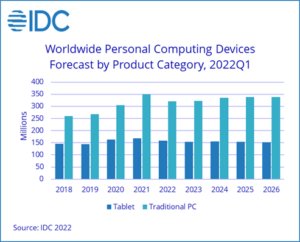

Headwinds from lockdowns, war, and inflation are the leading factors behind slowing demand for PCs and tablets. According to a new forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker, global shipments of traditional PCs will fall 8.2% year over year in 2022 to 321.2 million units. Similarly, the forecast for worldwide tablet shipments has been lowered to 158 million units, a 6.2% decline compared to 2021.

Despite the lower forecast for 2022, PC shipments are expected to remain well above pre-pandemic levels as upcoming device refreshes, robust commercial demand, and uptake within emerging markets continue to be drivers for the industry. And IDC expects shipments to return to positive annual growth in 2023 and beyond, although this year’s decline will result in a five-year compound annual growth rate (CAGR) of -0.6%. Meanwhile, tablets face a larger decline over the same period as competition from PCs as well as smartphones will continue to inhibit growth, leading to a -2.0% CAGR.

“Supply shortages have plagued the industry for a while and the recent lockdowns in parts of China continue to exacerbate the issue as factories struggle to receive new components from upstream suppliers while also facing issues downstream when it comes to shipping finished goods,” said Jitesh Ubrani, research manager for IDC Mobility and Consumer Device Trackers. “While the restrictions are expected to ease soon, worker sentiment within the supply chain remains muted, and backlogs of deliveries will persist for the remainder of the year.”

“On top of the compounding issues related to the pandemic, we have now added war, inflation, and on-going China lockdowns to the equation,” said Ryan Reith, group vice president with IDC’s Worldwide Mobile Device Trackers. “Our research continues to show strong demand and supply activity aimed at the commercial PC market, but the consumer and education markets are seeing increasing concerns and, as a result, reduced orders. The reduction in the most recent forecast was significant for many reasons, and the uncertainty remains high.”

Worldwide Personal Computing Device Forecast by Product Category, Shipments, Year-Over-Year Growth, and 2021-2026 CAGR (shipments in millions) |

|||||

Product Category |

2022 Shipments |

2022/2021 Growth |

2026 Shipments |

2026/2025 Growth |

2021-2026 CAGR |

|

Traditional PCs |

321.2 |

-8.2% |

339.0 |

+0.1% |

-0.6% |

|

Tablets |

158.0 |

-6.2% |

152.5 |

-0.7% |

-2.0% |

|

Source: IDC Worldwide Personal Computing Device Tracker, June 8, 2022 |

|||||

Notes:

– Some IDC estimates prior to financial earnings reports. Data for all companies are reported for calendar periods.

– Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.

– Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release.