In a recent Display Daily, I discussed how Quantum Dot (QD) manufacturers should be looking over their shoulders at perovskites. The reason that QD manufacturers can look in that direction at perovskites is that currently QDs are in front – way in front.

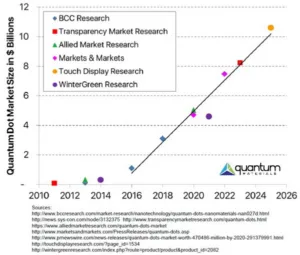

Most perovskite work is still at the university research level, but QDs from a variety of manufacturers, including Nanosys, QD Vision and Quantum Materials Corporation (QMC) are beginning to show up in consumer products. Growth in the sales of QDs is expected to begin seriously this year, as shown in the figure where forecasts from various market research studies were compiled on one graph by QMC.

One of the reasons why display manufacturers are interested in QDs is the large color gamut they can provide. For example, Nanosys says that with their QDEF, LCDs can now cover more than 90% of the Rec.2020 UHD broadcast color gamut standard. To fully meet the Rec. 2020 standard, lasers are necessary for all three colors: red at 630 nm, green at 532 nm and blue at 467 nm. Of course, with lasers you get laser problems including safety questions, speckle and cost.

According to Nanosys, it isn’t all that difficult for a TV manufacturer to switch from white LEDs to a QD-based system, at least if you have a direct backlight. Just replace the white LEDs with blue ones and add a sheet of QDEF between the LEDs and the LCD glass, as shown in the figure. 3M, among others, actually makes the QDEF film, using “trillions” of Nanosys QDs.

High end LCD TVs tend to have a local dimming backlight in order to increase perceived contrast and reduce power consumption, so this approach can be used. For example, the TCL X1 high dynamic range (HDR) and wide color gamut (WCG) TV shown at CES last week has a local dimming backlight with 2,304-segmented areas. Nanosys/3M QDEF technology was used in this set. By illuminating just one or a few of the segments, the X1 can reach its target 1,000 peak nits of brightness needed for HDR without excessive power consumption.

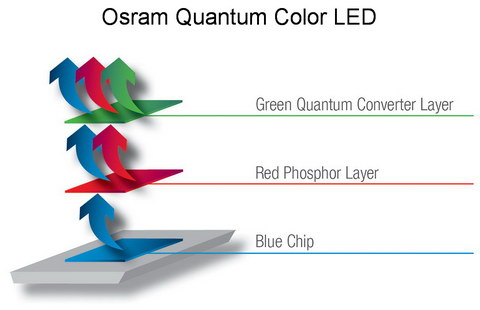

Edge lit TVs, which can be thinner, lighter and cheaper, can’t take this approach as easily. Not to worry, QD enhanced white LEDs are available for use in edge-lit systems. For example, Osram announced in December the availability of “Quantum Color” LEDs for displays. All white LEDs are based on GaN blue LEDs plus a material to convert some of the blue light to red and green. The most common (and cheapest) material is a yellow phosphor that generates both the red and green. The new Osram LEDs use a red phosphor layer to convert some of the blue to red and a green QD layer to convert more of the blue to green. Of course, some of the blue light passes through both layers to produce blue for the display. One trick in manufacturing a white LED like this is to make sure the red, green and blue are properly balanced to white. Don’t bother to ask Osram details of how they do this color balance – I’m sure they won’t tell you.

While QMC and Nanosys both claim coverage of 90% of Rec. 2020, Osram only claims coverage of 80% of Rec. 2020. Osram says it does cover 100% of the DCI P3 gamut (AKA SMPTE 431), as does Nanosys, QMC and every other QD maker. In today’s world, this smaller color gamut is not, in fact, a problem for people who want the best colors on their TV. No content is currently available that requires the full Rec. 2020 gamut. Since all Hollywood movies are color-graded to match the DCI P3 color gamut, there is a lot of content available for this standard. While the gamut was originally designed around digital cinema projectors with xenon lamps, it has become the de-facto standard for WCG content, even non-cinema content.

The fact that 3M film takes “Trillions” of QDs points out a potential problem with the technology. The color produced by a QD depends in its diameter. Blue QDs, not of any current interest to the display community, are about 2nm in diameter. Green QDs are about 2.5 nm and red QDs are about 5nm. The more uniform the QDs, the narrower the emission spectrum and the closer to the Rec. 2020 color point. Historically, QDs had been made in in a batch process. This both limits the quantity of QDs that can be made and limits how uniform they can be. QMC has a continuous process for QDs that it has developed to the point where it is ready to enter production. (QMC expects to begin generating revenues from quantum dot material sales in Q3 2016.) They say this process gives them the ability to manufacture over 2000 Kg/year. They estimate the total world manufacturing capacity at the end of 2015 was about 8000 Kg/year so, according to their data, they have 25% of the world capacity.

QDs have multiple applications besides displays. Like perovskites, QDs can also be used in solar cells. QMC claims “QD solar cells have 2x the maximum efficiency of traditional solar cells – theoretical maximum is 66%.” While most QDs are spherical, QMC uses its tetrapod QDs in solar cells. They also claim to have a roll-to-roll process capable of running at 600 meters/minute to make flexible solar cells. Other applications under development at QMC include lighting, anti-counterfeiting inks, and bio-medical use.

While I haven’t talked much about QD Vision, they were named as a CES 2016 Innovation Awards honoree for its Color IQ Quantum Dots. QD Vision is working with TV manufacturers Philips, Hisense and, no doubt, others. In addition, QD Vision is working with SoC maker Sigma Designs to develop a reference design for TV manufacturers to accelerate commercialization of high-performance Rec. 2020 HDR UHD TVs. The reference design will leverage cost-effective components from both companies to enable affordable, slim-profile Rec. 2020 HDR TVs in both curved and flat display configurations. The Sigma Designs chips will take the incoming content and up-scale it to the color gamut of the TV. Lets face it, little consumer WCG is currently available so most of the time people will be watching content color graded to Rec. 709, the HDTV color gamut.

While they don’t agree on whose QDs are the best, one thing all QD manufacturers seem to agree on is that QD TVs can have colorimetry just as good as OLEDs at significantly lower cost. Several years ago, OLEDs started with multiple advantages over LCDs: thin designs, ability to make curved screens, high dynamic range, high contrast and excellent colorimetry. The LCD TV industry has now demonstrated (and marketed ) TVs with all of these properties. While OLED displays have found a solid market in handheld devices, their foothold in large screen TVs is much more precarious. Are QDs finally going to close the window of opportunity for OLED TVs? –Matthew Brennesholtz