According to IDC, the PC market in India fell 15.2% year-on-year for 2016 with shipments of 8.58 million units. If special projects are discounted, the overall India PC market dropped 7.5% in 2016. The decline was initially due to reduced demand and high inventory in the first half of 2016 but a recovery started in June 2016 brought about by strong consumer sentiment backed by seasonality and increased festive demand.

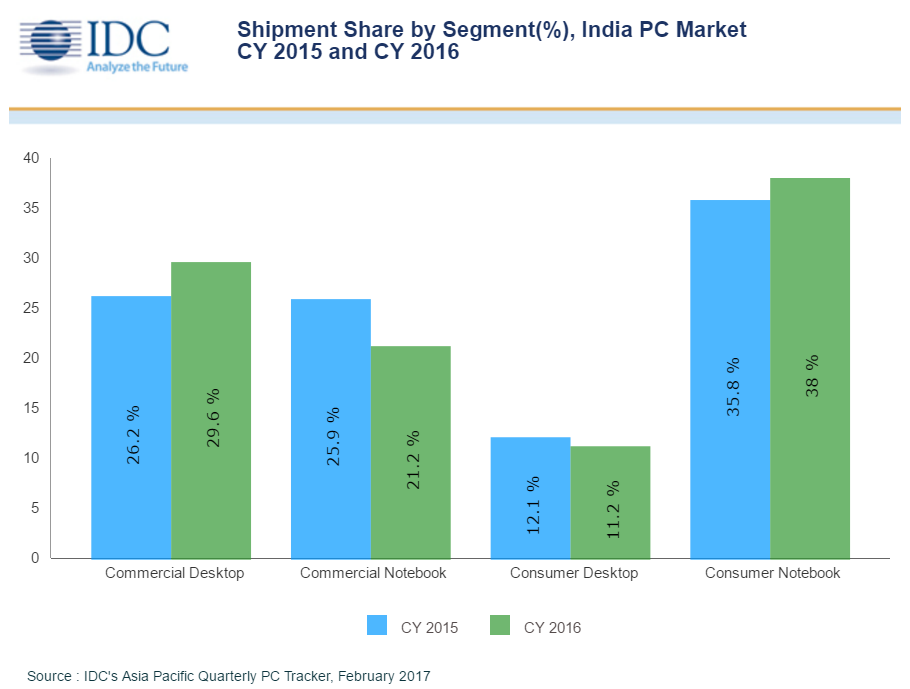

For the consumer PC market in India, the fall was 12.9% with shipments of 4.22 million units. For the commercial PC market, the fall was 17.4% with shipments of 4.35 million units.

Indian PC market shipments for quarter four of 2016 dropped 23.4% compared to the previous quarter, with shipments of 1.92 million units. This represents a 23.6% drop when compared to the same quarter in 2015.

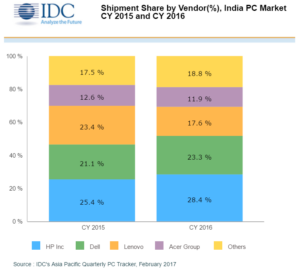

HP shipped the most units with a market share of 28.4% in 2016, which is an increase of 3% on its shipments in 2015. HP led the commercial category and also took top spot for consumers with a 26.8% market share for the third year in a row.

Dell was the second largest PC supplier in India in 2016, with an overall market share of 23.3%. Dell remained focused on addressing new opportunities in segments like government and education and saw a rise of 4.9% year-on-year in the commercial category to end 2016 with a 24.5% share.

Lenovo was the third largest PC supplier, with an overall market share of 17.6% which is a drop of 5.8% when compared to a year earlier. Lenovo’s consumer business fell 2.5% but it is believed that they will bounce back this year with improved marketing strategies and channel strength backed by innovation in its product line.