Global shipments of traditional PCs, including desktops, notebooks, and workstations, grew 55.2% year over year during the first quarter of 2021 (1Q21), according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

While PCs remain in extremely high demand, the growth rate benefitted from the shortages faced in the first quarter of 2020 when the global pandemic began, resulting in an unusually favorable year-over-year comparison. PC shipments reached 84 million worldwide in 1Q21, a modest 8% decline from the fourth quarter of 2020. While sequential declines are typical for the first quarter, a decline this small has not been seen since the first quarter of 2012 when the PC market declined 7.5% sequentially.

“Unfulfilled demand from the past year has carried forward into the first quarter and additional demand brought on by the pandemic has also continued to drive volume,” said Jitesh Ubrani research manager for IDC’s Mobile Device Trackers. “However, the market continues to struggle with setbacks including component shortages and logistics issues, each of which has contributed to an increase in average selling prices.”

The continued resurgence in the PC market as well as increases in average selling prices (ASPs) have primarily been driven by growth in gaming, the need for higher performance notebooks in the enterprise, and an increase in demand for touchscreens within the education segment.

“There is no question when entering 2021 the backlog for PCs was extensive across business, consumer, and education,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “The ongoing shortages in the semiconductor space only further prolong the ability for vendors to refill inventory and fulfill orders to customers. We believe a fundamental shift has occurred around the PC, which will result in a more positive outlook for years to follow. All three segments – business, education, and consumer – are experiencing demand that we didn’t expect to happen regardless of many countries beginning their ‘opening up’ process. Component shortages will likely be a topic of conversation for the majority of 2021, but the more important question should be what PC demand will look like in 2-3 years.”

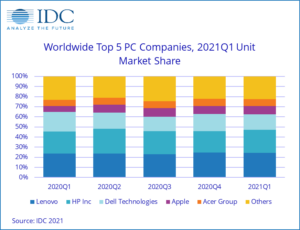

Top 5 Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (Preliminary results, shipments are in thousands of units) |

|||||

|

Company |

1Q21 Shipments |

1Q21 Market Share |

1Q20 Shipments |

1Q20 Market Share |

1Q21/1Q20 Growth |

|

1. Lenovo |

20,401 |

24.3% |

12,826 |

23.7% |

59.1% |

|

2. HP Inc. |

19,237 |

22.9% |

11,722 |

21.7% |

64.1% |

|

3. Dell Technologies |

12,946 |

15.4% |

10,495 |

19.4% |

23.4% |

|

4. Apple |

6,692 |

8.0% |

3,164 |

5.8% |

111.5% |

|

5. Acer Group |

5,837 |

7.0% |

3,364 |

6.2% |

73.5% |

|

Others |

18,868 |

22.5% |

12,552 |

23.2% |

50.3% |

|

Total |

83,981 |

100.0% |

54,123 |

100.0% |

55.2% |

|

Source: IDC Quarterly Personal Computing Device Tracker, April 9, 2021 |

|||||

Notes:

-

Some IDC estimates prior to financial earnings reports. Data for all companies are reported for calendar periods.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.

-

Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release.