Some weeks ago I argued that VR may not be ready for consumer prime time (Is Failure of VR an Option?). This was based on the observation of a very slow uptake of consumer devices even with falling prices, among other reasons like convenience, content, etc.

However, I excluded professional applications from my discussion as the use of VR technology in certain applications is very compelling. What this means is that some professional applications benefit from VR/AR technologies beyond the ‘new and exciting attraction’ of this new technology.

To be clear I am not referring here to AR software but to hardware sales such as smartglasses. The success of AR software solutions using the display of a smartphone, tablet, etc. is undisputable and will continue to grow. For the display industry, this market is only attractive if it is leading to more display sales, in other words, hardware sales. The display industry does not benefit from the number of videos you watch on your new TV, it is only the TV sale that counts. Now, if the latest movie experience requires a better TV (like in 4K, HDR, etc.) there is a certain hardware / content dependency that, so far, has not materialized in the consumer AR/VR market.

VR Architectural Application

VR Architectural Application

What are some of these professional applications and why do I believe that they are a very good opportunity for the AR/VR hardware manufacturers? Many of these applications are highlighted on the web on a daily basis, and I am sure that you can add several to the ones I have picked below. For example, there is the architectural application. In this case the unique advantage is the visualization of projects that do not exist yet. The architect can demonstrate how the project will look at any time of the day and night or from different viewpoints. The visualization is not based on the viewer’s imagination but creates the possibility of exploring the project in a way that makes it look as thought it already exists. Other than in CAVE environments, this is not possible today. You can take a look at such a project in this YouTube video from Alina Galushko.

Other applications include, for example, military training that allow the evaluation and replay scenarios that are not possible in any other way with the same amount of realism. This method allows for extended training of certain operations, giving the soldiers a higher chance of success, something that cannot be measured, at least not directly in money terms.

VR Military Training Application

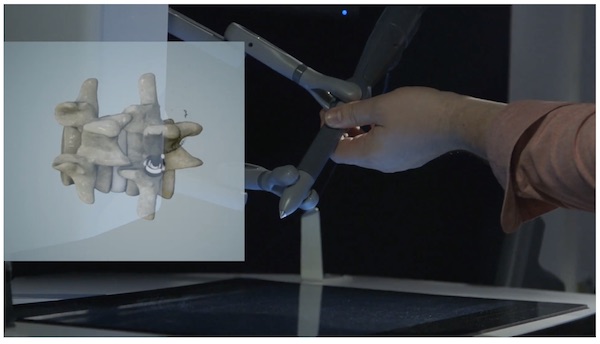

Then there is the medical application. From medical training to preparation and the performance of surgery, this field is full of opportunities for the AR/VR technology. Again, how do you measure the life of patients against cost of a VR headset? Training a surgeon in specific techniques is difficult and leads to very long training periods. If AR/VR technology can shorten these training times, the value would be very high indeed and can be easily measured in money.

In many professional applications there are two components that have to be evaluated in the cost / benefit analysis, monetary advantages or gains of time and accuracy that can be translated easily into money. There are also qualitative advantages that cannot be translated into money like improving the chances of success in military and medical procedures. Other applications may have different things to evaluate, but they will still fall into these two categories. This compares with the consumer market where there is no cost / benefit analysis – with success just based on the likes of people.

VR Medical Application

VR Medical Application

Then there are other reasons why professional applications provide a more exciting opportunity to many smaller AR/VR technology companies. Vuzix, for example, has been promoting professional applications before Google, Magic Leap, Oculus and HTC pushed the AR/VR idea for the consumer market. Sure, the consumer market offers a much larger opportunity for the new and upcoming AR/VR companies, but only if the adoption rate among consumers is fast enough to ensure a high number of unit sales.

This is somewhat of an issue for small companies; high unit numbers require high manufacturing capacity, which is something small start-up companies typically do not have. Using Asian workbenches is somewhat difficult for these companies if their market value are based on new and proprietary technology. Opening up the design to a third party for assembly and supply chain management is a tough pill to swallow. Larger brands typically do not have this issue. This is why many analysts are still betting on Apple entering the AR/VR market as the action thta will jump start the consumer market.

In addition, the larger the market opportunity, the larger the field of competitors and the higher the risk of failure.

So what makes the professional applications more attractive to AR/VR hardware and also software developers? As discussed above, lower unit numbers make it easier for smaller companies to fulfil market demands without releasing too much information about their freshly developed technology. But there are more reasons.

Professional applications have often more clearly defined requirements. These translate into specs that may make it easier to trade off one characteristic for another. For example, trading image resolution for field of view maybe easier to do in a medical training headset, than in a consumer headset that has to be excellent at both.

Another important aspect is content. If you buy a headset from Sony, you expect Sony to provide some content for this headset. This is definitely beyond the scope of small start-up companies. Even Apple offered only a few apps when they first released their iPhone. Of course they then came up with the App Store and rest is history. So what could a small company offer to consumers buying their headsets?

Of course, they all sell their first headsets as a ‘developer unit’ in the hope that one of these developers jumps on it and develops the ‘killer app’, which by the way still does not exist today. So far, this has not really panned out for AR/VR headsets in the way it worked for smartphones. One of the reasons may be the fact that the smartphone offered the same functionality as the then already well established cell phone, i.e. making phone calls. For those millennials out there, yes, you can still call someone on your smartphone. What basic functionality of an existing device does the AR/VR headset emulate?

In professional applications the content is often proprietary, taking the small hardware company out of the picture. Military applications will always be developed under the umbrella of secrecy; architectural applications will show the specific content for this one client, and so on. It makes it easier to sell hardware as a separate item from the content, a desirable situation for the hardware developer.

And then there is the price. Professional applications do not typically use a large number of units, which makes the cost benefit analysis much easier. Hardware prices in the thousand dollar range are much easier to achieve compared to consumer sales thriving to push the price below the impulse buy threshold, whatever that maybe.

On the other hand, lower volume production dictates higher prices, but for start-up companies higher volumes do not always translate into lower costs. There are investments necessary and a larger staff may drain the initial funding faster than expected.

With all this in mind, it is understandable that smaller companies may go after the professional applications first as a lower risk scenario. In the long run the larger companies will either buy them out or figure out a way to make a consumer device that succeed in making the optimal AR/VR device. By then the small players may have established themselves as a niche market player that can do things better than the consumer device for a specific market segment. (NH)