Gartner and IDC have released their PC shipment data for Q4’15. Shipments are thought to have fallen to 8.6% YoY, to 75.7 million (Gartner) or 10.6%, to 71.9 million (IDC). We cover the Gartner results in detail below.

Total shipments for 2015 reached 288.7 million units, an 8% YoY decline. Q4 was the fifth consecutive quarter of falling shipments worldwide. End-of-year sales failed to boost the overall market, hinting at changes to consumers’ PC purchasing behaviour. Windows 10 received generally positive reviews from businesses, but migration was minor as many firms were only beginning their testing periods in Q4.

Mikako Kitagawa of Gartner said that all regions registered a decline in shipments. Currency devaluations continued to affect EMEA, LATAM and Japan, which collectively saw shipments fall almost 10% YoY.

The outlook for 2016 is a decline of 1% YoY, although there is potential for a soft recovery later in the year.

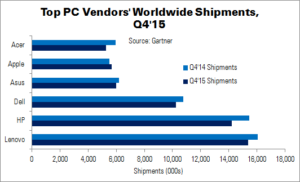

Market leader Lenovo registered a 4.2% shipment decline – its third consecutive quarter of lower shipments. However, this was a smaller fall than the industry average, and the company extended its lead. Lenovo had a 20.3% share of the worldwide market in Q4, performing particularly well in North America.

HP was in second place, also facing declining shipments worldwide. Its regional performance was mostly the same as or better than the regional average, aside from in the USA. A steep decline here was partly due to a poor YoY comparison; HP shipped many low-cost ‘Windows with Bing’ notebooks in Q4’14.

Dell’s shipments were down in all regions except Japan, where the company achieved single-digit Yoy growth. The company’s decline in the USA and EMEA was lower than the regional average.

| Preliminary Worldwide PC Vendor Unit Shipment Estimates for Q4’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’15 Shipments | Q4’14 Shipments | Q4’15 Share | Q4’14 Share | YoY Change |

| Lenovo | 15,384 | 16,061 | 20.3% | 19.4% | -4.2% |

| HP | 14,206 | 15,452 | 18.8% | 18.7% | -8.1% |

| Dell | 10,236 | 10,783 | 13.5% | 13.1% | -5.1% |

| Asus | 6,002 | 6,201 | 7.9% | 7.5% | -3.2% |

| Apple | 5,675 | 5,519 | 7.5% | 6.7% | 2.8% |

| Acer | 5,277 | 5,939 | 7.0% | 7.2% | -11.2% |

| Others | 18,940 | 22,635 | 25.0% | 27.4% | -16.3% |

| Total | 75,720 | 82,590 | 100.0% | 100.0% | -8.3% |

| Source: Gartner | |||||

Regional Performance

PC shipments in the US market totalled 16.9 million units in Q4’15: a 3.1% fall. Despite an 8.4% decline, HP retained its market leading position with a 27.1% share in Q4. Dell remained in second place, with a lower-than-average decline (-1.5%) and 24.5% share.

Holiday sales had a limited impact on the US market. Notebooks fell from the top of the wishlist, and there were few ‘mega deals’ for such items. Consumer interest moved to other items, such as TVs and wearables.

EMEA shipments were 22.5 million units, down 16% YoY. Some countries in Western Europe had solid Windows 10 promotions in Q4, and French shipments performed well. Overall, though, high inventory levels affected the sub-region. In Eastern Europe, the market experienced low-single-digit growth, driven by consumer demand for convertibles and PC replacements to move to Windows 10.

26 million PCs were shipped in APAC: a 1.5% fall. Windows 10 failed to cause a rush on PC shipments, and vendors sought profitability over volume. They focused on segments such as gaming PCs; bundled desktops and large monitors; and ultrabooks. Gartner’s preliminary results indicate a 4.7% decline in the Chinese PC market.

2015 was the fourth consecutive year in which PC shipments fell; a trend that began with the launch of mainstream consumer tablets in 2012. Local currency devaluation also played a role, especially in EMEA, LATAM and Japan. In contrast, the USA and APAC regions experienced minor declines.

The top six vendors accounted for 73.1% of the worldwide PC market in 2015, up from 70.4% in 2014. Lenovo retained the lead (19.8%) in the top three, followed by HP (18.2%) and Dell (13.6%).

| Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2015 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Shipments | 2014 Shipments | 2015 Share | 2014 Share | YoY Change |

| Lenovo | 57,123 | 58,956 | 19.8% | 18.8% | -3.1% |

| HP | 52,551 | 54,996 | 18.2% | 17.5% | -4.4% |

| Dell | 39,159 | 40,499 | 13.6% | 12.9% | -3.3% |

| Asus | 21,198 | 22,671 | 7.3% | 7.2% | -6.5% |

| Apple | 20,741 | 19,598 | 7.2% | 6.2% | 5.8% |

| Acer | 20,340 | 24,015 | 7.0% | 7.7% | -15.3% |

| Others | 77,624 | 92,945 | 26.9% | 29.6% | -19.7% |

| Total | 288,735 | 313,681 | 100.0% | 100.0% | -8.0% |

| Source: Gartner | |||||

Analyst Comment

IDC notes that 2015 was the first year since 2008 in which PC shipments were sub-300 million units, with a decline of 9.8%. Longer PC lifecycles, competing products and economic issues were the main factors constraining the market. 2015 also compared poorly to 2014, when the end of Windows XP support boosted shipments.

Adding detachable tablets to PC shipments would add around 6 percentage points to the Q4’15 results (-5%), and 3 points to 2015 (-7.5%). These devices are growing quickly, but from a small base. Their impact will be larger in 2016 as volume grows, boosting growth forecasts from a 3.1% fall to growth of 1%-2%.

Worldwide, IDC says that Lenovo (21.4%) led the market in Q4, followed by HP (19.9%), Dell (14.1%), Asus (7.9%) and Apple (7.9%) (both Gartner and IDC agree that there was an effective tie between these two companies’ shipments). (TA)

After publication, we got this nice chart from Statista. (BR)

You will find more statistics at Statista