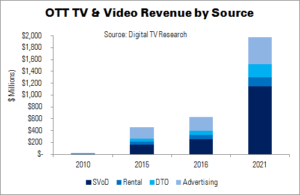

Eastern Europe is waking up to the potential of OTT, says Digital TV Research, which predicts revenues in the region will reach almost $2 billion by 2021. This is up from $26 million in 2010 and $454 million in 2015.

Russia, which is one of the 18 countries included in the forecast, accounted for around half of Eastern Europe’s OTT revenues in 2015. DTVR expects the country to remain at a similar level to 2021. Russia will provide about $724 million of the $1.5 billion to be added over the next five years, with Poland supplying $220 million.

The largest OTT revenue source this year will be subscription VoD (SVoD). Revenues from SVoD will climb to $1.1 billion by 2021, from $4 million in 2010. Russia will remain the leader, with revenues growing six times ($450 million from 2015 – 2021, and Poland in second place.

DTVR expects there to be 19.7 million SVoD subscribers in Eastern Europe by 2021, compared to 125,000 in 2010 and 3.4 million in 2015. Russia, again, will lead, with more than 10 million subscribers.

Report author Simon Murray said: “Netflix launched across the region in January 2016. However, it has been criticised for being too expensive [€8-12/month], lacking local content – or even being too English-language, and is yet to announce any local distribution partnerships. Perhaps Netflix has plans to rectify this, but it better move quickly before local players (especially in Russia and Poland) gain too great a foothold.”

Analyst Comment

IHS also released a report about the CEE region this week, saying that pay TV revenue reached €5 billion last year – of which Poland contributed €1.7 billion. However, Romania was the market with the highest level of pay TV saturation in the region, at 93%, and Russia had the highest total number of subscribers (more than 38 million). However, the depreciation of the rouble meant that revenues were down when measured in euro terms.

According to IHS, 48% of CEE pay TV subscribers took cable last year; 38% took satellite; and 13% took IPTV. Cable is expected to lead the market to 2020. (TA)