We received reports this week concerning Samsung Display’s plans. We received reports this week concerning Samsung Display’s plans to build capacity for making Quantum Dot OLED (QD OLED) panels. QD OLED could be Samsung’s answer to rival LG Display’s White OLED product, which has captured an increasing share of the premium TV market space sold by LG Electronics, Sony, and other brands.

We have reported previously that Samsung Display is building a pilot production facility for QD OLED, with capacity of 5K per month of Gen 8.5, which will start production in 2019. We understand that major expansion of capacity beyond the pilot will be decided in Q2 2019 if the pilot is successful, but recently we have learned that provisional plans for the capacity expansion have been made, in anticipation of a successful pilot.

The QD OLED production will be made on Samsung’s 8-1 and 8-2 lines in Tangjeong, which currently have a capacity of 170,000 and 190,000 Gen 8.5 TFT substrates per month making LCD. Portions of these lines,8-1-1 and 8-2-1, will be converted to QD OLED in 2019 – 2020, and in all cases the overall area capacity of the lines will be substantially reduced. For 8-1-1, 80k of LCD capacity will be converted to 25k of QD OLED capacity at a cost of $1.6 billion, and for 8-2-1, 50k of LCD capacity will be converted to 10k of QD OLED capacity at a cost of $0.6 billion. Together, a total of 130k of LCD capacity will be converted to 35k of QD OLED capacity for an investment of $2.2 billion.

Why is there such a big loss of capacity in converting from LCD to QDOLED? We speculate that SDC will be using photolithography not only for the OLED backplane, which, with oxide TFT, will require more mask steps than a-Si, but also for the quantum dot color converter (QDCC). If so, this would explain the nearly-factor-four reduction in capacity.

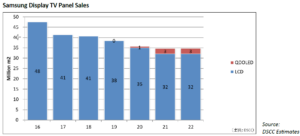

With this change, Samsung Display will have a substantial reduction in overall Gen 8.5 capacity. The reduction of 95k per month of Gen 8.5 represents more than 6 million square meters per year, which is about 20% of SDC’s Gen 8.5 capacity and about 12% of their total capacity. This will reduce SDC’s sales of LCD TV panels, especially in 49” and 55” sizes which are optimized on Gen 8.5. The effect on SDC’s TV panel business is seen in the chart below.

The increase of QD OLED will recover only a small part of the lost TV panel volume, but it is likely to be with high-priced QD OLED panels at large screen sizes. Since a 60” TV screen has roughly 1 square meter of viewing area, if the average size of Samsung’s QD OLED is bigger than 60”(likely, in my opinion) then this capacity will make less than three million panels, a figure easily absorbed by Samsung in the premium segment.

There are several other implications for this transition, if it turns out as these plans indicate. The reduction of Gen 8.5 capacity by Samsung amounts to about 2% of industry display capacity by area, which does not seem like a lot, but the experience of 2016 was that the impact of Samsung reducing capacity precipitated a shift in the market from oversupply to shortage. It’s not certain that a 2% reduction would do the same in 2019, but we can’t dismiss that possibility.

The other impact would be on glass supply. Samsung gets most of its glass from Corning, and the big reduction in SDC Gen 8.5 capacity would hit Corning disproportionately. Corning has other levers to regain this lost share – the US glass company will gain with Gen 10.5 fabs in China – but this shift can leave Corning with excess capacity in Korea.

DSCC will continue to closely watch these developments and will report in our weekly newsletter.

Analyst Comment

Thanks to DSCC for giving us permission to run this article in the ‘guest’ slot. The original was a joint article in the Display Supply Chain Monitor between Bob O’Brien and Yoshi Tamura. QDOLED is the concept of using blue OLEDs and then converting some of the blue to red and green using quantum dots. This ought to be more efficient than the scheme used by LG Display that relies on colour filters. (BR)