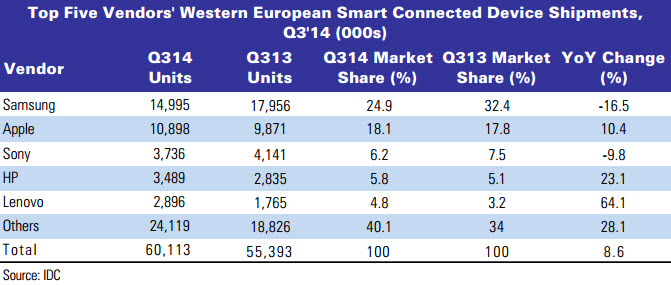

Increased PC demand was the main driver for smart connected devices (SCDs) in Western Europe in Q3, which posted another period of growth. IDC’s data shows that PC, tablet and smartphone shipments totalled 60.1 million – an 8.6% YoY rise.

As in Q2’14, PC shipments continued to rise, with demand moving to desktops and portables; this follows several years of delayed renewals and low-end consumer portable PCs driving growth. PC renewals slowed in the commercial space, due to XP replacements winding down; however, back-to-school purchases and preparations for Christmas sales boosted demand. Lower price points and attractive products also played a part. A 26.3% YoY rise was seen in this sector. Sell-in of low-end ‘Windows 8.1 with Bing’ units are expected to drive volume during the Christmas season.

Tablets continued to contract as the replacement cycle is longer than initially thought, reaching a plateau. Small tablets suffered from phablet demand, while the overall market was impacted by aggressively-priced Windows 8.1 with Bing portable. Despite low growth rates this year, IDC expects the tablet market to perform well in 2015. Continued price erosion and innovation will drive demand. The commercial segment, it is thought, will also improve, driven by hybrid demand. These devices posted 46.4% growth in Q3.

Smartphones were up 6.1%, largely due to the increased availability of affordable models and spread of 4G networks. The market is very competitive, although new vendors targeting the low-end have entered. ASPs were down 5.5% to $433, and are expected to fall to $317 by 2018.

Vendor rankings were unchanged. Samsung and Apple continued to lead thanks to large smartphone volumes (despite a fall of 16.7% for Samsung) and (for Apple) new product launches. Apple’s smartphone share rose to 17.1%. The company also led in tablets, despite a 15.9% volume decline YoY. Samsung held second place (volumes down 2.7%).

In PCs, HP remained the leader, followed by Lenovo and Acer. Sony and Samsung are no longer present in the top 10, due to their withdrawal from the European market (Display Monitor Vol 21 Nos 6 & 38).