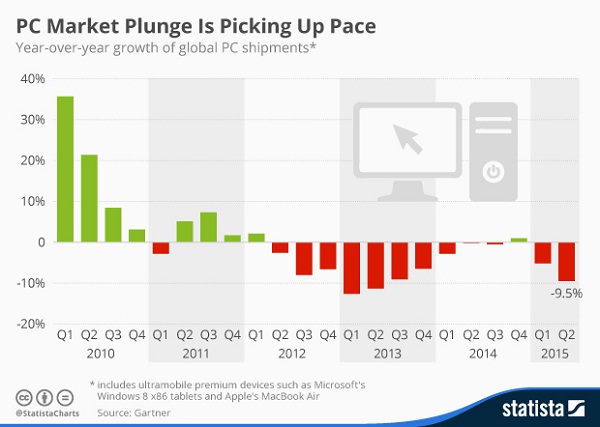

68.4 million PCs (including desktops, notebooks and convertibles) were shipped in Q2’15: down 9.5% YoY, according to Gartner, which is the steepest shipment fall in the industry since Q3’13. For the year as a whole, Gartner expects a 4.4% decline in PC shipments.

Although there were several factors contributing to the result, Gartner highlighted three in particular. Analysts noted that these are temporary growth inhibitors; they will not change the market’s overall structure. A return to slow and steady growth is expected in 2016.

“The price hike of PCs became more apparent in some regions due to a sharp appreciation of the US dollar against local currencies”, said principal analyst Mikako Kitagawa. “The price hike could hinder PC demand in these regions.

“Secondly, the worldwide PC market experienced unusually positive desk-based growth last year due to the end of Windows XP support. After the XP impact was phased out, there have not been any major growth drivers to stimulate a PC refresh. Lastly, the Windows 10 launch scheduled for Q3’15 has created self-regulated inventory control. PC vendors and the channels tried clearing inventory as much as possible before the Windows 10 launch”.

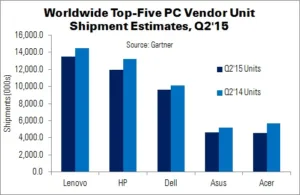

Statisa put this chart together using Gartner dataWorldwide, Lenovo held on to the top spot, but suffered a shipment fall for the first time since Q2’13. The company struggled in EMEA, Latin America and Japan. HP also experienced a shipment decline, after five consecutive quarters of growth. HP’s shipments were particularly hard-hit in EMEA – potentially due to local currency issues. Tight inventory controls in the consumer market, before the launch of Windows 10, are also thought to have had an impact.

Statisa put this chart together using Gartner dataWorldwide, Lenovo held on to the top spot, but suffered a shipment fall for the first time since Q2’13. The company struggled in EMEA, Latin America and Japan. HP also experienced a shipment decline, after five consecutive quarters of growth. HP’s shipments were particularly hard-hit in EMEA – potentially due to local currency issues. Tight inventory controls in the consumer market, before the launch of Windows 10, are also thought to have had an impact.

| Preliminary Worldwide PC Vendor Unit Shipment Estimates for Q2’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share | YoY Change |

| Lenovo | 13,456.9 | 14,440.4 | 19.7% | 19.1% | -6.8% |

| HP | 11,924.2 | 13,174.3 | 14.7% | 17.4% | -9.5% |

| Dell | 9,587.9 | 10,082.1 | 14.0% | 13.3% | -4.9% |

| Asus | 4,652.6 | 5,183.0 | 6.8% | 6.9% | -10.2% |

| Acer | 4,558.0 | 5,710.6 | 6.7% | 7.6% | -20.2% |

| Others | 24,220.7 | 26,978.4 | 35.4% | 35.7% | -10.2% |

| Total | 68,400.3 | 75,568.8 | 100.0% | 100.0% | -9.5% |

| Source: Gartner | |||||

Dell’s shipments fell for the second consecutive quarter. The company decline in EMEA was ‘relatively moderate’ compared to Lenovo and HP. Gartner expects this to be due to Dell’s smaller consumer presence, meaning that inventory control pre-Windows 10 has had less of an impact.

By region, PC shipments reached 15.1 million in the USA (-5.8%), 18.6 million in EMEA (-15.7%) and 24.2 million in APAC (-2.9%).

In the USA, the decline was led by a double-digit fall in desktop PC shipments, which offset the single-digit growth of mobile PCs. Gartner estimates the desktop fall to have been the sharpest since 2009. Q2’15 shipments also suffered from a poor YoY comparison to Q2’14, when Windows XP replacements were ongoing.

This was the fifth consecutive quarter of mobile PC growth in the USA, despite Windows 10 inventory controls. Affordable thin and light notebooks are beginning to attract more interest in the enterprise sector. HP led the US market, despite a 10.1% YoY fall. Dell closed in on the market leader, but Lenovo was the only top-five vendor showing YoY growth.

In Europe, vendors spent much of the quarter trying to manage high inventory levels. Promotions, forcing them to absorb lower margins, were used as one inventory-clearing strategy. Gartner believes that vendors will see better sell-in into the channel in Q3’15, due to new Windows 10-based devices.

Both desktop and mobile PCs fell in APAC. Shipments in China are estimated to have fallen 4%, as consumer demand remains weak.

Analyst Comment

IDC recorded a steeper decline, saying that shipments fell 11.8% YoY to 66.1 million units. Vendor rankings were much the same, with Lenovo, HP and Dell taking the top three spots. However, Apple – which was not present in Gartner’s figures – came in at fourth place in IDC’s, followed by Acer and Asus. Neither company includes tablets in their PC results.

Aside from the vendor differences, conclusions were much the same. Both companies said that the factors keeping growth low were temporary. The PC market will stabilise “in future years”, said IDC’s Loren Loverde. (TA)