Display Supply Chain Consultants (DSCC) held an event to give an update on global display market trends – set nicely half way between the SID Display Week Business Conferences and still available to purchase online until early January. As usual, there was lots to learn, but today I’m going to the ‘big picture’ as outlined by Ross Young. I was really pleased that he looked ahead as well as back!

He started with a review of the Crystal Cycle, but we’ve covered that many times over the years. This year, of course has seen high prices followed by rapidly falling prices. Margins this year hit a five year peak, but are falling now. BOE is now the top panel supplier by revenue.

The overall panel market revenue will be broadly stable at somewhere between $150 billion and $160 billion, around the levels of this year over the period to 2026. This year the supply chain has been challenged and Covid led to demand growth for home IT and TV. Displays became even more important in our lives.

By application, all IT markets were up in 2020, but only automotive will be up this year- and that is because it was so far down in 2020. Automotive will see the strongest growth in 2022 but will be volatile because of chip shortages. IT grew its in share of revenues from 21% in 2019 to 25% in 2020 and to 29% in 2021.

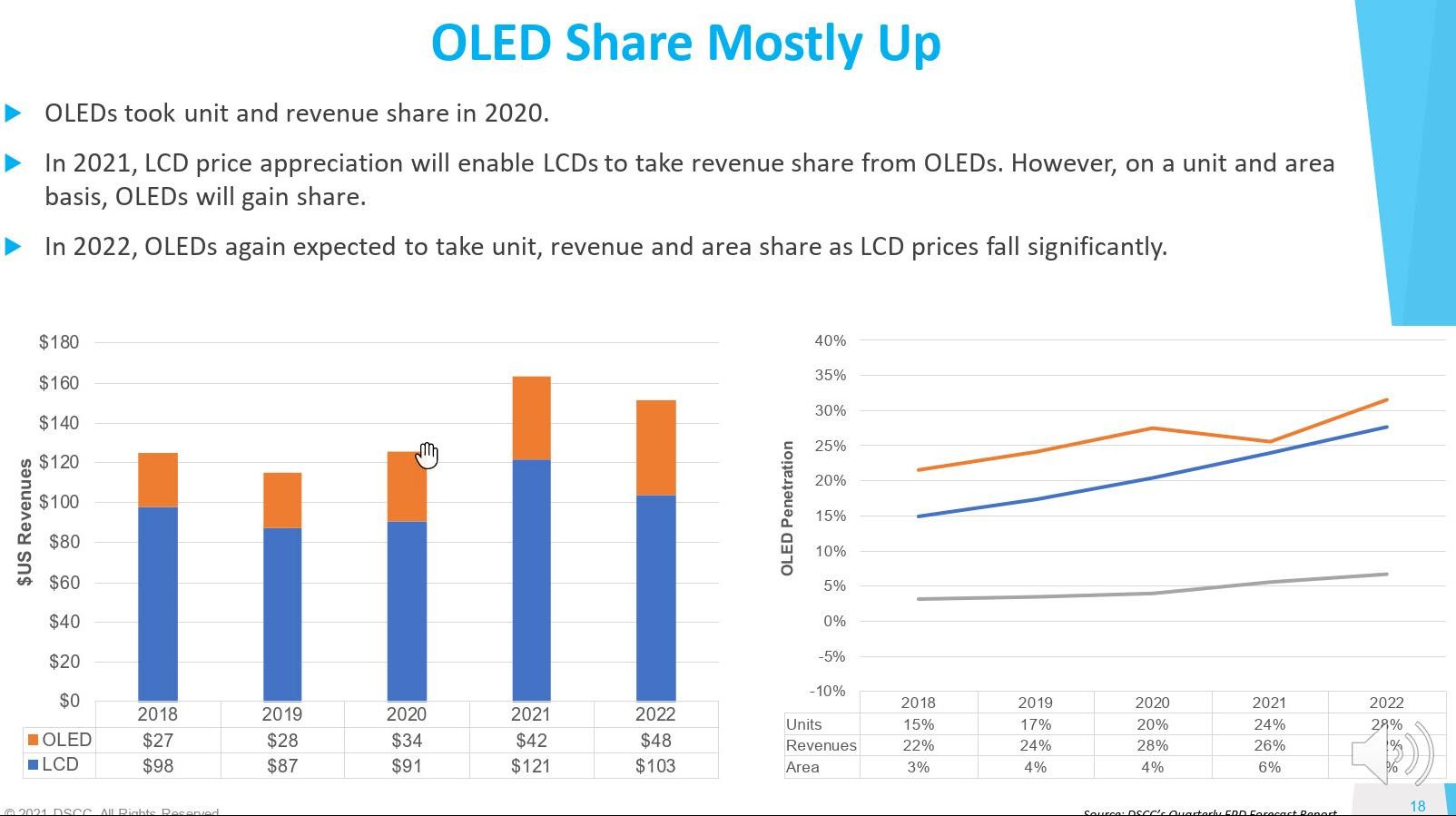

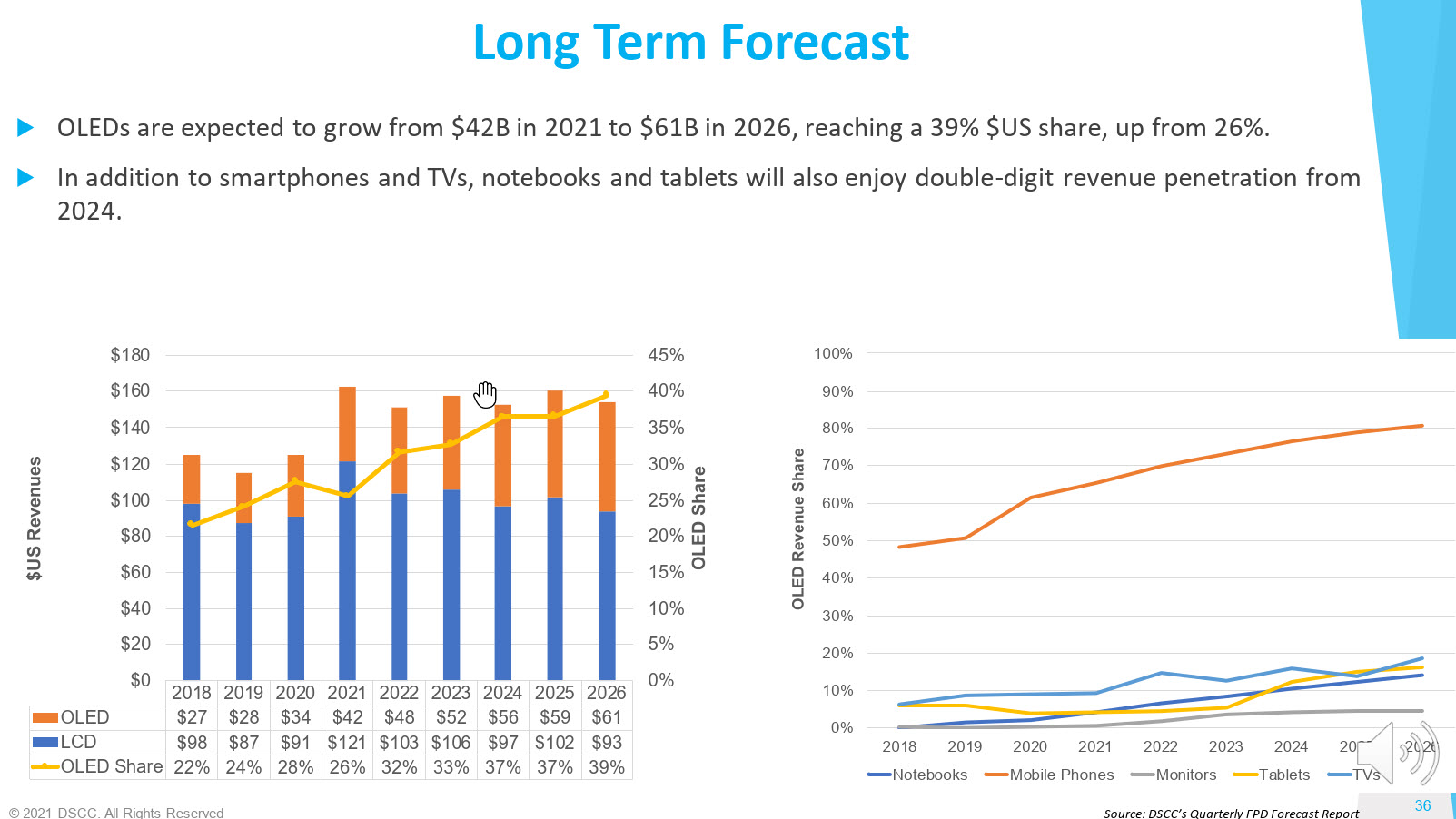

Looking by technology, OLED took unit and revenue share from LCD in 2020, but some of the revenue share was taken back in 2021 because of high LCD pricing. In 2022, OLED will again take share in revenue and units, reaching 32% of revenues and 24% of units.

However, by application, OLED has only succeeded in volume terms in the smartphone market with over 60% penetration by revenue. In TV, it should get past 10% in 2022, but is at only mid-single digits in other applications.

Key 2022 Events

A significant event might be the rumoured deal between Samsung’s VD (TV) group and LG for the supply of 1.5 million to 2 million OLEDs and 4-5 million LCDs for TVs. If this happens, (and DSCC sees it as more and more likely, given the volume of rumours) LG Display will be a significant winner with the claim that it has the leading TV technology with “all major brands adopting their WOLEDs”. LGD will have tight supply and high utilisation so should be able to get better prices for its panels. It may even be able to think about licensing the technology for WOLED to Chinese panel makers to expand the supply chain.

Samsung should also be a winner as it will be able to take back TV share that it has lost to OLED in the last couple of years. DSCC thinks that Samsung is big enough to back ‘all the TV technologies’ and go with those that are best. Using WOLED from LGD will also win more time to develop and evaluate Samsung’s own new QD-OLED technology. LGD’s equipment suppliers would also win from this development.

MiniLED LCD could be a loser as OLED takes some of Samsung’s high end TV business, unless it can move into the mid-range faster than expected.

New OLED Manufacturing Techniques?

A second potentially big event in 2022 is if Samsung Display (SDC) issues POs for equipment for the first G8.5 RGB OLED fab using fine metal mask (FMMM) technology and IGZO backplanes. This has been rumoured for a while, but would give SDC a ‘first mover’ advantage in OLED IT markets and improve their lead in OLED notebooks and extend it in tablets and monitors. Having such markets would help reduce the seasonality of OLED business (because of the smartphone market) and smooth out some of the peaks and troughs in the supply chain.

Ulvac could be a big winner of a Samsung decision as DSCC believes that the firm has an exclusive deal with SDC for FMM VTE tools to be used in such an OLED fab and allowing Ulvac to take share from Canon Tokki in the FMM VTE market. Overall there is likely to be spending of around $1.5 billion in equipment to build a G8.5 and if the fab is successful and the technology could be extended into TV, it could lead to a boost to OLED equipment sales.

LGD and BOE could then be losers as Samsung moves ahead in OLED technology. CSOT could have to change its IJP strategy if SDC can get high yield using FMM VTE. LTPS suppliers could also suffer if IGZO is successful.

IGZO can be lower cost than LTPS/LTPO, is scalable to G8/G8.5 and Sharp has a roadmap to get IGZO mobility up to the level of LTPS at 60cm²/(V?s), from the current level of 10-15 cm²/(V?s). That level of performance would enable higher resolution and variable frame rates with much lower capex than from LTPS or LTPO. (This is a topic I’m planning for a deeper dive, shortly – editor).

DSCC calculations suggest that 16.2″ notebook panel costs could reduce in cost from $220 to $250 with current manufacturing to around $120 by 2025 and that G8.5 Oxide would be cheaper than G8.5 miniLED LCDs with 2596 zones. The same trend would be seen for tablets and monitors, too.

Panel Pricing

There will be lots of talk of declining LCD panel pricing in the TV market and there will be more news about LGD and SDC ending TV LCD panel production in Korea. The rate of price decline in miniLED will also be important. MiniLED is going to have to come down in cost to stay competitive with OLED and brands will have to decide to promote OLED or miniLED.

BOE may announce Phase 2 of its B17 LCD fab for TV panels and that will weigh on the supply and demand side as well as on equipment suppliers.

The development of the Samsung/UDC agreement in 2022 and developments in blue OLED will get traction. More suppliers will introduce LTPO technology. Under panel cameras will get better and IR sensors will arrive to eliminate notches. Rollable development will continue, although DSCC expects to wait until 2023 to see a product on the market. Multi-fold tablets may be delayed to 2024 and Apple’s plans for foldables will be the subject of continued speculation over timing.

There could be more consolidation among panel suppliers in China and there will be lots of microLED progress.

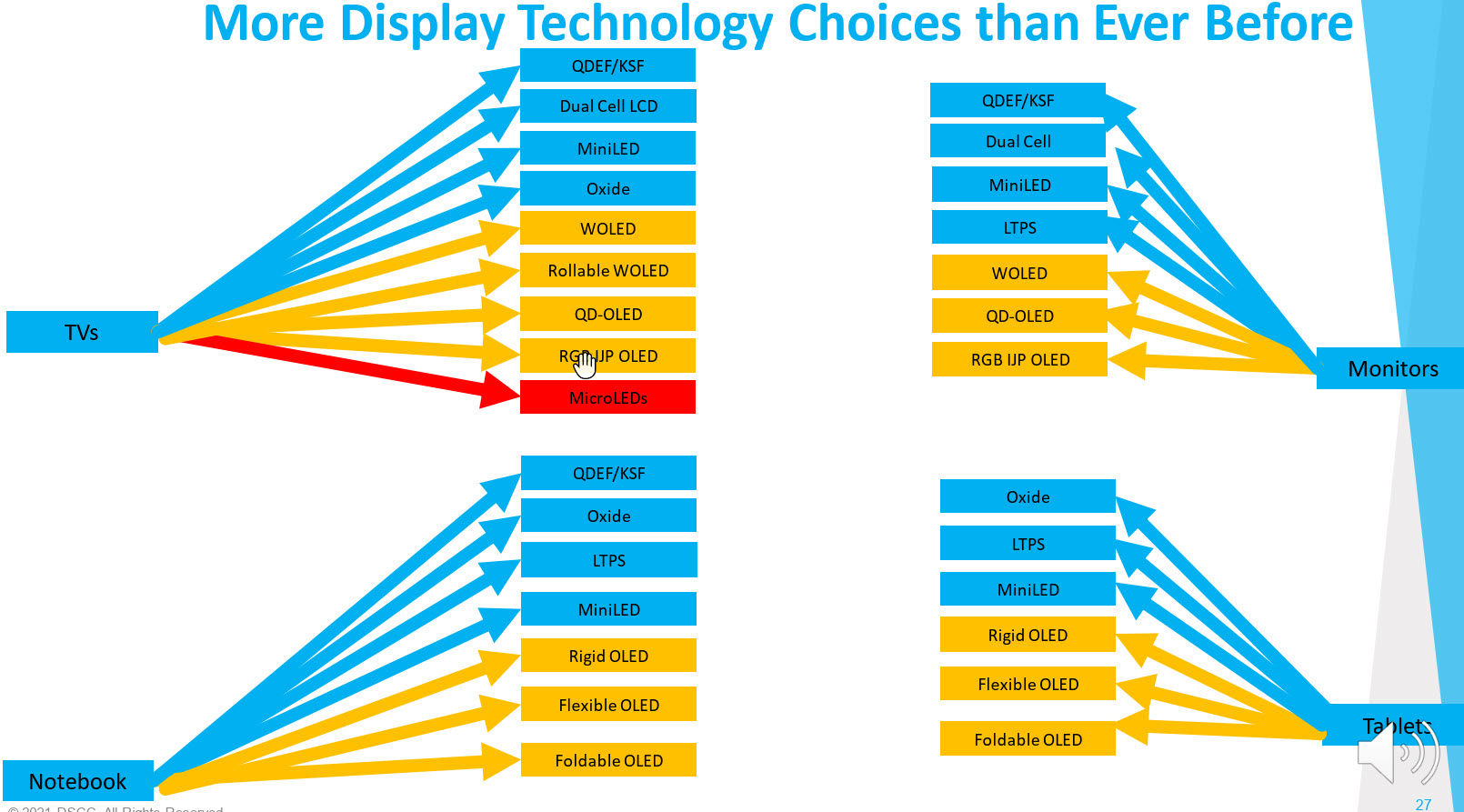

As Young has pointed out over the last couple of years, there are more and more choices available for panel suppliers and brands to differentiate their products.

Overall ‘advanced displays’, which DSCC takes to mean OLED + miniLED based panels, will continue to grow share. Brand strategies, like the adoption of miniLED by Apple, will have a significant impact on the balance between the two technologies.

MiniLED cost reduction strategies will be important to get the technology into monitors – the area where it will be strongest – and there should be lots of improvements in both performance and manufacturing.

OLED will also push manufacturing costs down.

OLEDs should account for the majority of unit volumes with around 80% of revenue by 2026 in the smartphone market as all flagship products are now OLED-based. Tablets will see miniLED doing well in 2022-2025, but with OLEDs growing in share after that. OLED should stay ahead of miniLED in tablets an advanced displays should take 15% of the overall volume in tablets.

In monitors, miniLED will dominate OLED, and advanced displays should take over 21% of revenues by 2026, but only 10% of units. In TV, advanced displays will take about 10% by volume, although DSCC has not yet modified its forecast to take account of any TV OLED purchases by Samsung. In revenue terms, advanced TV should take 37% of revenues by 2026. MiniLED cost and OLED capacity will be the key determinants for the forecast.

OLED should reach a 39% revenue share of the overall market by 2026 (BR)