge gave Samsung a volume push at the end of the quarter.

Apple’s large iPhones helped it to achieved its strongest-ever Q1, with 61.2 million units shipped. Greater China was a driver. Overall, iPhone sales were up 40% YoY, and 63% in emerging markets.

Lenovo came third, thanks to its Motorola acquisition combined with strategic positioning of the Lenovo and Motorola brands. New premium handsets revealed at CES proved that the company is not only focused on the entry-level market.

Huawei continued to push for the premium market with its P-Series and Honor models. Mid-range and high-end phones accounted for more than 30% of Huawei’s shipments in Q1 – up 5% YoY. The low-cost Y-Series sold well inside and outside China.

LG came in at fifth place, dislodging Xiaomi with its renewed focus on entry-level 4G devices, as well as mid-range units in North America. The L- and F-Series was successful in both emerging and developed markets. LG’s wider product portfolio enabled it to pass Xiaomi, which has a more limited geographic presence.

Analyst Comment Juniper Research released its Q1 smartphone results a few days after IDC, with results that broadly tally. Juniper estimated a more positive quarter, however, saying that global shipments rose 23% YoY, to 350.9 million units. Figures and market position for the top vendors were very similar to IDC’s results. According to Juniper, Samsung’s shipments fell below 82 million, but the company remained the market leader. Samsung’s market share was up QoQ to 23%, but down from 29% in Q1’14. Higher smartphone sales, bolstered by the new A Series, were partly offset by falling sales of tablets and feature phones. The news was not all bad, however, as Juniper expects Samsung’s performance to rise in the coming months, largely due to the S6 and S6 Edge. Apple had a record Q1, with iPhone shipments above 61 million (up 40% YoY). A sales surge in Greater China was particularly beneficial; sales were up 71% in the country, resulting in revenues of $16.8 billion. Juniper differed from IDC in that it also released some information about Microsoft and Blackberry. Blackberry’s decline continued, with shipments estimated at 1.5 million. Microsoft, meanwhile, has been hard-hit by its dropping of the low-cost Asha brand; shipments were down almost 40% YoY, to sub-9 million units. A ‘big quarter’ is predicted for several vendors, with the release of flagship products including the Apple Watch, Huawei’s P8, HTC’s One M9 and Xiaomi’s Mi5. (TA)