Display Supply Chain Consultants (DSCC) has released a new report that takes a deep dive into the health and financial performance of all publicly traded companies in the display supply chain. This report, the Quarterly Display Supply Chain Financial Health Report, also analyzes the health and performance of each layer of the display supply chain.

According to DSCC Founder and CEO Ross Young, “This report was a monumental effort as we captured all financial data, industry metrics and forward looking guidance from 60 companies in 5 different languages across 6 different countries over 15 quarters as we went back to Q1’13. All of the data has been integrated into an easy to use pivot table and is updated quarterly. In addition, unbiased analysis of each company’s earnings and guidance is put into a Powerpoint presentation and delivered to customers within 48 hours of their earnings reports. This report makes it easy for companies to benchmark their financial performance against their competition as well as track the health and financial performance of their suppliers and customers. Procurement managers may find it particularly useful in price negotiations in quantifying their suppliers’ profit margins. It also represents an easy way for financial analysts to benchmark the companies they are tracking and monitor those that they haven’t been following. The report also enables bankers to quickly perform financial due diligence on potential acquisition targets. In addition to all the income statement, balance sheet and cash flow metrics, the report also aggregates important industry metrics such as shipments, prices, bookings, backlog, design wins, sentiment, days of payables, cash conversion cycle, conference call commentary, etc.

Companies covered in this report include:

- Equipment – Applied Materials, AP Systems, AVACO, Canon (Tokki), Coherent, Jusung, LIG Invenia, Nikon, Orbotech, SFA Engineering, SNU Precision, Tera Semicon, TES, ULVAC, Viatron Technologies, V-Technology, Wonik IPS and Y.A.C.

- Materials – 3M, Asahi Glass, Corning, Idemitsu Kosan, LG Chem, Merck, NEG, Nitto Denko, Toppan, Toray, TPK and UDC.

- Panels – AUO, BOE, CPT, CSOT, HannStar, Innolux, JDI, LG Display, Samsung Display, Sharp and Tianma

- OEMs – Compal, Foxconn, Pegatron, Quanta and TPV

- TVs and Phones – Apple, Changhong, Hisense, LGE, Samsung, Sharp, Sony and TCL

- Retailers – Amazon, Best Buy, Costco and WalMart

Some interesting highlights from this report include:

- The revenues for all the companies in this report rose 9% Q/Q and 2% Y/Y to $472B in Q3’16 and should approach $2 trillion for the year. Contributing to the quarterly growth was seasonal strength for OEMs, up 21%, rising panel prices for panel manufacturers resulting in 18% sequential growth and record equipment spending for equipment manufacturers with FPD equipment revenues up 15%. On a Y/Y basis, FPD equipment spending was up 38%.

- Equipment manufacturers had the highest gross margins at 43% followed by brands, glass suppliers and materials suppliers with OEMs in single digits.

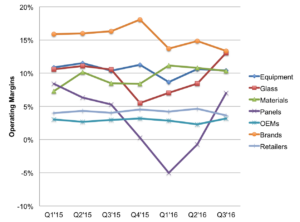

- Operating margins in Q3’16 were in a relatively tight band of 3% – 13% with panel suppliers improving the most on significant price increases and rising from -1% to +7%. In fact, a panel supplier had the highest operating margins of all 60 companies. If we looked at display divisions or business units rather than corporate wide results, FPD glass operating margins were the highest at over 20%.

- Brands had the highest net margins at 10% thanks to Samsung and Apple. However, each layer of the supply chain was profitable thanks to panel price increases, which put an end to 3 consecutive quarters of quarterly losses at panel suppliers.

- Days of inventory declined at panel suppliers on tight supply conditions while increasing in most other segments on the seasonal build for the holiday season.

- Liquidity was healthy and stable except in materials as multiple materials suppliers had over 100% debt/equity ratios.

- Only panel suppliers had negative free cash flow, due to their high capex. However, panel suppliers did generate billions in cash flow from operations.

- Panel suppliers set a record for quarterly capex at over $5.7B, which should be broken in Q4’16 and in Q1’17.

This highly informative report contains an information-rich pivot table and around 500 slides of data and analysis. Despite the massive amount of content provided each quarter, pricing for an annual subscription starts at just $4995 with a single issue available for as low as $2495.