Chris Chinnock returned to deliver a presentation prepared by Display Supply Chain Consultants, Ross Young and Bob O’Brien, as they were unable to attend. On the supply side, DSCC makes the point that quantum dot displays can leverage all the existing a-Si capacity and there are no real changes in the manufacturing process to adopt quantum dots. Adoption of quantum dots in color filters will be more complex and require changes in the front plane part of LCD manufacturing. But, as was pointed out in the morning session, QD color filters can offer a step change in efficiency offering the option for brighter or more efficient displays.

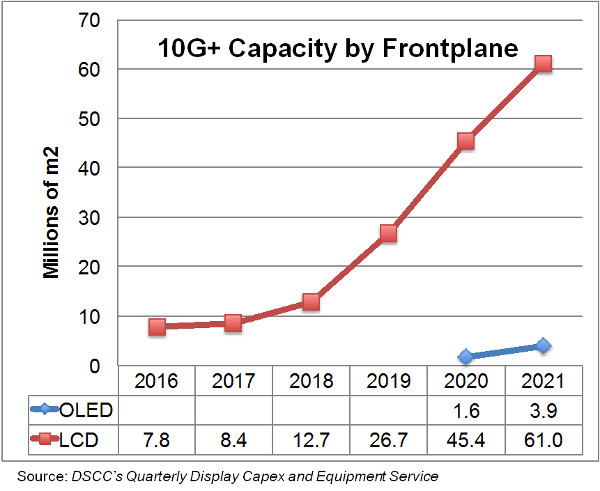

In terms of fab investment, a tsunami of new capacity is coming in the 10/10.5G fabs that are optimized for 65″ and 75″ panels. While OLED 10.5 fabs are coming too, the capacity in LCD will dwarf the OLED capacity. By 2021, 10/10.5G LCD fab capacity should reach 61 million square meters while OLED will be at 3.9 million square meters.

DSCC also looked at capex for OLED vs. LCD fabs finding a-Si fabs in the 10G class will be 49% less expensive to build than the WOLED process used today and 39% less expensive than potential ink jet OLED manufacturing. And WOLED materials costs will never catch up to LCD costs although ink jet and hybrid approaches will obtain parity by 2018, if those processes can come online.

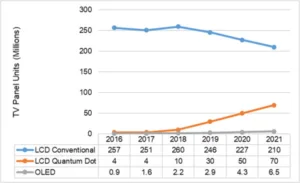

The upshot is by 2021 that QD LCD panel sales will reach 70M units, cannibalizing conventional LED TV panels sales as the drop to 210M. OLED will be well behind at 6.9M units.

In the TV market, the team reported on some US statistics suggesting that the over $1000 segment is fairly stable at 8% of the market, but price is the main driver in the US with 50% of 60″+ TVs selling for less than $1,000 and half of 55″ sets selling for less than $500.

Interestingly, Samsung’s Q2 TV sales show that in the $1500+ segment they were number one, but this represents 5% of unit sales which contribute 20% of revenue and 40% of profits. Now you know how important these flagship products are to the TV brands.

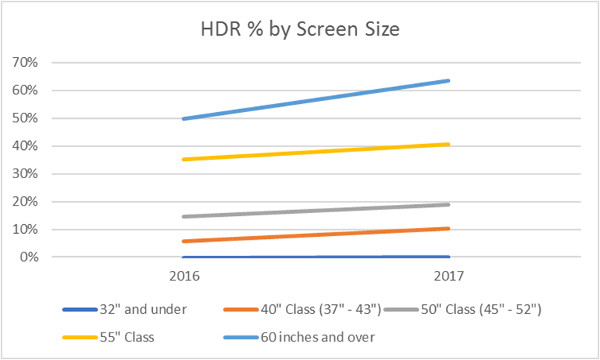

HDR is moving toward a mainstream feature with many brands adopting it as a checkbox item. But this will also create a wide variety in performance levels for HDR, which could well lead to some marketing challenges for retailers and confusion with consumers who may assume the TV they bought will have high brightness because it is labeled “HDR”.