Global PC shipments fell 9.6% YoY in Q1’16 – the sixth consecutive quarter of declines. Shipments reached 64.8 million units: the first time that they have fallen below 65 million since 2007, says Gartner.

As well as the continued impact of the strong US dollar, Q1 was affected by high inventory from Q4’15. All major regions showed shipment decline, and all developed economies exhibited signs of a shrinking PC installed base. LATAM contracted the most: shipments were down 32.4%. The PC market in this region was strongly influenced by Brazil, where economic issues and an unstable political climate affected sales. Low oil prices drove economic contraction across LATAM and Russia – switching them from growth drivers to market laggards.

New household adoption of PCs is lower than it has been in the past – especially in emerging regions. Smartphones are the dominant force in these markets. However, a Windows 10 refresh is expected to begin towards the end of 2016.

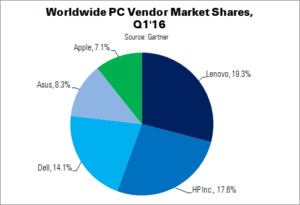

Lenovo led shipments in the worldwide PC market, despite a 7.2% fall. The company’s shipments were down in all regions except North America (up 14.6%). Lenovo has shown double-digit shipment growth in the USA over the last four quarters, despite the overall market declining.

HP Inc. (which now manages HP’s PC business) faced challenges in Q1. The company has said that it wants to stay away from low-profit segments. Q1 emphasised profits, at the cost of shipment share.

Although third-place Dell faced a 0.4% decline, this was much better than the global industry average. Shipments were up in North America and Japan, but down in all other regions.

| Preliminary Worldwide PC Vendor Unit Shipment Estimates, Q1’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Lenovo | 12,484 | 13,458 | 19.3% | 18.8% | -7.2% |

| HP Inc. | 11,408 | 12,537 | 17.6% | 17.5% | -9.0% |

| Dell | 9,145 | 9,182 | 14.1% | 12.8% | -0.4% |

| Asus | 5,365 | 5,288 | 8.3% | 7.4% | 1.5% |

| Apple | 4,611 | 4,563 | 7.1% | 6.4% | 1.0% |

| Others | 21,764 | 26,657 | 33.6% | 37.2% | -18.4% |

| Total | 64,776 | 71,687 | 100.0% | 100.0% | -9.6% |

| Source: Gartner | |||||

In the US, PC shipments reached 13.1 million units, down 6.6% YoY, and the lowest in the last three years. The decline particularly affected consumer-focused vendors, as US consumers had “no particular motivation” to buy a new PC in Q1, said Gartner’s Mikako Kitagawa. Hybrid device shipments rose, but not enough to offset the decline in desktops and notebooks.

Dell was the leading vendor in the US, passing HP. Shipments were up 3.1%, thanks to Dell’s focus on the business market, while HP’s fell 17.3%.

| Preliminary US PC Vendor Unit Shipment Estimates, Q1’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Lenovo | 3,461 | 3,358 | 26.3% | 23.9% | 3.1% |

| HP Inc. | 3,109 | 3,760 | 23.7% | 26.7% | -17.3% |

| Dell | 1,903 | 1,661 | 14.5% | 11.8% | 14.6% |

| Asus | 1,666 | 1,672 | 12.7% | 11.9% | -0.3% |

| Apple | 667 | 770 | 5.1% | 5.5% | -13.5% |

| Others | 2,340 | 2,857 | 17.8% | 20.3% | -18.1% |

| Total | 13,146 | 14,078 | 100.0% | 100.0% | -6.6% |

| Source: Gartner | |||||

23.3 million PCs were shipped in APAC: a 5.1% decline. Consumer sentiment was dampened by both the ongoing weakness of the Chinese economy and low global demand. PC penetration is high in major cities, meaning that there is a challenge to prompt PC replacements. The PC life cycle is lengthening, further affecting demand.

In EMEA, shipments declined 10% to 19.5 million units. Consumer demand remained stable in Germany and the UK, but was down in France – impacted by the move to HD TV. Consumers chose to buy a new TV or receiver box, instead of a PC. Gartner expects major business PC deployments to begin at the end of 2016, when organisations have finished testing Windows 10.

Analyst Comment

IDC released its data at the same time, with largely similar estimates. The firm says that worldwide PC shipments totalled 60.6 million units (an 11.5% decline), and expects Windows 10 enterprise pilot schemes to turn into purchases at the end of the year. Inventory reductions in the channel appear to be ending, but channels, vendors and users remained cautious about new purchases.

In regional terms, IDC says that APAC and EMEA performed slightly above the forecast (although both still declined), but a poor quarter in the Americas pulled down worldwide results. Shipments were down 5.6%, to 13.6 million units, in the USA.

Lenovo led the worldwide market in IDC’s data, as it did in Gartner’s. HP Inc. was second, Dell in third, Apple in fourth and Asus in fifth. (TA)