Quantum Dot Display is an evolving technology that has established itself as a formidable force in 2019 with lower prices, higher product availability and improved performance enabling strong growth in shipments.

This technology is expected to enter an expansion phase in next few years through high capital investments (from Samsung) and technology developments that will enhance other technologies such as LCD, OLED and MicroLED. Finally, it aspires to be a leader by offering the most cost effective, flexible emissive quantum dot display in future. QD technology still has many challenges and faces strong competition from other display technologies.

Strong growth: Driven by lower prices and a broader range of product availability

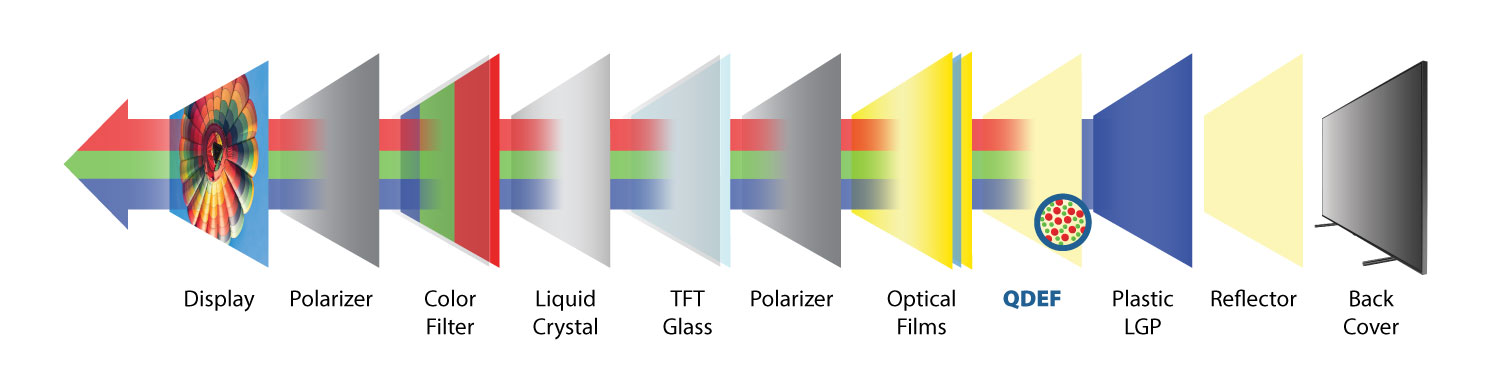

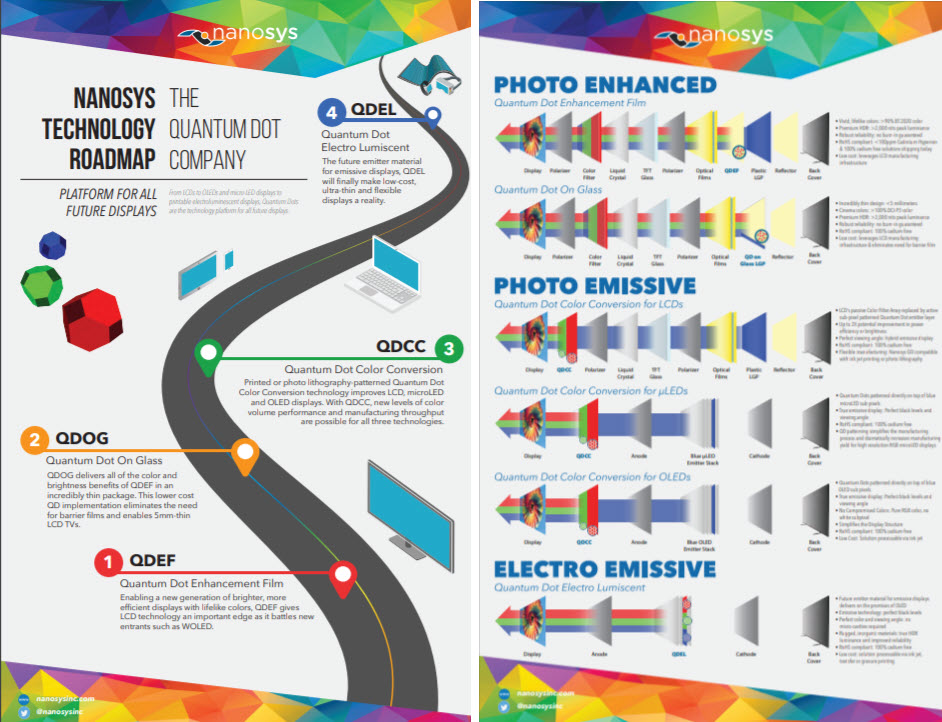

The presence of Quantum Dots technology in the market increased with Samsung’s introduction of QD cadmium free TV (technology licensed from Nanosys) in 2015. QD enhancement film contains trillions of red and green emitting quantum dots. QD film sheets can be dropped in front of a blue LED LCD backlight in place of a diffuser sheet, converting some of the blue light from the LEDs in the backlight to red and green, creating an RGB (white) light source that goes through the LCD and color filter.

QDEF architecture (image:Nanosys)

QDEF architecture (image:Nanosys)

The first generation QD enhancement film (QDEF) enabled LCDs to have better color purity, wider color gamut, and offer a brighter and more immersive HDR experience while maintaining power efficiency for TV applications. But challenges such as higher prices, reduced viewing angles, relatively slow switching speed, lower black level and environmental concern limited its growth rates. The technology has evolved during last few years to improve or eliminate most of these issues. This has resulted in broader adoption of the technology.

Samsung is the dominant supplier of QDLED TV, based on its use of QDEF on LCD. The company is now offering products ranging from 43-inch to 98-inch with resolutions up to 8K at various price points. Its 43-inch QLED TV could be had at less than $500, during last Black Friday. According to industry estimates, Samsung shipped more than 5 million QDLED TV units in 2019.

Besides Samsung, Vizio, TCL, Hisense, Konka and Xiomi are already offering QDEF-based LCD TVs. Vizio’s M series 65-inch price also went below $500 during 2019 Black Friday. TCL announced that their sales volume of QLED TV surged by 66% y-o-y in 2019. Hisense’s H9 Quantum and the brand overall experienced over 50% more sales in the US.

Nanosys, the dominant leader of quantum dot materials reported 50% y-o-y growth in shipments in fiscal 2019. According to Nanosys, 100 unique QD technology-based products were available in the 2H of 2019 up from about 50 in 2017.

Monitors Adopt QDs

Nvidia developed a G-Sync HDR PC gaming 4K QD monitor with stunning wider color gamut, higher contrast, better color saturation and higher brightness in 2017. HP, ASUS, Acer, Samsung, and others have now introduced 4K HDR gaming monitors with QD enhancement film. These high-end monitors were geared towards gamer, video editors, graphic designers, and professional photographers available in different sizes and at different price points.

QD empowering LCD products: With MiniLED, Dual-Cell and New backlight solutions

At CES 2020, a series of QD products were introduced based on MiniLED backlights and a higher number of Full Array Local Dimming (FALD) zones. That enabled products with very high contrast, deeper black level, higher color accuracy, high efficiency, higher peak brightness, and greatly improved picture quality.

Acer and Asus showed the latest versions of their QD MiniLED 32-inch 4K G-Sync gaming monitor with 1152 dimming zones (nearly 100% increase from the previous version of 576 zones for HDR), 1400 nits peak brightness, improved contrast and 90% of BT 2020 color gamut vastly improving picture quality. Samsung introduced the G9 49-inch ultra wide, its first QD LCD gaming monitor (5120x 1440 resolution) with 240Hz rapid refresh rate, 1 ms response time, 32:9 aspect ratio, 1000R curve and 1000 nits peak brightness.

Samsung’s QLED 8K Q950

Samsung’s QLED 8K Q950

TCL introduced its first MiniLED backlight-based TV with >25K MiniLEDs. The LEDs are infused directly into a glass substrate enabling very high contrast, more even light distribution for enhanced uniformity, higher brightness, enhanced color and stable long life performance.

Samsung showcased a 8K QLED TV, with a bezel-less design, 99% screen to body ratio and very thin body design (15mm thin even with FALD). Samsung also introduced a QD notebook, with 600 nits of brightness and longer battery life.

Hisense showcased a dual cell LCD TV where two LCD (2K and 4K) panels are fused together for higher contrast and with FALD light control at close to pixel level. The company has already upgraded it to a 8K quantum Dot dual cell TV with a combination of two 4K panel, MiniLED backlights, 2500 nits peak brightness, wide color gamut, 80,000:1 static contrast, and deeper black like OLED.

LCD is a mature technology. But innovation is continuing, with FALD capabilities, MiniLED, dual cell and QD technology contrast and black level increasing to get closer to the emissive OLED level. LCD is reinventing itself with the help of QD technology.

QD Entering the next generation expansion phase: With QDOG, QDCC & Emissive Display

Quantum Dot display is continuously evolving with technology innovations and material developments. In the process it is empowering other display technologies such as LCD, OLED and MicroLED.

QDOG (Quantum Dot on Glass)

Here QD is applied to a glass light guide plate, enabling higher efficiency, higher yield rates and thinner display for monitor and TV. Nanosys has introduced QDOG materials that can be made on master glass sheet light guide plate (LGP) and then cut into panel sizes for higher efficiency and yield rates. A HP Pavilion 27 monitor uses the QDOG technology to have a very thin (6.5mm) screen.

QDCC (Quantum Dot Color Conversion)

QDCC layers can be applied to any display containing a blue light source including LCDs, OLEDs, and MicroLEDs, and can be fabricated using inkjet printing or photolithography, depending on features and size requirements.

LCD: In LCD there is leakage between different color channels due to the presence of the color filter. In the QDCC process, the color filter array is replaced with a layer of active QD emitter thereby increasing efficiency and brightness more than two times. QDCC moves the Quantum Dots to the front of the display giving a wider viewing angle. Three display companies are currently working on QDCC LCD. Still, making an in-cell polarizer can be a challenge. A demo of QDCC LCD is expected at SID 2020 for small and medium size.

(other challenges for QDCC include converting enough of the blue to red and green in those pixels and having to add some technology [such as a filter] to prevent stimulation of the quantum dots by ambient light).

MicroLED: MicroLED is more reliable than OLED, produces brighter images and has a faster response time. But manufacturing is a challenge due to the difficulty of the mass transfer of MicroLEDs onto the backplane. With QDCC, display makers can start with a blue MicroLED array and then patterned quantum dots can convert blue light into both red and green at the sub-pixel level.

QDs can provide high color purity, fast response time, high efficiency and stability. It can be made compatible with the MicroLED manufacturing process and can reduce defect rates (from the pick and place process). This type of MicroLED display is expected to come in two or three years. It may still have challenges with full color conversion

QDOLED: QDOLED could combine the best of OLED and quantum dot technology: very high contrast (due to the OLED sub-pixel), perfect black, wider viewing angles with better color gamut and higher brightness. It uses solution-printed QD as the emitter material to make AM QLED displays. Printable, low cost QD materials with superior performance have the potential to directly compete with OLED displays even in the flexible segment. However there are still many challenges.

Blue emitting materials still have efficiency and lifetime issues. Multiple layers of blue OLED can be used to reduce the problem. Samsung Display has announced its plan to invest 13.1 trillion won (about $10.5 billion) up to the year 2025 in QD-OLED TV R&D and production line. It will convert LCD production line to QD-OLED. The new QD-OLED TV line (8.5 Gen) is expected to start production in 2021. Samsung Display has already had a launch ceremony.

QNED: Recent industry information is showing Samsung to be working on QNED technology, a QD nanorod based on GaN technology. GaN blue light-emitting nanorods can replace blue OLED providing even higher efficiency, improved brightness, longer lifetime no burn-in issue while using QDCC.

QD Emissive Display

Electro emissive QD display will have similar properties to OLED (perfect black and viewing angle), but with higher color gamut and higher brightness. The concept uses solution-printed QD as the emitter material to make AM QLED displays. Printable, low cost QD materials with superior performance have the potential to directly compete with OLED displays even in the flexible segment. But, again, there are still many challenges. Blue emitting materials still have efficiency and lifetime issues. Recent industry news reported that researchers in Samsung have succeeded in developing quantum dots that were 21.4% more efficient with a million hours increased lifetime without heavy metal use. The company is planning to integrate this technology into QD emissive display.

Current Situation

The majority of the current quantum dot technology-based LCD TVs and monitors use QDEF. Lower prices, higher availability of products and increased performance have resulted in strong shipments growth in 2019. QD technology is evolving and new products are expected to come in next few years with QDCC entering expansion phase. There are still many challenges. Components, materials, process, products and costs are continuously improving. QD display technology is entering the expansion phase. – (SD)

(Editor’s Note – Nanosys has a number of good graphics showing the different architectures at https://www.nanosysinc.com/nanosys-roadmap and the firm’s roadmap can be downloaded here)

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com