South Korea, once the foremost supplier of displays, relinquished leadership to China as the Chinese government targeted the display industry by subsidizing the capex of LCD fabs, providing up to 75% of the capital. South Korea, led by Samsung Display, abandoned LCDs for OLEDs and dominated the new display technology. As OLEDs thrived, driven by success in the billion-unit smartphone market, the Chinese applied their LCD approach to OLEDs, creating a challenge to Korea as a mainstay in the display market. While there are multiple OLED panel makers in both countries, SDC and BOE have taken the leadership positions in this high-stakes battle.

SDC has used its technology leadership by producing performance and feature improvements, such as LTPO and CoE, to differentiate their offering at the premium level, e.g., Apple’s 220 million iPhones. BOE constructs new OLED fabs using government subsidies and is close to matching SDC’s capacity, which results in lower prices, making their offerings attractive in competitive settings.

BOE has been sniping at SDC’s OLED leadership by engaging with Chinese smartphone OEMs—Huawei, Honor, and others—to create state-of-the-art OLED displays and by providing Apple with replacement panels for older models and supplying entry-level iPhones with new panels.

SDC, which contributes annual gross profits of over $3 billion to Samsung, is a cash cow and has on two occasions loaned funds to SEC for semiconductor expansion. But SDC’s technological leadership has become less impactful, and they have lost market share. SDC responded to the threat by taking BOE to friendly IP courts in Texas, asking for restrictions on imports due to numerous patent infringements. While BOE has countersued with their own patent suits, they face another daunting challenge raised by the pandemic that seeks to reduce dependence on China for economic and security reasons.

As SDC presses their IP advantage, they have asked LG Display to transfer 70 LCD patents in the US to Samsung. Although SDC no longer produces LCDs, the acquired IP will be used in patent disputes with BOE. LG Display also passed on 55 patents in South Korea to Samsung Display in June. Eighty percent of these were related as family patents to the US ones. This is the first time that LG Display has transferred patents to rival Samsung Display. Samsung Display has never passed on its patents to LG Display. Samsung filed patent infringement lawsuits in the US against BOE and CSOT with the International Trade Commission as well as federal and district courts. BOE countered with suits against Samsung Display at the federal level. Most of these suits deal with OLED technologies, but additional suits that deal with LCD will be more damaging to Chinese companies. The newly acquired patents include those related to in-plane switching (IPS), which is used to improve the viewing angle of LCD panels. BOE has faced allegations that it has infringed on LG Display’s IPS patents in the past. Samsung Display also acquired 107 LCD patents in the US from Taiwan’s AUO last year in June. Samsung and LG have a patent sharing agreement in Korea, which allows each company to use the IP without having to pay royalties.

BOE is #1 in LCDs and #2 in OLEDs. BOE’s counter suits have less substance as the Korean IP is more rigorous and fundamental, given the Koreans’ longer history with displays. BOE carries with it the baggage of the Trump administration’s emphasis on countering the Chinese export and long-term threat. BOE has countered with a messaging campaign to convince the US public, including the courts, that they don’t pose a threat to US market competition and supply chain security.

US consulting firm Pamir Consulting alleged that Chinese firms including BOE, TCL, HKC, Tianma, and Visionox have established a dominant position in the global display market and recommended various restrictions, including tariffs, reshoring incentives, and limits on access to US capital and technology.

BOE responded by apparently asking NERA to evaluate the structure, economics, and competitive landscape of the global display industry. NERA reported that display manufacturers operate across multiple countries, including China, South Korea, Japan, Vietnam, and the United States. Moreover, the industry’s technological progress—reflected in innovations such as OLED and foldable displays—has led to broader product availability, improved quality, and falling prices, trends that are typical in competitive markets. NERA concluded that despite the lack of any internal infringement suits, manufacturers from mainland China are subject to strong competitive constraints. They compete not only with non-Chinese firms but also with each other. This internal and external competition limits any individual firm’s ability to raise prices or control output. Economic dominance, in the antitrust sense, requires the ability to sustain pricing above competitive levels over time, which the report finds is not occurring in this market.

NERA found no credible evidence that manufacturers from mainland China disrupt access to display panels in the United States, claiming Korea, Taiwan, Vietnam, India, Japan, and the US have new manufacturing sites, reducing dependency on any single country.

While acknowledging the presence of subsidies, NERA’s analysis notes that many other governments—including those in the US, South Korea, Japan, and India—also provide subsidies to encourage domestic production.

NERA’s findings also address concerns about national security. While the Pamir report identifies the risk Chinese manufacturers pose to the US military display supply chain, the NERA study shows that other companies—both domestic and international—already supply advanced display technologies, such as Micro OLEDs and Micro LEDs, for military applications. The military represents only a small fraction of global display demand, further limiting the potential impact of restricting Chinese firms.

We were asked to endorse the NERA study and refused, finding there were a number of oversights and misleading statements, including:

• Failure to recognize that Japan is closing its fabs and Taiwan’s Innolux and AUO expect at least 30% of revenue to come from non-display activity, which has resulted in the sale of existing fabs.

• The subsidies (up to 75% of the capex) provided by the Chinese government make it impractical for companies in other countries to compete, and there is no display production in the US, India, or Vietnam.

• The $80 billion LCD market is 75% concentrated in China and growing higher each year.

• The largest fabs (Gen 10.5) are all in China.

• The three major China LCD makers have a program of controlling panel prices by setting utilization rates as a function of demand.

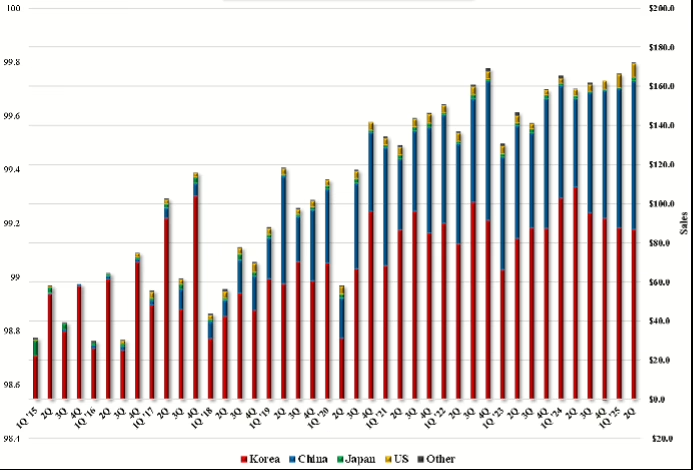

• Korea’s dominance in OLEDs ended and has fallen under a 50% share, even less if only the profitable small/medium segment is included. The next chart shows OLED red and green emitter material purchases by region.

• China is outspending Korea in new OLED fab construction by a factor of 3:1.

• With Samsung and LG Display exiting the LCD market and Taiwan deemphasizing displays, the only source for replacing the millions of LCDs in the US military and intelligence will soon be China.

These factors essentially make the NERA report null and void. Display competition should be based on technology, availability, and cost, but not on infringing IP or arbitrary nationwide exclusions. With the slowing of demand and the lack of new applications, companies should strive for improved manufacturing efficiency, increased performance, and lower costs. The use of resources to sue or develop self-serving messages is wasteful, failing to contribute to the long-term goals.

The full report can be found at here.

The anti-China movement was highlighted by the contents of a defense spending bill, which cited China’s unfair practice of subsidizing local fabs as the rationale for excluding their displays. The hypocrisy of US lawmakers reached a new high, as these are the same politicians that passed and reaffirmed the CHIPS Act, a $50+ billion giveaway to the US semiconductor industry.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.