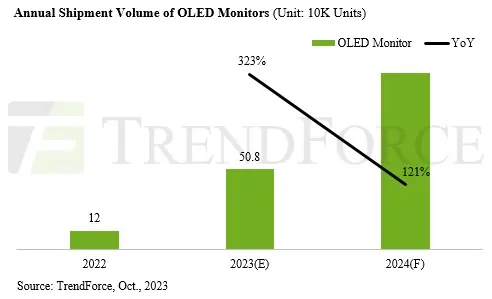

There is no doubting that the volumes are still relatively low in comparison to the total opportunity, but TrendForce is predicting a massive leap in shipments for OLED monitors in 2024. On the other hand, TrendForce is also predicting that notebooks, where volumes are significant, are also going to experience growth in 2024 but by single digit percentage points.

2023 is shaping up as a banner year for OLED monitors, with TrendForce data indicating shipments could reach an impressive 508,000 units, marking a 323% YoY increase. By 2024, a greater diversity in OLED product sizes and specifications is anticipated, especially with the introduction of 27-inch and 31.5-inch OLED panels. This influx of new products could propel shipments past the one million unit mark.

Samsung is gearing up for a significant boost in OLED monitor shipments in the second half of 2023, aiming for a 27% market share, similar to LG’s recent performance. Dell, on the other hand, is championing its 34-inch model in hopes of securing over 20% of the market. Asus, a recent entrant in the OLED sector, is targeting close to 9% market share for the year.

For 2023, 34-inch OLED monitors are projected to lead the market with a 37% share, while the 27-inch models are expected to claim 32%. They’re followed by 49-inch and 45-inch monitors with 14% and 10% market shares, respectively. As we look ahead to 2024, 27-inch monitors are slated to gain traction, especially with both Samsung Display and LG Display ramping up their 31.5-inch OLED production, potentially pushing its market share above 10%.

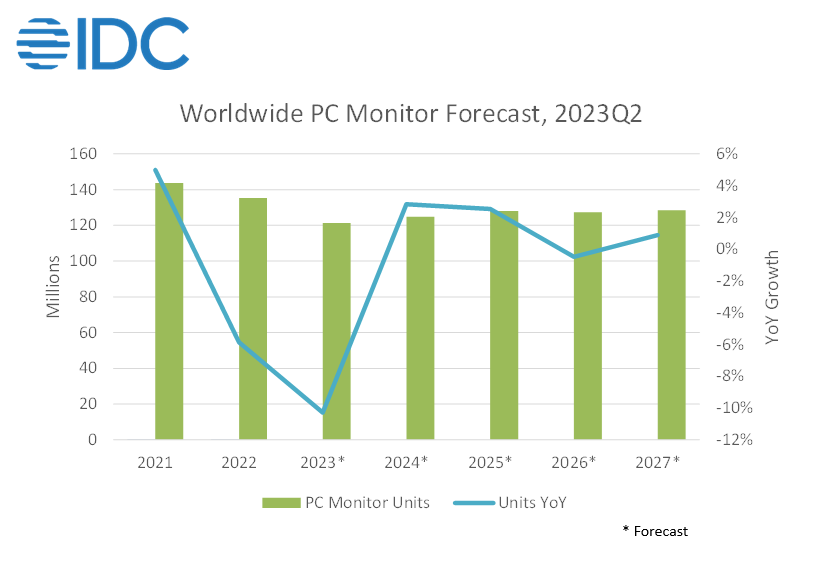

As a comparison, it is probably worth putting OLED monitor shipments in the context of the broader monitor market. OLED monitor shipments are still going to be a fraction of a percentage point of total worldwide monitor sales. The numbers from different market research firms don’t deviate much when it comes to PCs and notebooks and monitors. Forecasts you can take with a pinch of salt because, so far, the psychic network has not managed to infiltrate the ranks of IDC’s analysts to guarantee its prognostications, and analysts tend to always push a things-are-looking-up perspective because their clients need to go out with positive outlooks. So, will 2024 see an uptick in PC monitor sales? Maybe. Will it see growth in OLED monitor sales? From that small a base? Yes, it should happen.

Notebook Sales Face Uncertain Economic Headwinds

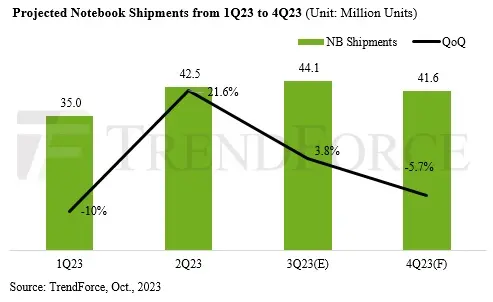

Shifting our attention to notebooks, TrendForce’s Q2 data highlighted a healthy stockpile inventory, with a pronounced preference for mid and low-tier models in both North America and the Asia-Pacific region. In a strategic move to capitalize on the back-to-school season, notebook shipments for Q2 peaked at 42.52 million units, a 21.6% quarterly increase. Shipments for the first half of the year totaled 77.5 million units, representing a 23.5% YoY decrease.

For the latter half of 2023, consumer purchasing power is the primary driver of growth, though the economic prospects in key notebook markets like the US and Europe are uncertain. This has softened the typical seasonal buying surge, leading to a projected 3.8% growth in Q3 notebook shipments, approximating 44.13 million units. By year’s end, notebook shipments are estimated at 163 million units, translating to a 12.2% YoY drop.

Moving towards 2024, there’s cautious optimism. While market stocks seem to be aligning positively and anticipated inflationary pressures appear to be steadying, global notebook shipments are only tentatively set for resurgence. TrendForce’s forecast pins the annual growth rate at 2–5% for 2024, slightly surpassing pre-pandemic figures. Still, the burden is on China and the US to lead this recovery.

Factors like muted seasonal market activity and soft demand have negatively impacted business profitability, complicating budget projections for the upcoming year. Additionally, with the ascent of AI and its infrastructure gaining precedence, IT spending may be redirected. As Windows 10 support is scheduled to conclude in October 2025, businesses are expected to begin device upgrades in 2024. Yet, TrendForce suggests that the demand for commercial notebooks might dampen any expected momentum, making significant expansion in shipments less likely.

Analyzing consumer demand, China faces economic and employment hurdles that could hinder market growth. The US, having experienced a demand surge in 2023, may see more moderate growth in 2024. Europe, after a two-year recalibration, might experience a resurgence in consumer demand, contingent on a more favorable economic atmosphere. Meanwhile, Southeast Asia, propelled by an expanding consumer base, predicts a modest uptick in device shipments.

The bigger issues is that the PC and notebook market has seen a few years of sales slowdowns and drops in demand. If there is a big upgrade cycle in 2024, for it to have significant impact on the supply chain, pushing prices and profits up, it would need to be around 10-15% growth from where it is today. That would not have been out of the realm of possibility a few years ago, but the notion of upgrade cycles is a little meaningless these days because we have no idea how the economy is going to shape up for any region. There have been predictions for the last three quarters about market recoveries in the third and fourth quarter of this year. Those predictions are being pushed out to 2024. Consumers don’t have the budgets to make the market, and businesses are not in any hurry to invest in equipment. It’s a bit of a vicious cycle.

The AI PC

Is there an AI PC savior that could help bring back double digit growth to the PC market? There are some analysts that think so. Certainly, the impact of AI, and the need to be competitive, is driving China’s strategic investments in the technology.

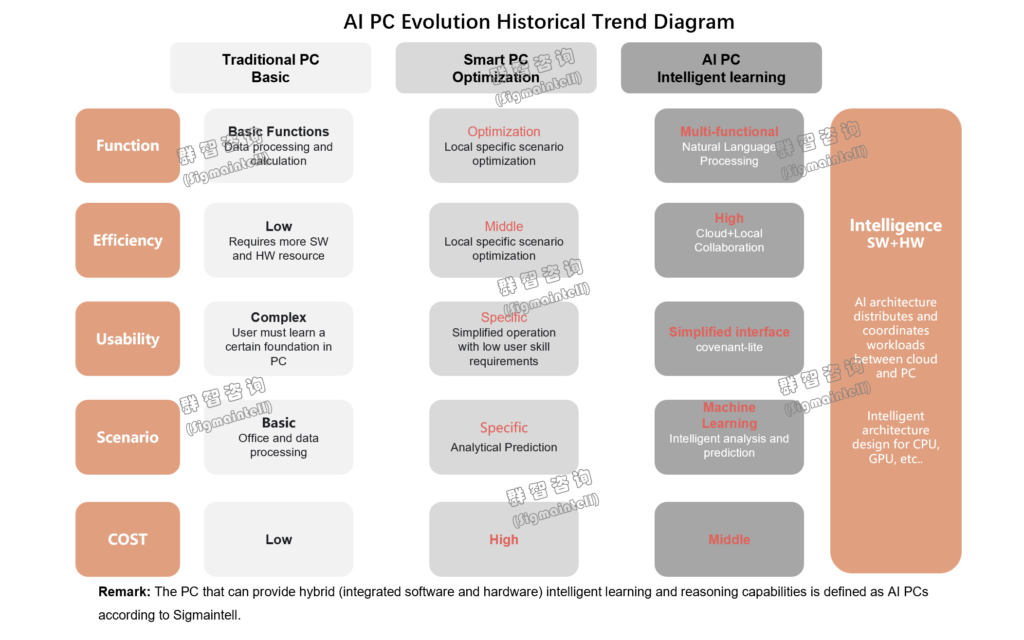

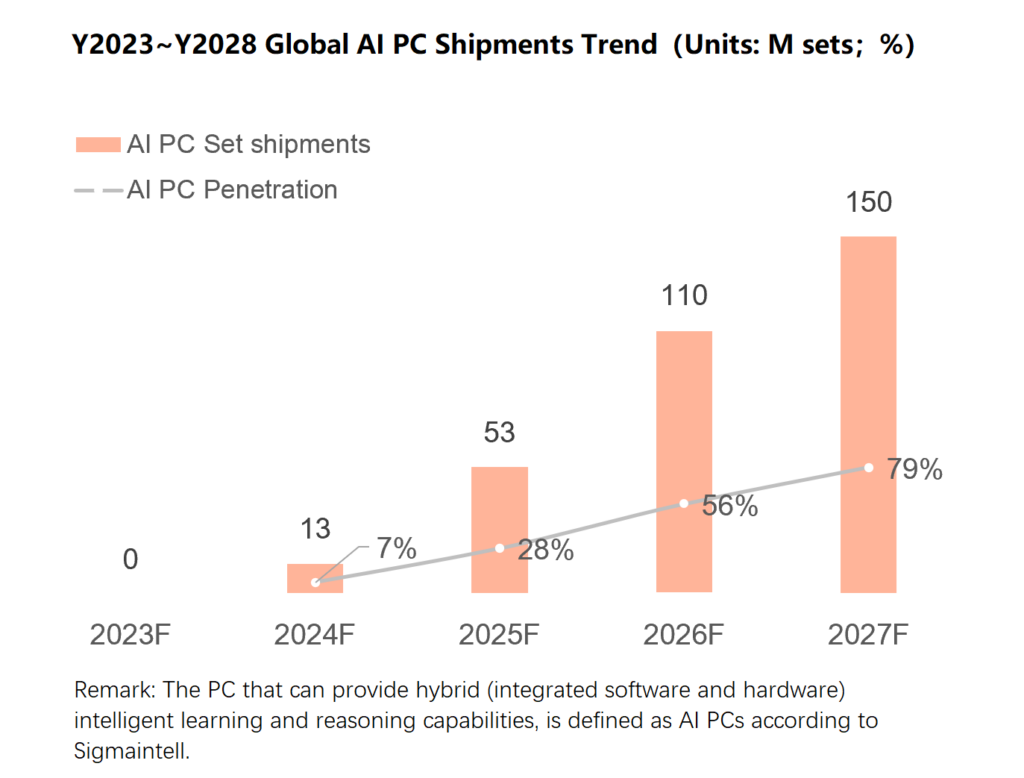

China’s Sigmaintell is predicting that 2024 will be the first year when we will begin to see AI-enable CPUs and, in combination with Windows 12, the first shipments of AI PCs.

Sigmaintell also sees the rise of AI PCs as changing the requirements for human-machine interaction, putting the burden on displays to do more than just provide primary display functions. That could be the inclusion of sensors and cameras under glass through to better power consumption, lower latencies, and higher resolutions to deal with the demands of richer, more dynamic computer interactions for all users. The fast twitch display is not just for gamers, at this point.

It’s an interesting take, and hard to argue against. The real challenge for AI PCs is how to make them more engaging, and more functional than traditional PCs, imbued with the powers of AI that they will be. That challenge is one that the display industry needs to run with, and according to Sigmaintell, at least, starting immediately.