Click for higher resolution44% of current tablet users are looking to use a different device according to Gartner. “Replacement activity across all types of devices has decreased,” said Ranjit Atwal, research director at Gartner. “Users are extending the lifetime of their devices, or deciding not to replace their devices at all.”

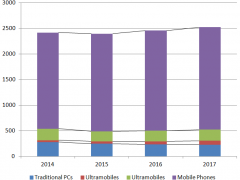

As a result, worldwide combined shipments of devices (PCs, tablets, ultramobiles and mobile phones) are expected to reach 2.4 billion units in 2015, a 1% decline from 2014 and down from the previous quarter’s forecast of 1.5% growth.

Gartner’s latest device forecast also shows that shipments in all categories will contract in 2015, except for mobile phone shipments, which are on track to increase 1.4% in 2015. Smartphone shipments are expected to increase 14% in 2015. Emerging Asia/Pacific, including India and Indonesia, is on pace to show the strongest growth (43%) in 2015, while Greater China will grow 3%.

“By 2017, we estimate mobile phone shipments will reach the 2 billion mark, and smartphones will represent 89% of the market,” said Annette Zimmermann, research director at Gartner.

| Worldwide Devices Shipments by Device Type, 2014-2017 (Millions of Units) | ||||

|---|---|---|---|---|

| Device Type | 2014 | 2015 | 2016 | 2017 |

| Traditional PCs (Desk-Based and Notebook) | 277 | 247 | 234 | 226 |

| Ultramobiles (Premium) | 37 | 44 | 57 | 78 |

| PC Market | 314 | 291 | 291 | 303 |

| Ultramobiles (Tablets and Clamshells) | 226 | 199 | 208 | 218 |

| Computing Devices Market | 540 | 490 | 499 | 521 |

| Mobile Phones | 1,879 | 1,905 | 1,960 | 2,000 |

| Total Devices Market | 2,419 | 2,395 | 2,459 | 2,521 |

The global PC shipment market is expected to total 291 million units in 2015, a decline of 7.3% year over year, and to show flat growth in 2016.

“Until the end of 2015, currency devaluation and subsequent price increases will continue to restrain the replacement of ultramobiles premium and notebooks by businesses in particular,” said Mr. Atwal. “In 2016, we expect currency impacts will negate (sic) and while Windows 10 products on the Intel Skylake platform will increase in volumes throughout the year, Windows 10 adoption among businesses will ramp sharply in 2017, where we expect the PC market to return to a 4% growth”.

The ultramobile segment (tablets and clamshells) is also on track to contract in 2015. Ultramobile shipments are expected to total 199 million units in 2015, a decline of 12% year over year. Tablet shipments are on course to reach 192 million units in 2015, down 13% from 2014.

“The tablet market is coming under increasing pressure,” said Ms. Zimmermann. “Users of tablets with a screen size between 7″ and 8″ are increasingly not replacing their devices.”

Gartner’s new user survey conducted in June 2015 across six countries* found that 44% of current tablet users are planning to substitute their tablets with a different device. It is potentially even higher for laptop users, as 54% of them are intending to opt for an alternative device, including the highest %age of undecided consumers (see Table 2).

| Desktop | Standard Laptop | Convertible laptop (screen does not detach from main unit) | Convertible laptop (screen detaches from main unit) | Tablet | Smartphone | Phablet | Not sure/Haven’t decided | |

|---|---|---|---|---|---|---|---|---|

| Desktop (n = 3,393) | 65% | 12% | 6% | 4% | 2% | 11% | ||

| Laptop (standard or convertible) (n = 3,798) | 7% | 46% | 13% | 12% | 4% | 19% | ||

| Tablet (n = 1,924) | 2% | 6% | 6% | 7% | 56% | 4% | 6% | 13% |

| Smartphone (n = 6,851) | 2% | 2% | 66% | 14% | 16% | |||

| Replacement with same type of device | ||||||||

Analyst Comment

The comments and table on changes is interesting, not only for those that sell the devices, but also for those selling peripherals. Few desktop or laptop users are looking at changing from those systems (if you include convertibles as laptops). In that case, they are still likely to want monitors. On the other hand, 21% of tablet users are likely to move back or upwards to laptops and desktops. (BR)