Well over a year after the emergence of COVID-19 and global lockdowns, PC monitor shipments continue to show strong growth as the pandemic has drastically altered a formerly staid market.

According to the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker, worldwide shipments were just over 35 million units in the second calendar quarter of 2021 (2Q21), growing 11.2% over the same quarter a year ago (2Q20) – the first full quarter when COVID-19 lockdowns were in full force.

Along with solid demand, the same pressures that contributed to strong results in previous quarters were still in play during 2Q21. Supply was constrained by challenges that affected much of the electronics industry at large. Components, especially ICs that go into display panels, remained tight and limited monitor availability. Rising transportation costs and logistical challenges also led some markets to accrue further backlogs. These factors led to some price hikes in an overall strong quarter as buyers sought to fulfill urgent demand and hedge against expected future shortages.

Company Highlights

Commercial shipments took a smaller share of the overall market in the second quarter compared to a year ago, highlighting a still tenuous business segment that is more focused on procuring PCs amidst some recovery in office occupancy. Home users and gaming monitors drove much of the demand in 2Q21, which benefited the consumer-focused and lower-tiered vendors. Vendors who rank below the top 5 collectively captured almost 36% of market share, achieving a gain compared to their 32.2% share from a year ago.

|

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Q2 2021 (shipments are in thousands of units) |

|||||

|

Company |

2Q21 Shipments |

2Q21 Market Share |

2Q20 Shipments |

2Q20 Market Share |

2Q21/2Q20 Growth |

|

1. Dell Technologies |

7,549 |

21.5% |

6,365 |

20.2% |

+18.6% |

|

2. Lenovo |

4,164 |

11.9% |

3,080 |

9.8% |

+35.2% |

|

3. TPV |

3,712 |

10.6% |

4,919 |

15.6% |

-24.5% |

|

4. HP Inc. |

3,543 |

10.1% |

4,514 |

14.3% |

-21.5% |

|

5. Samsung |

3,537 |

10.1% |

2,500 |

7.9% |

+41.5% |

|

Others |

12,569 |

35.8% |

10,168 |

32.2% |

+23.6% |

|

Total |

35,074 |

100.0% |

31,547 |

100.0% |

+11.2% |

|

Source: IDC Quarterly PC Monitor Tracker, September 2021 |

|||||

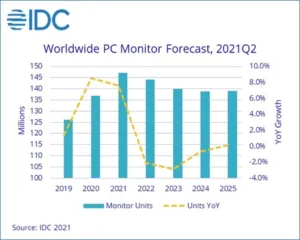

Looking ahead, IDC expects to see some stabilization in monitor component pricing as demand levels off and component shortages ease in the second half of this year. Shipments are expected to reach a peak in 2021 at just over 147 million units, which is the highest volume since 2012. Volumes are forecast to then taper off in subsequent years settling at 139 million by 2025.

“The second quarter capped five consecutive quarters of positive year-on-year growth, four quarters of which were growth in the double digits. Such momentum has never been seen in the history of our monitor coverage,” said Jay Chou, research manager for IDC’s Worldwide Quarterly PC Monitor Tracker. “However, we believe the market will soon reach an inflection point. Demand will begin to cool in the latter half of 2021, with small declines in 2022 thru 2024. Nonetheless, long-term assumptions have already shifted for the better compared to pre-COVID times as location-agnostic modes of work/study become more popular, thus enlarging the installed base.”