Global TV shipments came in flat year-on-year at 61.5 million units in the fourth quarter of 2025, masking a dramatic regional reshuffling underneath the headline number. Data from Omdia’s TV Sets Market Tracker for 4Q25 shows that a 25.3% collapse in Chinese domestic shipments was absorbed almost entirely by accelerating demand across developing markets and continued steady growth in mature Western ones.

The China decline was not a surprise to those who have been tracking the market closely. Government subsidy programs that had pulled forward consumer upgrades throughout 2024 and into early 2025 ran their course, and the resulting hangover was sharp. With that demand borrowed from the future now exhausted, Chinese brands faced the classic post-stimulus correction at home, just as macroeconomic headwinds were already weighing on consumer spending. What was notable, however, was how quickly and effectively the major Chinese brands redirected their commercial firepower.

Regional Divergence Sharpens

The quarter’s data draws a clear line between markets on the way up and the one market in structural retreat, at least for now.

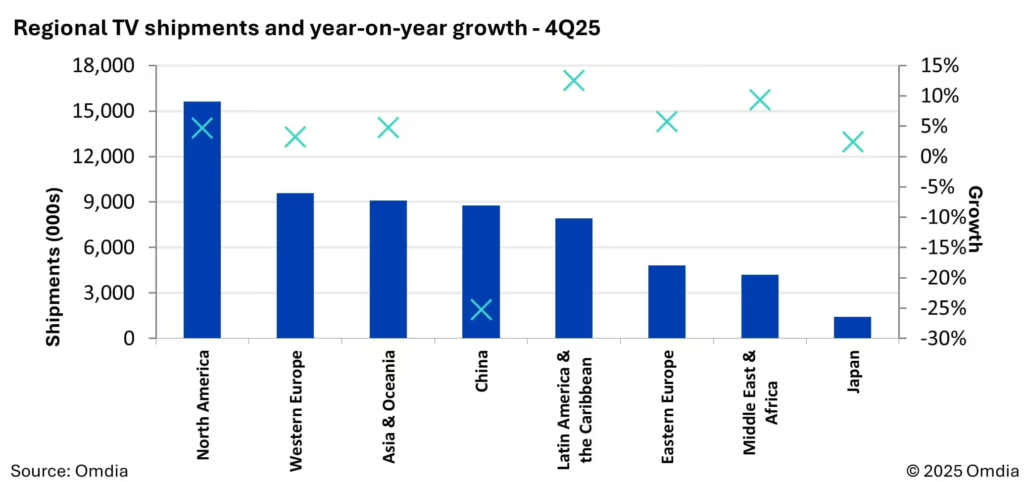

North America grew 4.7% year-on-year, and Western Europe expanded 3.2%. Both are respectable results for mature markets in a consumer electronics category that has long struggled to find organic growth drivers. The stronger performances came from the developing world, where Latin America and the Caribbean posted 12.5% growth and the Middle East and Africa climbed 9.4%, numbers that reflect genuine demand expansion rather than statistical noise.

The regional shift was significant enough to redraw the rankings. Western Europe moved into second place globally for the quarter, with Asia and Oceania in third, after both regions overtook China, a position China had held comfortably for years.

In North America, the picture is more nuanced. Shipments were up, but sell-through during the critical holiday period underperformed expectations. The result is elevated inventory heading into Q1 2026, a condition that typically pressures pricing and margins in the months that follow.

TCL and Hisense Execute the Pivot

Despite the sharp domestic contraction, TCL and Hisense together grew combined shipments by 2.2% year-on-year. Their combined share of North American shipments rose from 28.6% to 30.7%, even as compliance requirements in the US market have become more demanding.

Matthew Rubin, Principal Analyst for TV Set Research at Omdia, framed the situation directly: “Chinese brands have shown strong agility in their growth strategies over the past year. Accessing the US market is more challenging now, but both TCL and Hisense have adjusted supply chains to meet new requirements. That flexibility comes with added cost, and profitability is becoming a bigger priority, particularly as component costs such as memory rise.”

The supply chain adjustment point deserves attention. Adapting logistics and sourcing to satisfy US compliance requirements is not a trivial undertaking, and doing it while simultaneously absorbing rising memory costs narrows the margin for error considerably. The bet both brands are making is that American appetite for XXL-size TVs will remain durable enough to justify the added cost structure.

The Premium Technology Contest

The broader strategic question hanging over the industry is which technology owns the premium segment, and on that front the quarter’s data is genuinely interesting.

OLED shipments grew 8.6% year-on-year globally in Q4 2025. Western Europe, the world’s largest OLED TV market, was up 11.5%, reinforcing the technology’s position as the preferred choice for high-spending European consumers. OLED’s per-pixel light control and established brand equity in premium retail channels continue to make it a compelling proposition for panel makers and set brands alike.

At the same time, the competitive pressure from MiniLED is intensifying at exactly the price points where OLED has historically been most secure. CES 2026 made this plain, with TCL putting MiniLED paired with enhanced Quantum Dot technology at the center of its 2026 lineup. Both TCL and Hisense are positioning MiniLED not as a budget alternative to OLED, but as a premium-tier offering in its own right, leaning into the brightness and color volume advantages the technology provides.

The next 18 months will be a meaningful test of whether RGB MiniLED can close the image quality gap convincingly enough to shift purchasing decisions at the high end of the market. Panel costs, content ecosystem support, and retail display real estate will all factor into that outcome. The shipment data from early 2026 will tell a clearer story, but the battle lines are already drawn.