PMA Research, the worldwide market information experts on large displays, have published their latest sell-through tracking report on large-format (32-inch and larger) flat panel displays being sold by leading U.S. AV, PC and IT Distributors who typically serve commercial markets.

Large-format display sales through U.S. distribution grew in May, rising 11% in volume and 17% in revenues when compared with April. Year-over-year showed the expected growth over pandemic-suppressed May 2020 with units and revenues up more than 30% and 40% respectively, when compared to last year. In fact, May 2021 display sales exceeded May 2019 sales by 5%, a positive sign that segments of the market are returning. Delayed purchases from pent-up demand are closing and shipping, despite continued product component shortages and challenging shipping and logistics issues.

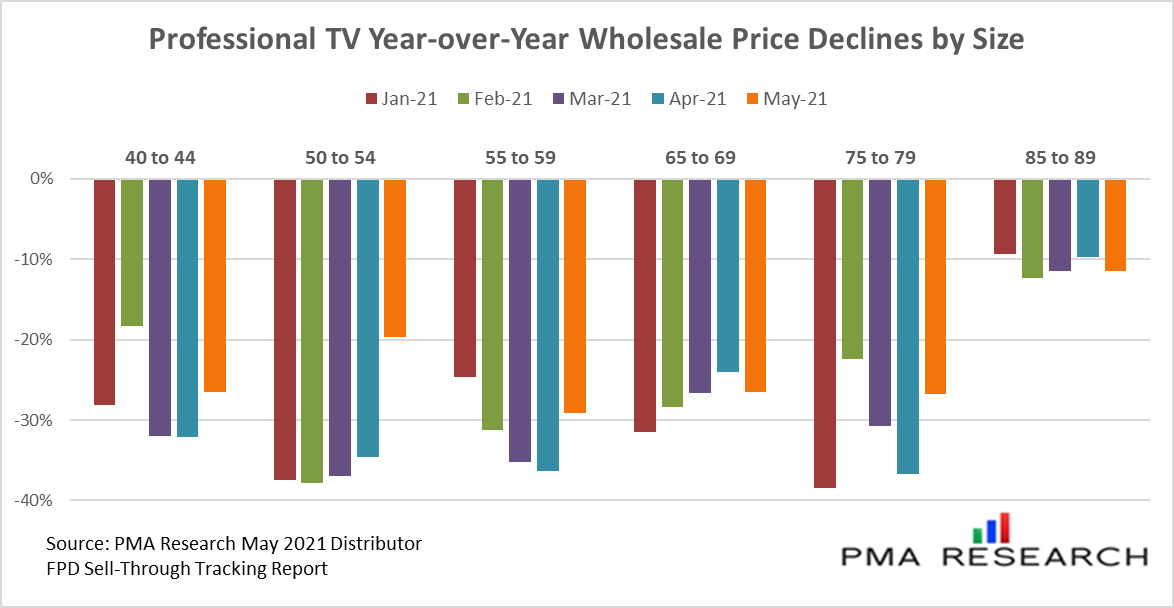

There were some notable product and pricing trends in May. In the consumer television segment unit sales were down 5% from last year. This decline was likely caused by a combination of rising prices for many types of televisions, paired with a shift in consumer spending to vacations and other entertainment, which have grown as vaccination rates rise and restrictions ease in the United States. Unlike consumer televisions, professional televisions with cheaper consumer LCD glass continued to sell briskly in distribution, doubling in sales volume in May compared with last year. Average prices for this specific product segment have dipped significantly in the last six months with some sizes dropping over 25% compared with prices just one year ago. This is counter to the trend for consumer televisions where prices have increased for LCD TVs in practically every size segment below 80-inches. However, this is likely to change as some manufacturers have announced price increases on their professional TV lines as recently as this week.

There were significant shifts in screen size mix in May too. Most notably, a four-point drop in the +70” segment. That is the largest drop in market share for this segment in the past 24 months. These shifts were more likely the result of supply constraints rather than an indication of shifts in demand. There was limited availability for some LCD glass sizes. Also shipping and logistics problems affected every size segment somewhat randomly. Next month could show an entirely different trend as logistics problems continue.

PMA’s monthly Flat Panel Distributor Tracking report offers timely sell-through data and analysis on unit sales and market trends of large-format displays sold by leading U.S. AV and IT Distributors. These reports are ideal for tracking product and channel trends.

About PMA Research

PMA Research (PMA) specializes in worldwide market information for the projector industry, including detailed and comprehensive coverage of High-End Projectors, Mainstream Projectors, and Pico Projectors. With a series of quarterly projector shipment and forecast reports along with monthly sales tracking, PMA publishes data-driven insights for projector manufacturers, component suppliers, accessory companies, and channel partners. Expanded coverage of the display industry includes market information on U.S. Professional Large-Format Flat Panel Displays. PMA’s Flat Panel Tracking Reports offer timely sell-through data and analysis on unit sales, revenues, and true volume-weighted selling prices of Professional Large-Format Flat Panel Displays sold by leading N. American dealers, systems integrators, and distributors.

PMA Research was formerly Pacific Media Associates, which was established by Dr. William Coggshall. Dr. Coggshall was a co-founder of Dataquest (now part of Gartner) and helped start the syndicated high-tech market information business. PMA Research has offices in the United States, Europe, and Asia.