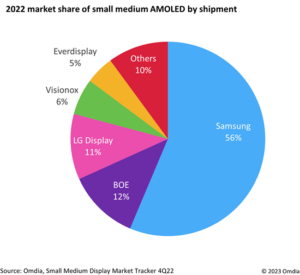

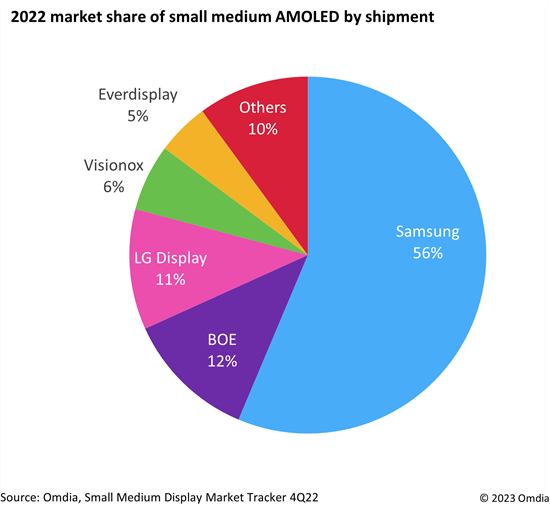

In 2022, shipments of small-to-medium size (9.0-inch and smaller) AMOLED experienced a decrease of 6% due to reduced smartphone demand resulting from global inflation. Samsung continued to hold its position as the top manufacturer in the AMOLED market with 429 million shipments in 2022, although its market share shrank. LG Display maintained its ranking but experienced a slight increase in market share.

However, BOE surpassed LG, taking second place with a 12% market share. BOE has made significant progress by securing orders for flexible LTPS-AMOLED from Apple for the iPhone 12 and improving its technical capabilities. BOE should gradually reduce the shipment gap with Samsung. Meanwhile, Visionox and Everdisplay, emerging Chinese AMOLED manufacturers, have been making strides in catching up to their leading Korean counterparts.

According to Omdia, the AMOLED market is currently focused on LTPO technology due to its low power consumption. In response, Samsung has expanded its LTPO-AMOLED production capacity to meet the demand for high-end smartphones. On the other hand, BOE and other Chinese display manufacturers have increased shipments of LTPS-AMOLED for mid-range smartphones produced by regional Chinese brands.