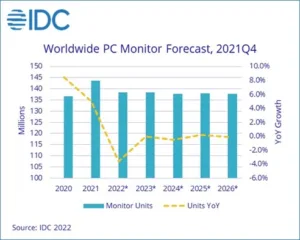

The global PC monitor market continued its quarterly decline in the fourth quarter of 2021 (4Q21) with unit shipments shrinking 5.2% compared to the same quarter in 2020. Despite a challenging second half of the year, the market still exceeded expectations and ended 2021 with a 5.0% year-over-year growth rate, according to the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker.

With 143.6 million units shipped globally, 2021 also stood as the best performing year since 2012, when volume was 150.3 million. A weaker second half in 2021 brought down the strong momentum of the first half, which had an impressive year-over-year growth rate of 19.4%. Challenges seen in the third quarter persisted in the holiday quarter. Although mature regions slowed, volume was buttressed by emerging markets catching up on backlogs while global commercial volume helped to offset a softer consumer base. However, even as monitor component supplies improved to some degree, persistent challenges from high shipping rates and Asian supply chain lockdowns remained. These challenges that defined the latter half of the year are expected to play well into 2022 and will lead to a 3.6% year-over-year decline in 2022.

“2021 marked the end of the longest run for monitors, which saw an uninterrupted growth spurt from 2018 to 2021,” said Jay Chou, research manager for IDC’s Worldwide Client Devices Trackers. “Whether it was businesses refreshing PCs and monitors as they moved towards Windows 10 or the pandemic pivot towards work from home, these developments gave a much-needed boost to what had been a staid industry. However, we now see growing saturation, inflationary pressures from the pandemic and the Ukrainian crisis further accelerating an already cooling environment in 2022, when we expect monitor shipments to shrink 3.6% and then stabilize after.”

Company Highlights

Dell and Lenovo emerged as the only two companies in the Top 5 to deliver shipment growth in 4Q21. Although overall commercial shipments declined 2.2% year over year in the fourth quarter, the commercial portion of the market proved more resilient as it has throughout the year, showing only modest losses in the second half of 2021 as return-to-office trends continued to gain ground. Companies that had better control of their supply chain or a stronger presence in emerging markets fared better. Dell and Lenovo both outgrew the market and registered upper single digit year-over-year growth. Lenovo also overtook HP as the number 2 vendor for the quarter. Consumer-focused vendors suffered even more as the total consumer monitor market shrank more than 8% year over year.

|

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Q4 2021 (shipments in thousands of units) |

|||||

|

Company |

4Q21 Shipments |

4Q21 Market Share |

4Q20 Shipments |

4Q20 Market Share |

4Q21/4Q20 Growth |

|

1. Dell Technologies |

8,236 |

22.1% |

7,686 |

19.5% |

+7.2% |

|

2. Lenovo |

4,835 |

13.0% |

4,547 |

11.5% |

+6.3% |

|

3. HP Inc |

4,000 |

10.7% |

4,980 |

12.7% |

-19.7% |

|

4. TPV |

3,926 |

10.5% |

4,759 |

12.1% |

-17.5% |

|

5. Samsung |

3,278 |

8.8% |

3,839 |

9.7% |

-14.6% |

|

Others |

13,043 |

35.0% |

13,560 |

34.4% |

-3.8% |

|

Total |

37,317 |

100.0% |

39,371 |

100.0% |

-5.2% |

|

Source: IDC Quarterly PC Monitor Tracker, March 2022 |

|||||

|

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, 2021 (shipments in thousands of units) |

|||||

|

Company |

2021 Shipments |

2021 Market Share |

2020 Shipments |

2020 Market Share |

2021/2020 Growth |

|

1. Dell Technologies |

30,267 |

21.1% |

26,435 |

19.3% |

+14.5% |

|

2. Lenovo |

17,068 |

11.9% |

14,361 |

10.5% |

+18.9% |

|

3. TPV |

16,748 |

11.7% |

19,394 |

14.2% |

-13.6% |

|

4. HP Inc |

15,076 |

10.5% |

18,500 |

13.5% |

-18.5% |

|

5. Samsung |

13,454 |

9.4% |

11,754 |

8.6% |

+14.5% |

|

Others |

50,974 |

35.5% |

46,290 |

33.9% |

+10.1% |

|

Total |

143,587 |

100.0% |

136,734 |

100.0% |

+5.0% |

|

Source: IDC Quarterly PC Monitor Tracker, March 2022 |

|||||