The Super Bowl is driving all lows in TV prices, LCD makers’ production capacity outstrips demand, automotive OLEDs are going to be a bright spot, and Apple is keeping its suppliers on their toes while driving prices down.

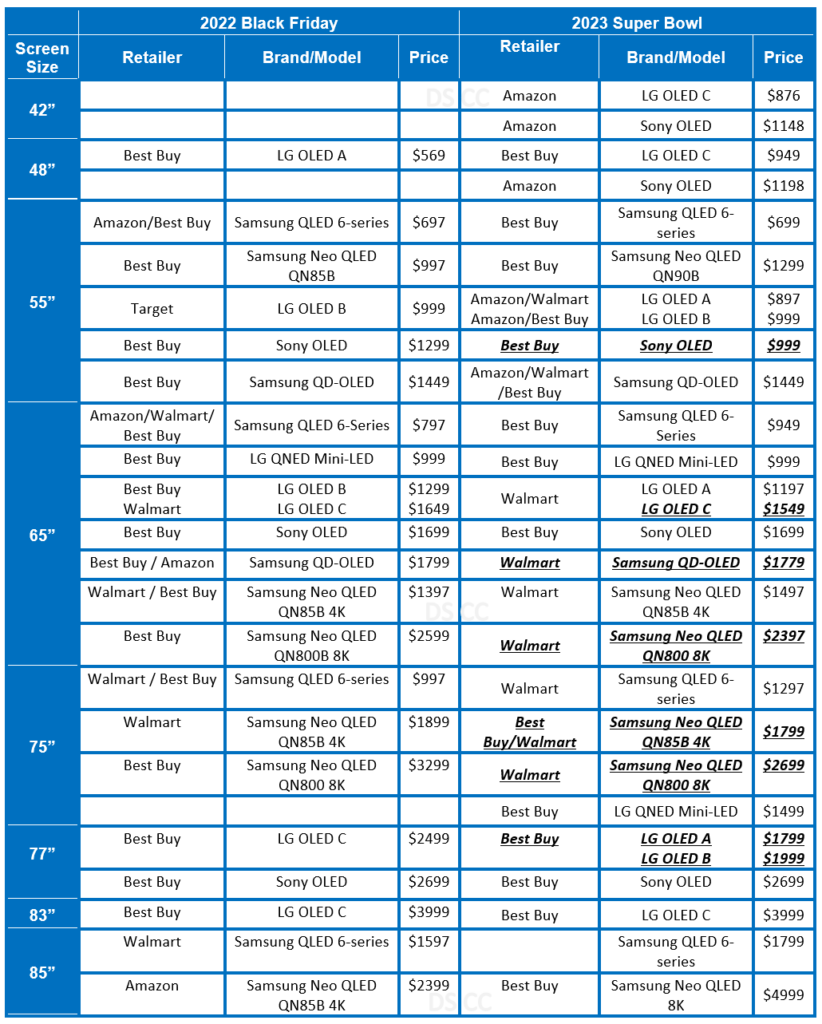

DSCC has a flurry of information to share with the world on the display industry’s supply chain. First up for bat is Super Bowl TV pricing. As you would expect, in the bargain bin category, Walmart and Hisense TVs beat their own pricing from last year’s Black Friday while Samsung (mostly), LG, and even Sony, did the same at the premium level. However, while it may look like the there isn’t much panicked discounting right now compared to Black Friday, there are some things to consider. Best Buy, Walmart, and Amazon are pretty much the mainstays of setting pricing agendas in the US market. So, they tend to be on a constant carousel of markdowns, specials, and one-off sales, and this won’t be the last time bargains are to be head. It may the last time for a while before we get an event-driven sale. It would really help if you could know what TV line is actually being sold. I defy someone to explain the SKUs, product names, and number schemes in plain English. Consumers could be buying the same TV at two different prices because they are two different SKUs. The premium segment is a weird juxtaposition because the spread in pricing is so high that it really makes you wonder how consumers make sense of it all when they are about to plunk down three grand for a TV. One day, when TVs are named without using a weird Elvish version of hexadecimal code, we may be able to compare apples to apples.

LCD TV Panel Trends

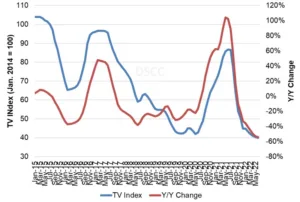

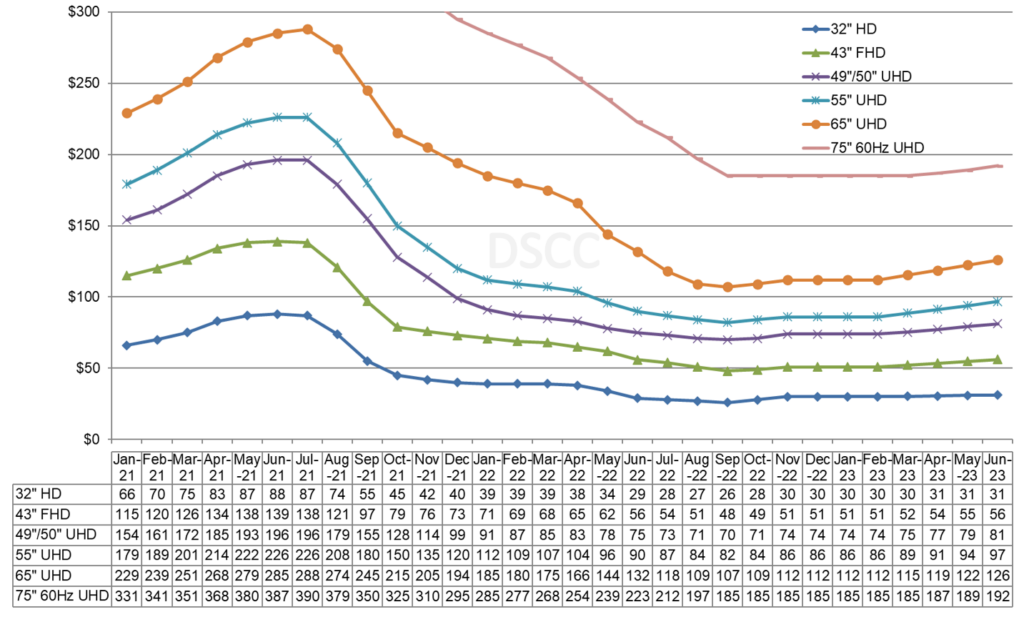

LCD TV panel prices are stagnating at their bottom but the expectation are that there will be a modest rally driven by an increase in demand as inventories are driven down. We’ll have to wait and see how this first quarter pans out in terms of TV sales, but there is not much on the horizon for 2023 to spark demand. Even at CES 2023, the emphasis by the major brands was on the total home automation package and not the usual wall-to-wall of TV coverage that we have seen in the past. So, if there are challenges in the supply chain, as we see here, and there is soft demand, as we see everywhere, it’s probably going to mean more emphasis on the high-end, maybe the mid-range which is underserved, and transitions to new formats.

Automotive OLED Shipments a Ray of Light

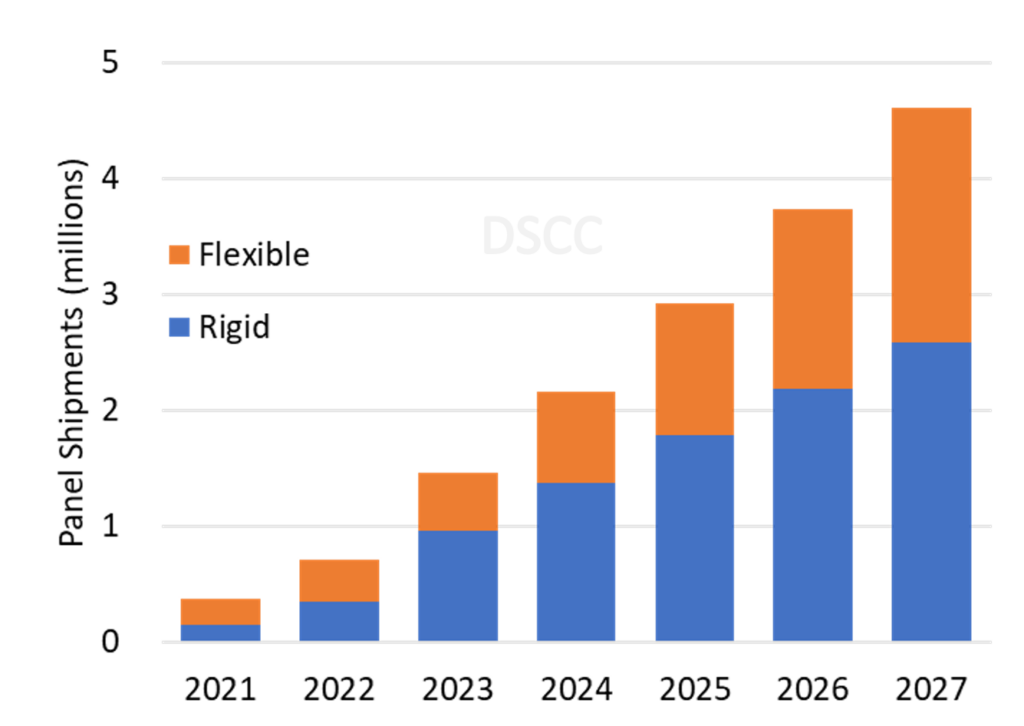

The market for automobiles is subject to the same macroeconomic pressures that all consumer channels are feeling right now, and OLEDs shipments are dwarfed by LCD panel shipments, according to Yoshio Tamura at DSCC, but you have to feel that the digital transformation of the in-car experience is worth the extra cost of OLED. The upside for automotive manufacturers is so high and the upsell on OLED displays is going to get lost when someone is forking out $30-40,000 and upwards on a new car.

iPhone 13 and 14 Panel Sales

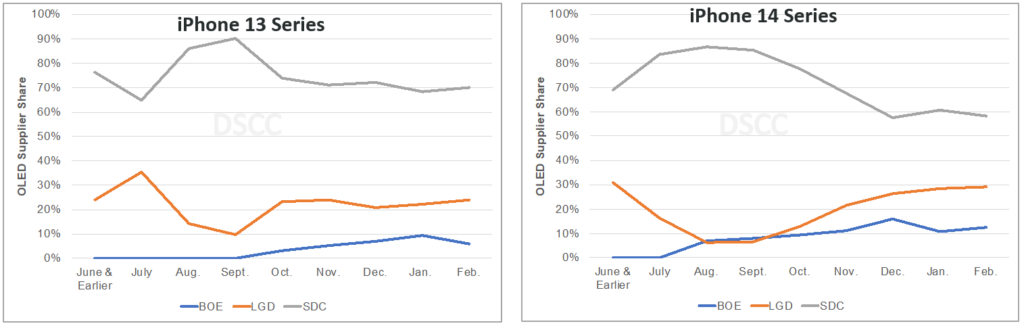

DSCC notes that there have been some changes in panel supplier shares for iPhone 13 and 14, there’s only three to worry about, BOE, LG Displays, and SDC. For future generations of iPhones, the mix of market share may be more evenly distributed, which would be the best option for Apple. However, if iPhone sales are going to remain below par in 2023, there may be a price war among suppliers. As it is, BOE has undercut the Korean manufacturers to raise it share of the business with Apple. No reason to assume that any more squeeze from a lack of demand will drive greater competition.

DSCC does excellent work in covering all of these topics, and we this information with their kind permission. Check it out here.