Ovum has released a report that points out that Netflix has achieved massive subscriber growth and global scale, but has seen deteriorating profitability. The company pointed out that in 2011, Netflix generated net profits of $0.81 per customer per month ($226m in total), while the equivalent free cash flow figure was $0.67 ($186m in total). Over the first nine months of 2016, monthly net profit per customer has declined to $0.16 per customer, Ovum said, but free cash flow per customer has declined to a negative $1.33 – amounting to a cash burn of more than $1bn for the first nine months of 2016 alone. The deteriorating cash burn per customer is the greatest concern to the company which thinks it looks set to get worse. Furthermore, Netflix’s (barely) positive profit margin looks to rest mostly on some very aggressive accounting, Ovum added.

Analyst Comment

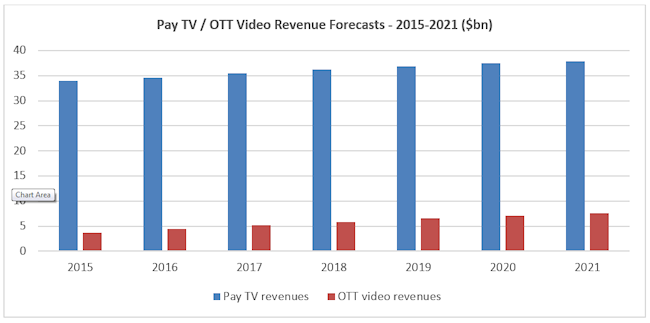

There have been a number of rumblings and rumours about a possible acquisition of Netflix by Disney, but neither company is commenting and the views of commentators have covered a spectrum of views about the possibility. In checking out this story, we came across this interesting forecast showing that Ovum believes that the European Pay TV market will grow by almost 12% between 2015 and 2021, from $33.9bn to $37.9bn, with subscribers growing from 98 million in mid-2016 in Western Europe, to 105 million by the end of the period. (BR)