PC shipments fell to 71.7 million units in Q1’15, representing a 5.2% YoY decline, according to numbers from Gartner.

The replacement cycle, which was boosted by XP renewals last year, is now returning to pre-2014 levels. “However, this decline is not necessarily a sign of sluggish overall PC sales long term”, said Gartner’s Mikako Kitagawa. Mobile PCs (including notebooks, hybrids and Windows tablets – Gartner does not cover Chromebooks, sub-10″ Windows tablets and non-Windows tablets in its PC data) were up compared to Q1’14.

The results are in-line with forecasts of a modest decline in PC shipments this year – but one that will lead to a slow, consistent growth stage for the next five years.

Desktop PCs, especially those used for business, declined rapidly in Q1. Mobile models, however, are being driven by a separate replacement cycle, which led growth over the period. Going forward, PC replacements will be driven by thin and light designs with tablet functionality. Gartner’s early data suggests strong growth of hybrid models, especially in mature markets, in Q1.

| Preliminary Worldwide PC Vendor Shipment Estimates, Q1’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

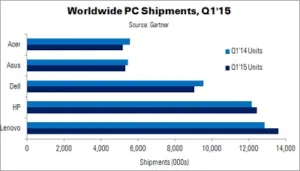

| Lenovo | 13,584 | 12,846 | 18.9% | 17.0% | 5.7% |

| HP | 12,442 | 12,143 | 17.3% | 16.0% | 2.5% |

| Dell | 9,038 | 9,527 | 12.6% | 12.6% | -5.1% |

| Asus | 5,306 | 5,462 | 7.4% | 7.2% | -2.9% |

| Acer | 5,183 | 5,562 | 7.2% | 7.3% | -6.8% |

| Others | 26,179 | 30,153 | 36.5% | 39.8% | -13.2% |

| Total | 71,733 | 75,694 | 100.0% | 100.0% | -5.2% |

| Source: Gartner | |||||

Only HP and Lenovo achieved shipment growth in Q1. Lenovo experienced its best-ever result in EMEA and the USA, and has become one of the world’s leading producers of hybrid notebooks. HP performed moderately well and retained its top position in the USA and EMEA. The company increased its US share, but the gap between it and second-place Lenovo narrowed in EMEA.

Dell’s shipments fell YoY, for the first time in six quarters. The company benefited from XP replacements last year, but sales have slowed as the replacement cycle faded.

Shipments in the USA reached 13.9 million units in Q1’15, down 1.3% YoY. This was the first shipment decline in the region for four quarters. However, this is “not a sign of doom”, said Kitagawa. The largest reason for the fall was the double-digit decline in the desktop market, primarily due to slowing XP replacements. Mobile PCs, however, continued to grow. Early results show that US mobile models could have grown 10% in Q1.

HP extended its lead in the USA, taking a 26.1% market share. Lenovo and Asus showed the strongest growth, rising 13.5% and 10.8%, respectively.

EMEA PC shipments were down 4.4% YoY, to 21.7 million units. Trends varied across the region, but a bright spot was strong shipments of hybrid notebooks, leading consumer mobile PC growth. Desktop shipments fell rapidly. Overall, the devaluation of the euro against the dollar had a limited impact in Q1, but prices are expected to rise in Q2.

APAC PC shipments passed 24.3 million units, down 1.2% YoY. The overall regional average continued to be ‘dragged down’ by the China market, where both consumer and commercial segments are acting cautiously in PC purchases. Desktop PCs were down 5.2% in APAC in Q1, but mobile PCs grew 3.7%.

Analyst Comments

IDC’s numbers were lower than Gartner’s, and recorded a 6.7% YoY fall in Q1 following the strong second half of 2014. The firm estimates that shipments fell to sub-69 million units; their lowest since Q1’09. Windows 10 is expected to act as another release for pent-up PC demand later this year – a factor that Gartner did not comment on.

Shipments in the USA (14.2 million, down 1%) fell slower than the rest of the worldwide region, with vendor strength, emerging product adoption, an improving consumer market and rising economy all getting a nod as positive factors. Growth was centred on portables, such as Chromebooks and Windows 8.1 With Bing models.

EMEA shipments were down. Vendors focused on depleting inventory build-up of Windows 8.1 With Bing models from Q4’14. There was a rise in ASPs and fall in shipments due to the end of promotions for 15″ Bing units and unfavourable exchange rates, which led to rising component prices.

APAC volume was close to expectations, with the China market holding back the rest of the region. Japan – a separate region in IDC’s results – saw shipments fall a massive 44%, although this was only slightly worse than forecast.

Worldwide, shipments were led by Lenovo (13.4 million, up 3.4%), followed by HP (13 million, 3.3% growth), Dell (9.2 million, down 6.3% – the first negative quarter since Q2’13), Acer (4.8 million, down 7%) and Asus (4.8 million, 4.4%).