Our own Managing Editor, Bob Raikes, opened up the afternoon session by looking at the development of the large display markets in Europe. He said that he chose the topic because there are real opportunities for added value by companies in Europe. He identified four markets for digital signage and public displays, LED displays, interactive meeting displays and projectors.

Our own Managing Editor, Bob Raikes, opened up the afternoon session by looking at the development of the large display markets in Europe. He said that he chose the topic because there are real opportunities for added value by companies in Europe. He identified four markets for digital signage and public displays, LED displays, interactive meeting displays and projectors.

The public display market has developed a lot since Raikes previously talked about it at the conference and is now around 700,000 displays per year, mainly in the West of Europe. He said that the market is split into two different applications: ‘inform’ and ‘promote’. Inform applications are those where somebody sees the need to communicate information and understands that there is a cost – for example, way-finding or showing information to clients in a queue. That kind of application continues to develop and grow.

The second application, ‘promote’, is where a network operator offers access to a display network and charges for access to advertisers. That application is struggling to develop as quickly as hoped. In the last few years, a number of networks with that model have failed and so growth in that area has not been as solid as hoped. It was unlucky for digital signage that it arrived as an application at about the same time as online media. In contrast to digital signage, online has a huge range of metrics available, which helps to encourage buyers to spend on that medium.

One of the challenges in digital signage is ensuring that potential revenues from advertisers can work through the system via media buyers and network owners to the hardware industry. Initiatives such as Vukunet from NEC are helpful in enabling this kind of development.

An interesting segment of digital signage is the video wall market, but this market is under attack from two directions. From “below”, two by two simple video walls are being threatened by large single displays. He briefly explained the way that the generations of LCD making had developed, and how larger fabs are more competitive on very large displays.

On the other hand, very large arrays are likely to be replaced by LED walls, which are now getting cheap enough to displace them, where viewers are not too close.

Meeting room displays are a good growth market with high levels of annual growth (excluding the huge Fatih project in Turkey). However, the market is very different in each geography, with the market mainly in the UK and Netherlands at the moment in education applications. However, these markets were early to adopt interactive projectors and these are not yet pervasive in Europe.

Turning to LEDs, Raikes showed how the price of these displays is, very broadly, related to the number of LEDs. At the moment, the cheapest LED displays, per pixel, are at 3mm pitch where cheap displays are down to around a cent per pixel and he quoted the data from Panasonic at Infocomm last year that suggested that LED is now competitive with very narrow bezel LCD.

However, there is a huge range of different qualities and prices in LED displays. There are markets both in fixed installation and in rentals. The rental market is an important one, but is very strongly driven by conditions in the financial markets. When money is cheap and low cost, that market rises, but if credit is tight, it dries up.

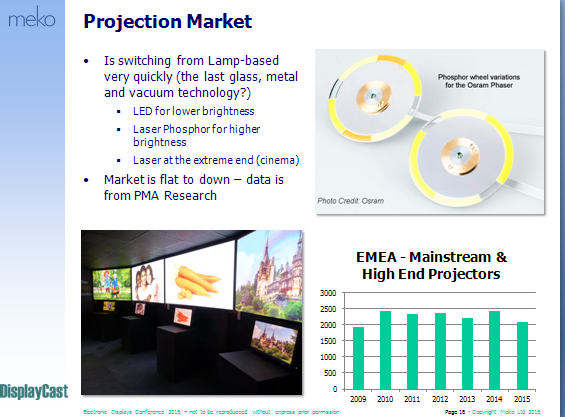

Finally, Raikes talked about the big change in projection, where light sources are rapidly moving away from “the last glass, metal and vacuum technology”, as IHS’s Paul Gray has said in the past, to solid state sources of LED, laser-phosphor and pure laser. This is allowing projection to make inroads into applications such as digital signage where long life is important, as well as delivering better image quality. Raikes showed the sales results from PMA Europe, which indicate that the mainstream projection market in Europe is not currently growing.